S&P 500 declined, small-caps underperform. Weekly market recap, trading week 50/2024

Summary of the trading week using the most popular posts from the X platform

57,000 - this is the number of views of this content over the last 30 days. This is pretty impressive how fast the overall reach has been growing here and on social media. Unfortunately, inflation has also been rising. The best ways to fight this are investing in financial markets and growing business and its profits.

This is why prices for NEW paid subscribers will go up from the 1st of January 2025 to $19.99 a month and $199 a year. This is still below the pricing of most creators and a decent price for the amount and quality of research you receive. You can secure the current (old) pricing below before December ends.

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

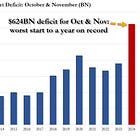

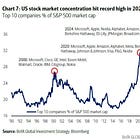

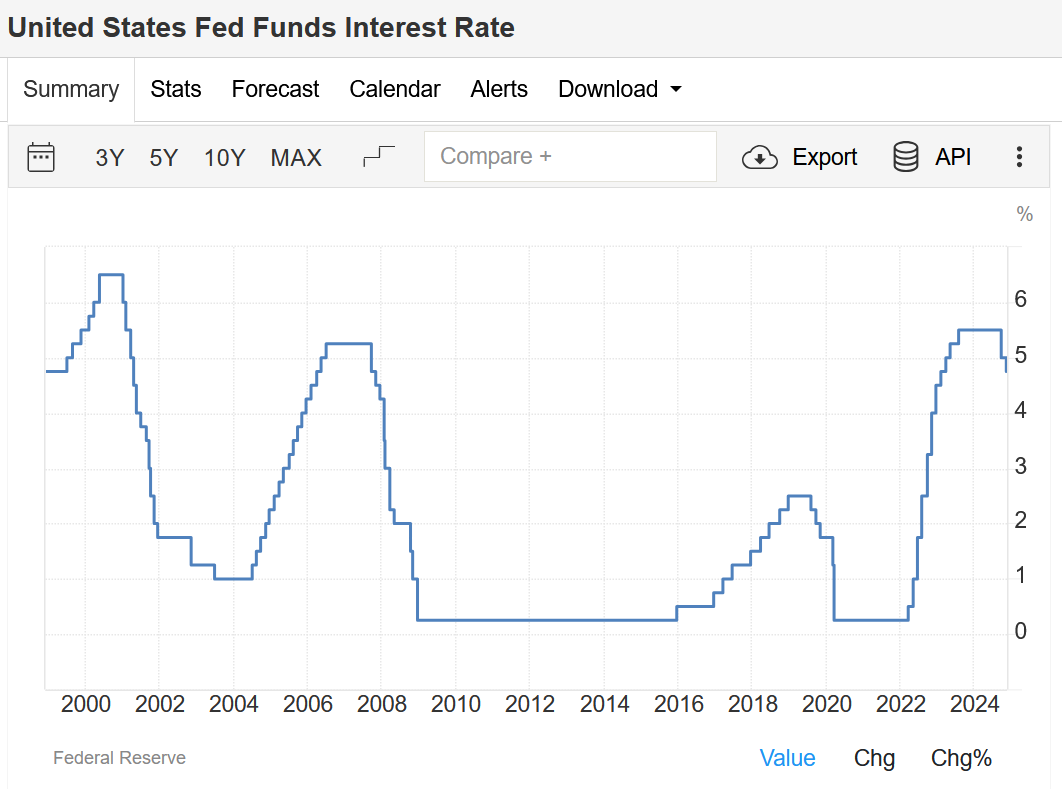

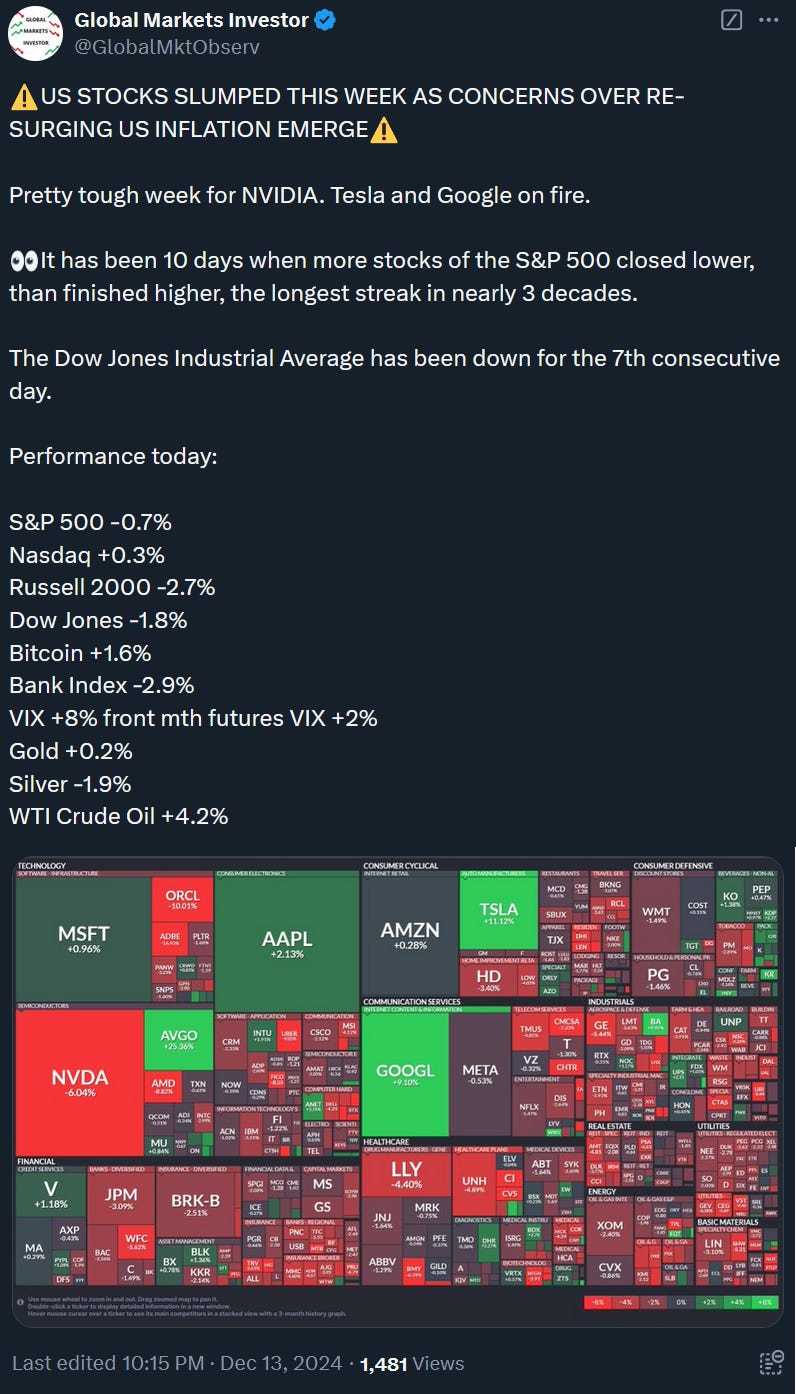

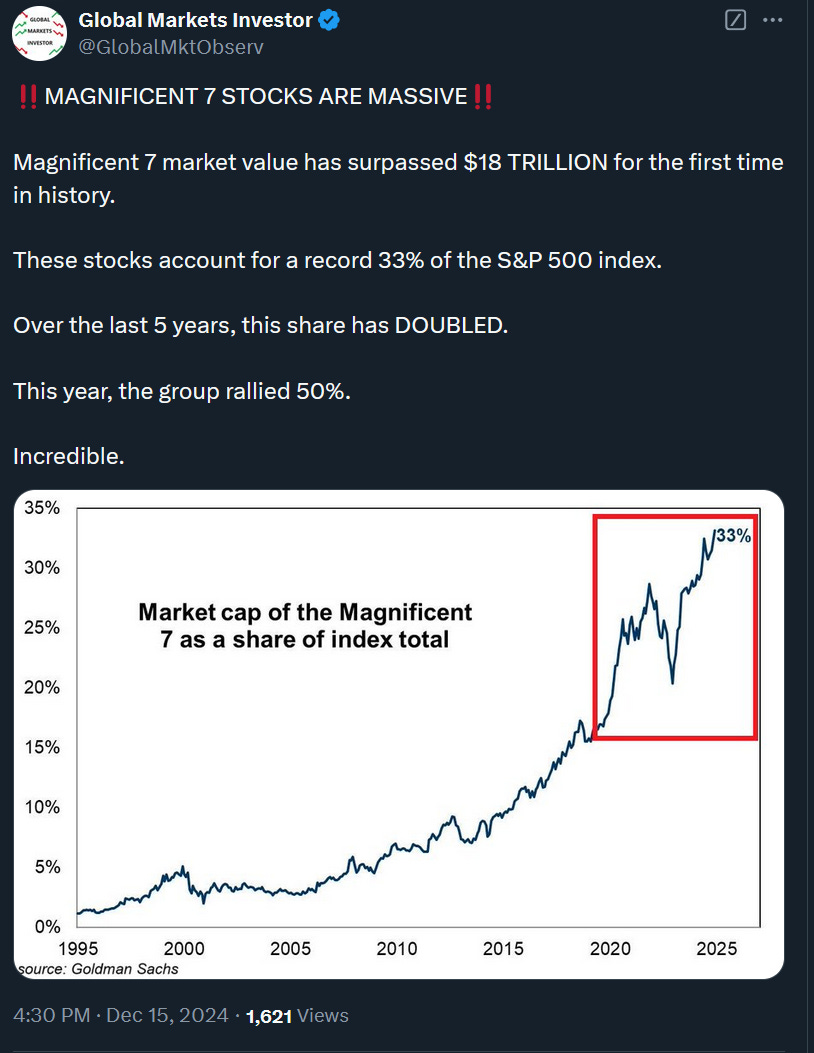

US stocks fell last week as inflation data has raised some concerns among investors that the Fed will not be cutting rates as quickly as initially anticipated. The only strength has been Big-Tech stocks with the Magnificent 7 hitting new all-time highs. Small-capitalization stocks saw the most weakness.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 dropped 0.7%

