S&P 500 declined in 4 out of the last 5 days. Weekly market recap, trading week 46/2024

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

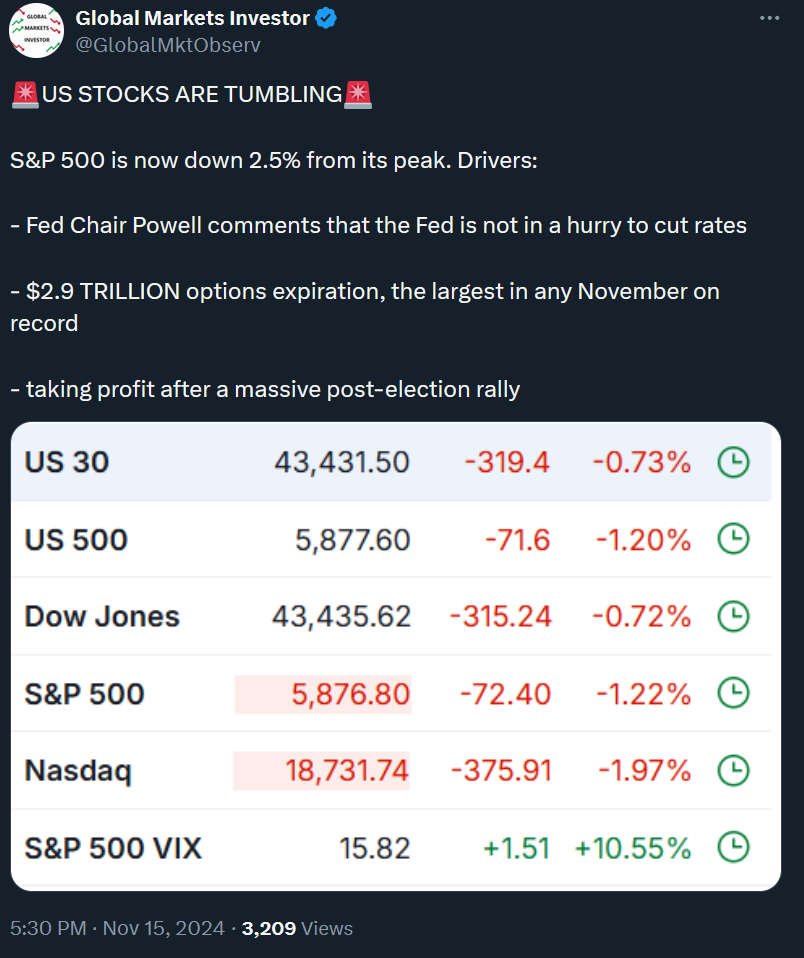

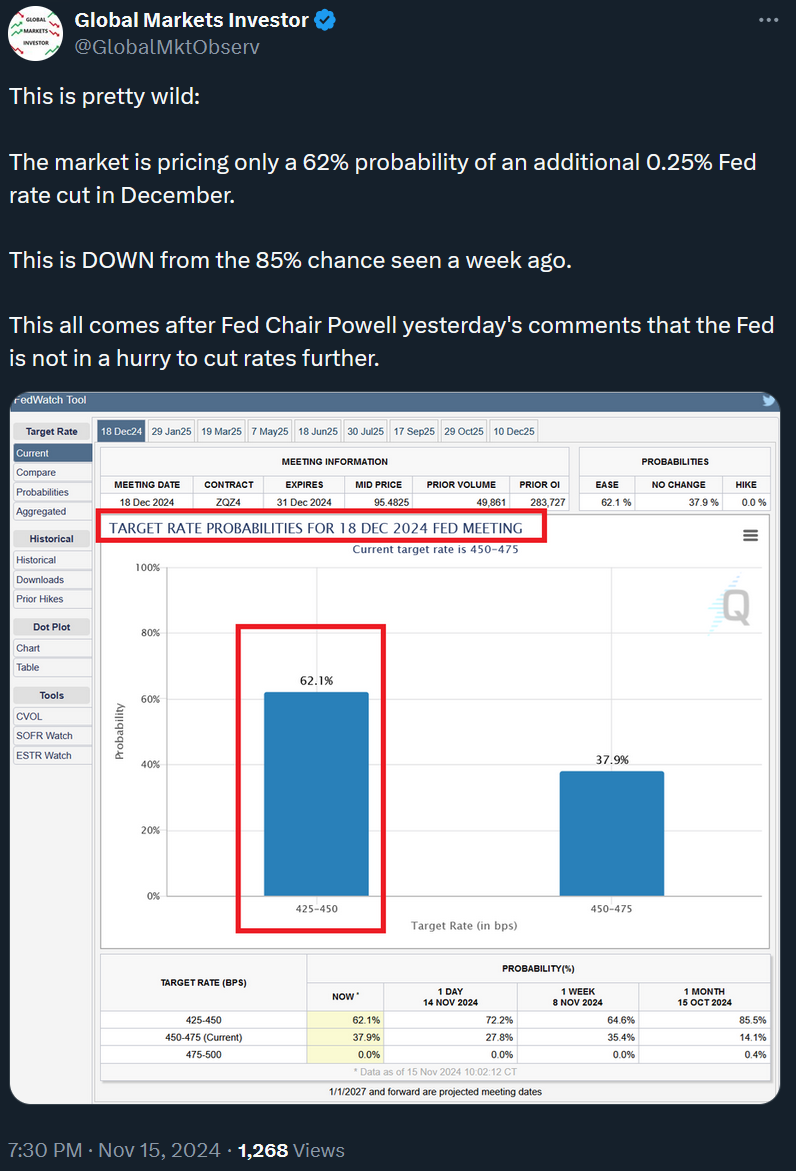

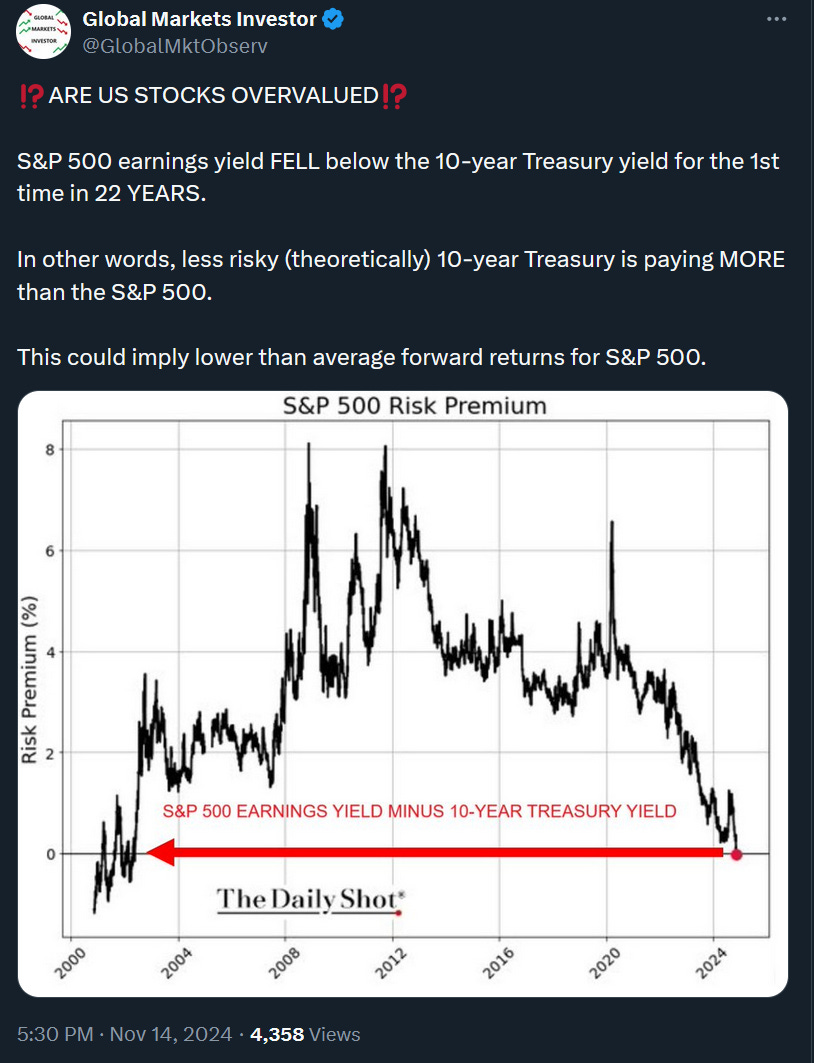

Last week saw an interest reversal as US stocks have become short-term oversold and hit some resistance levels. The S&P 500 dropped in 4 out of the last 5 days with Nasdaq falling every day. This has been driven by some profit taking, US inflation data coming in above expectations on Thursday, huge $2.9 trillion options expiration as well as the Fed Chair Powell comments saying on Thursday that the Fed is not now in a hurry to cut rates. Is the Fed pivoting again?

