S&P 500 bounced last week after two weeks of declines. Weekly market recap, trading week 52/2024

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process. These posts are also surrounded by commentary and explanations of complicated topics.

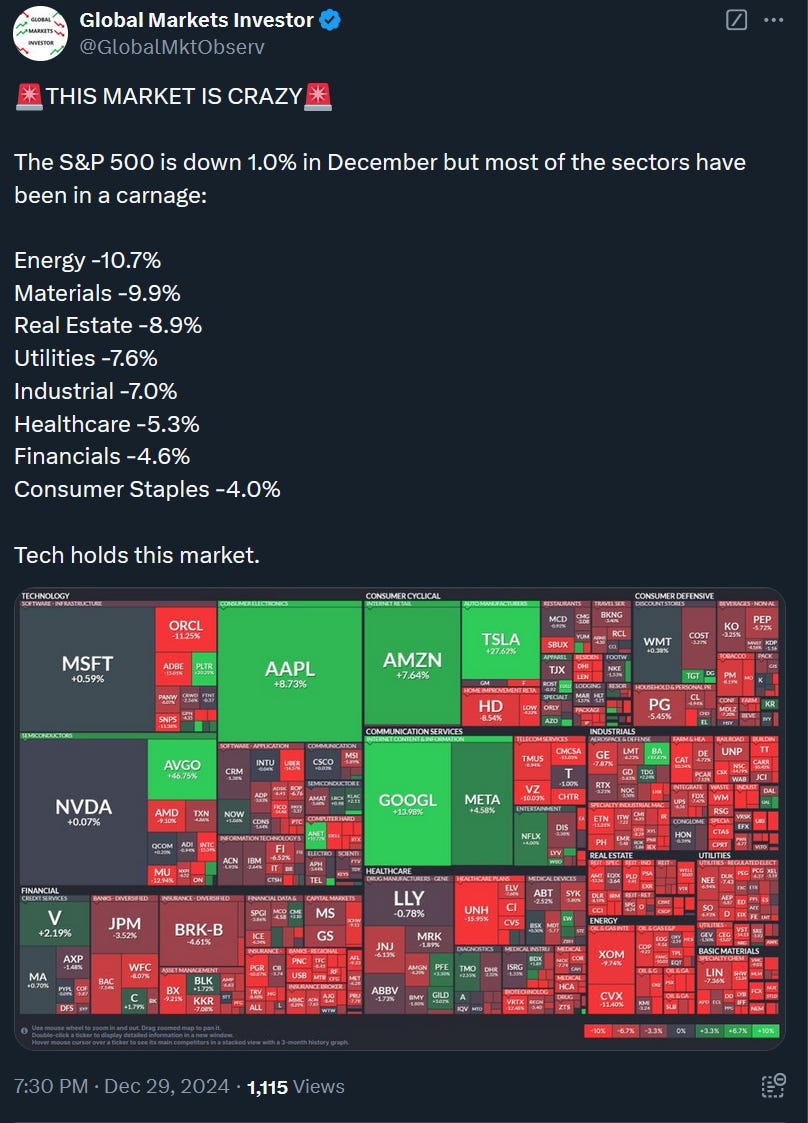

US stocks bounced somewhat last week despite experiencing some losses on Friday. Under the surface, the market continues to be extremely weak with only 2 sectors being up month-to-date. It is a time for the two final trading days of the year.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 increased 0.6%

- Nasdaq index rose 0.7%

- Dow Jones was up 0.3%

- Russell 2000 (small caps) declined 0.2%

- VIX fell by 12%

- WTI Crude Oil jumped 1.0%

- Silver fell 0.1%

- Gold dropped 0.4%

- Bitcoin tumbled by 2.6%

For the trading week ending January 3, key events are:

- US Pending Home Sales for November on Monday

- Markets Closed Due to New Year’s Day on Wednesday

- US ISM Manufacturing PMI on Friday

- One Fed speaker on Friday

Pretty slow week ahead in terms of the data. From the market perspective, it will be key to watch whether the S&P 500 will continue to fall after rejecting the ~6,000 points area. As a result, some volatility should be expected.

2) US private sector employment is in a recession.