- Nasdaq index rose 0.3%

- Dow Jones was down 1.8%

- Russell 2000 (small caps) declined 2.7%

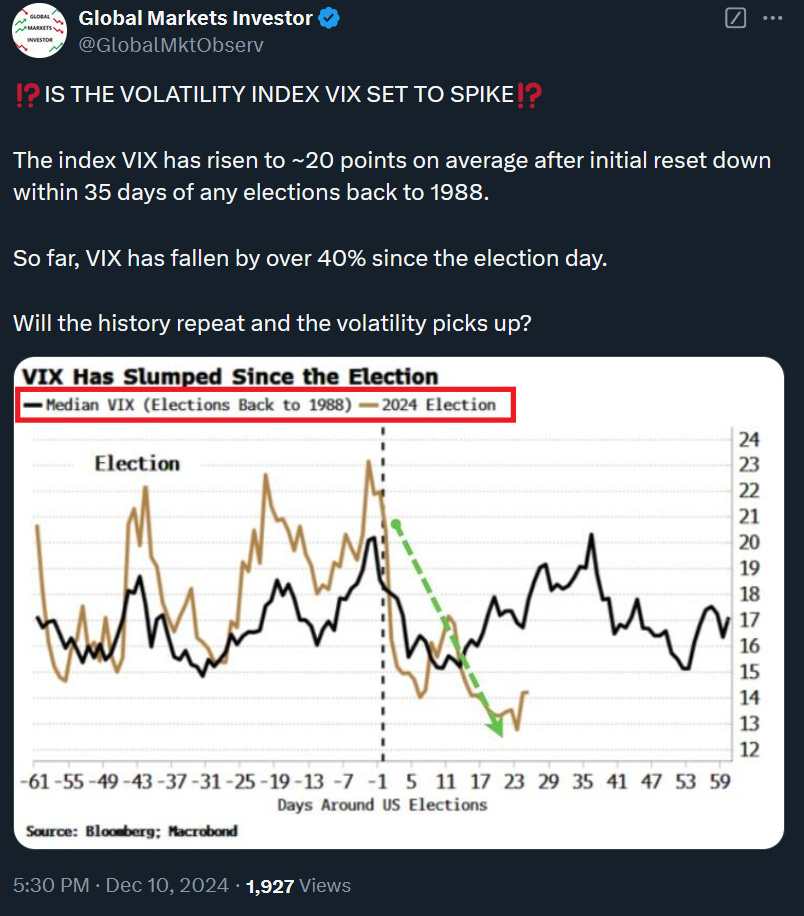

- VIX jumped by 8%

- WTI Crude Oil soared 4.2%

- Silver fell 1.9%

- Gold increased 0.2%

- Bitcoin rose by 1.6%

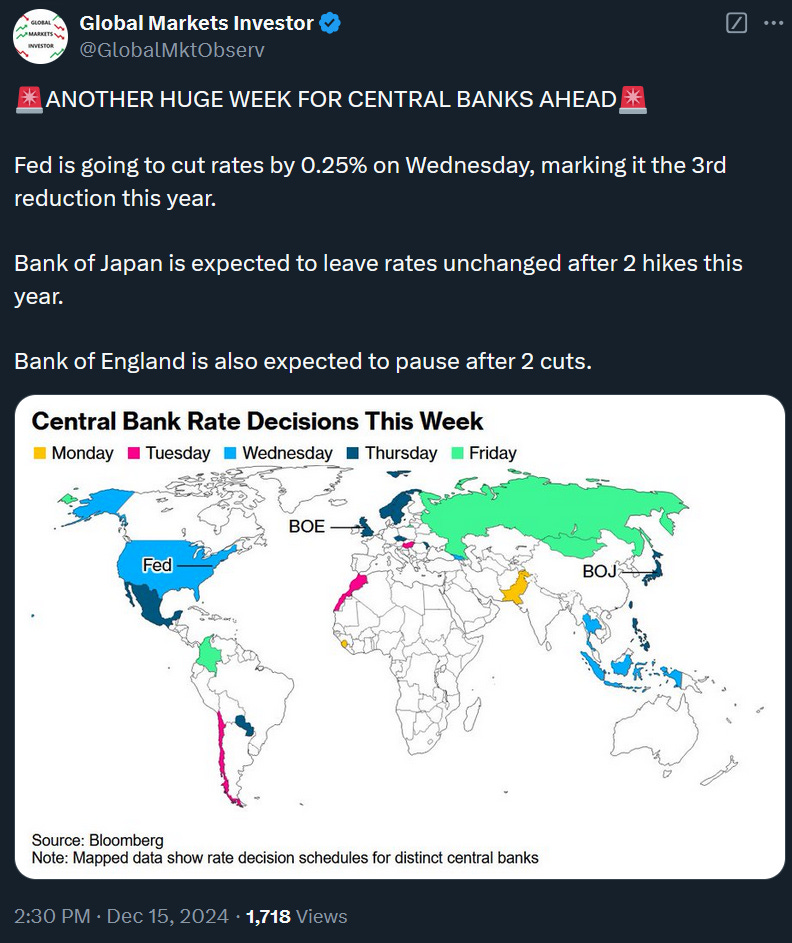

For the trading week ending December 20, key events are:

- US S&P Global Manufacturing and Services PMI for December on Monday

- US retail sales for November on Tuesday

- Fed interest rate decision and Chair Powell Conference on Wednesday

- US GDP data for Q3 2024 (third estimate) on Thursday

- US existing home sales data for November on Thursday

- US PCE inflation for November on Friday

This is an absolutely huge week. Investors will be the most focused on the Fed and its forward guidance as they try to assess the future path of interest rates. The market is now pricing a 96% chance of a cut on Wednesday and subsequently 2 more rate cuts in 2025.

2) The US stock market is getting weaker under the surface.