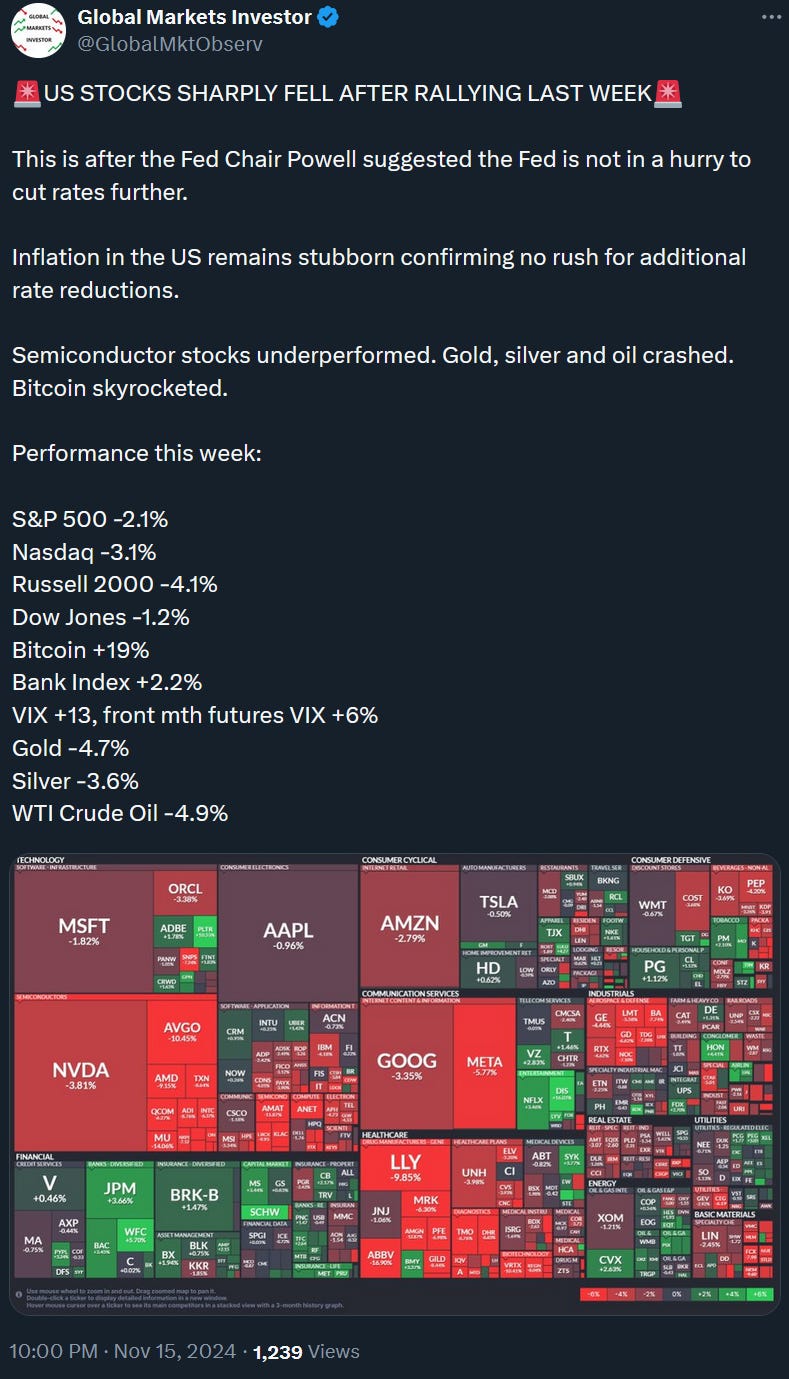

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 fell 2.1%

- Nasdaq index dropped 3.1%

- Dow Jones decreased 1.2%

- Russell 2000 (small caps) declined 4.1%

- VIX spiked by 13%

- WTI Crude Oil tumbled 4.9%

- Silver was down 3.6%

- Gold fell 4.7%

- Bitcoin spiked by 19%

For the trading week ending November 22, key events are:

- NVIDIA quarterly earnings for Fiscal Q3 2025 on Wednesday

- US Housing starts and Building Permits for October on Tuesday

- US Existing Home Sales for October on Thursday

- US S&P Global Manufacturing and Services PMI data on Friday

- US Consumer Sentiment on Friday

- 8 Fed Speeches

All eyes on NVIDIA results and its outlook. Nvidia is expected to report $33.2 billion in revenue and $0.74 earnings per share (EPS), according to Bloomberg data. The company has to beat expectations by a wide margin to keep the momentum. Let’s see how this plays out.

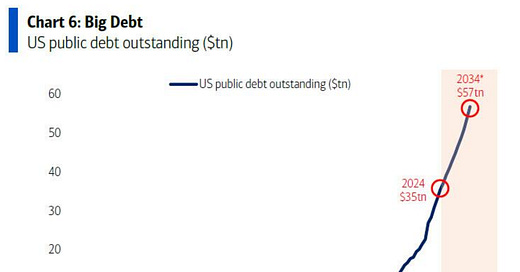

2) US debt crisis is deepening. Some additional staggering stats about the US national debt.