S&P 500 bounced as Fed rate cut expectations rose. Weekly market recap, trading week 03/2025

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process. These posts are also surrounded by commentary and explanations of complicated topics.

US stocks experienced some relief rally as government bond yields declined. This was been driven by:

- big banks beating earnings estimates,

- the Bank of Japan governors comments bringing the US dollar (and yields) down,

- some slightly better than expected economic data,

- Fed officials’ dovish comments,

- and in effect rising Fed rate-cut expectations (the market sees 0.39% equivalent of cuts in 2025, up from 0.25% last week).

Will be interesting to see whether this continues next week or if the rip will be sold as major indices sit at key resistance levels.

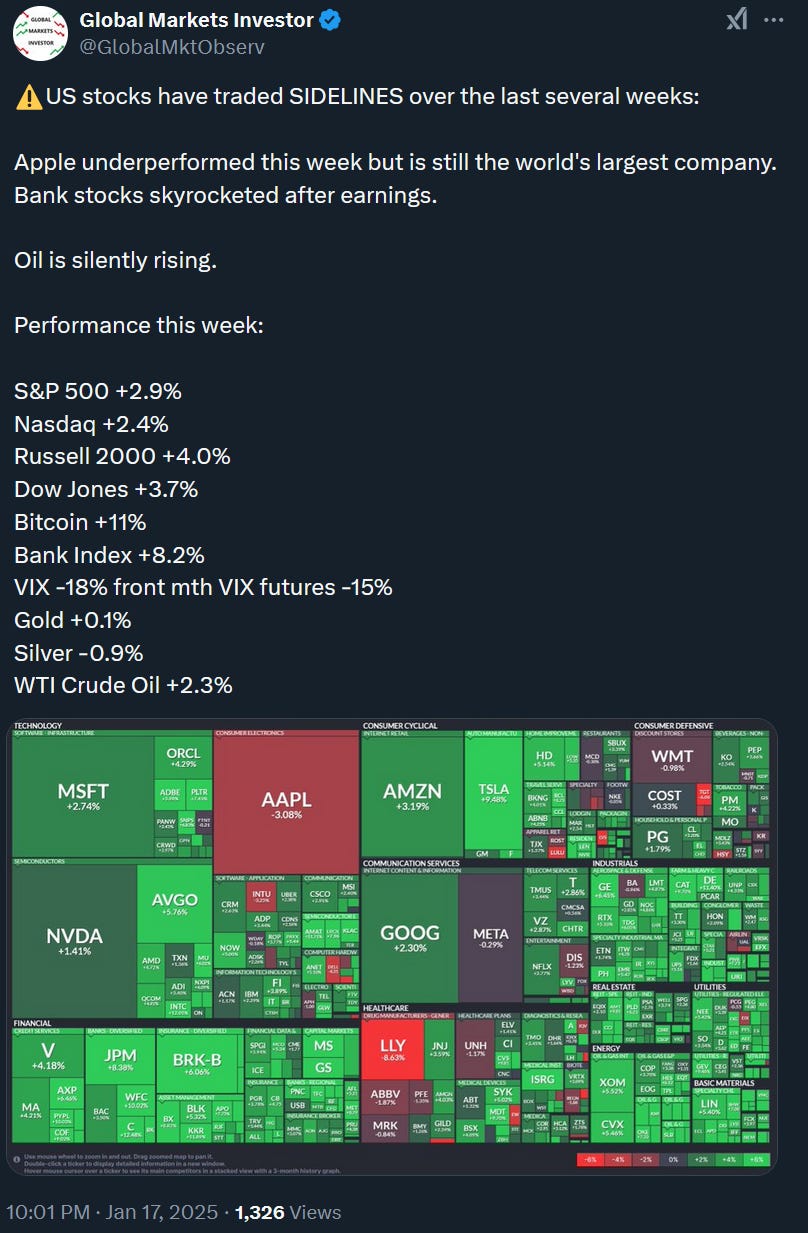

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 jumped 2.9%

- Nasdaq index soared 2.4%

- Dow Jones surged 3.7%

- Russell 2000 (small caps) spiked 4.0%

- VIX dropped 18%

- WTI Crude Oil rose 2.3%

- Silver fell 0.9%

- Gold increased 0.1%

- Bitcoin skyrocketed 11%

For the trading week ending January 24, key events are:

- Martin Luther King Day, US Markets Closed on Monday

- President Trump Inauguration on Monday

- US Initial Jobless Claims on Thursday

- US S&P Global Manufacturing and Services PMIs for January on Friday

- University of Michigan Consumer Sentiment for January on Friday

- ~10% of the S&P 500 companies reporting their Q4 2024 earnings

Pretty muted week in terms of economic data. All focus will be on the companies’ earnings results.

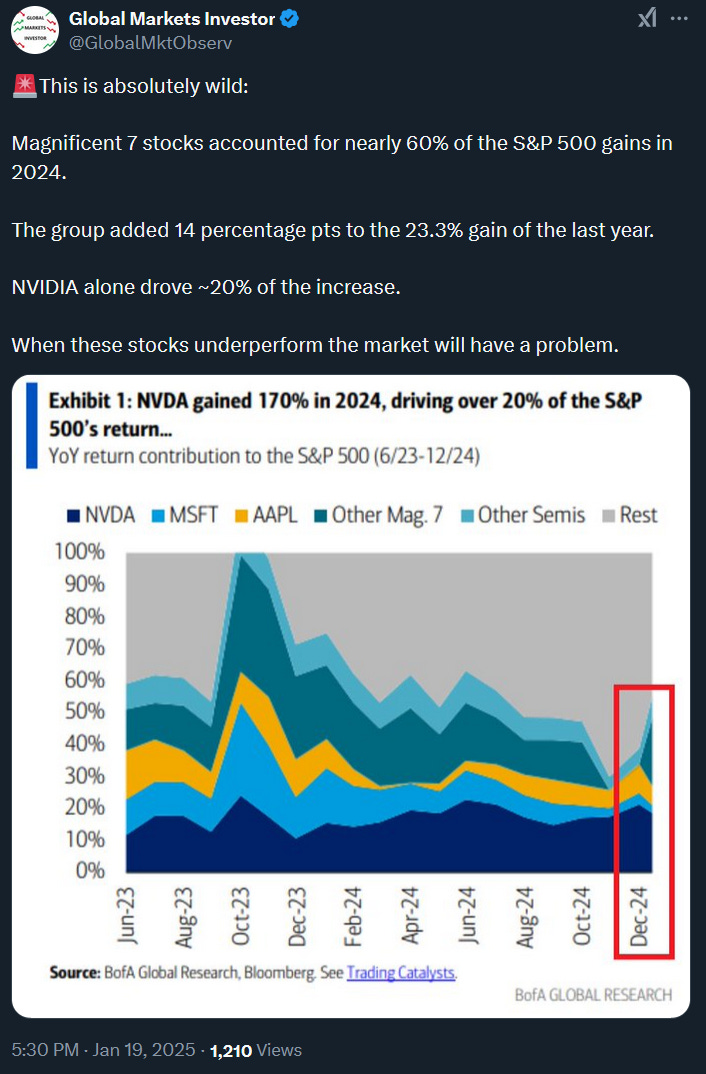

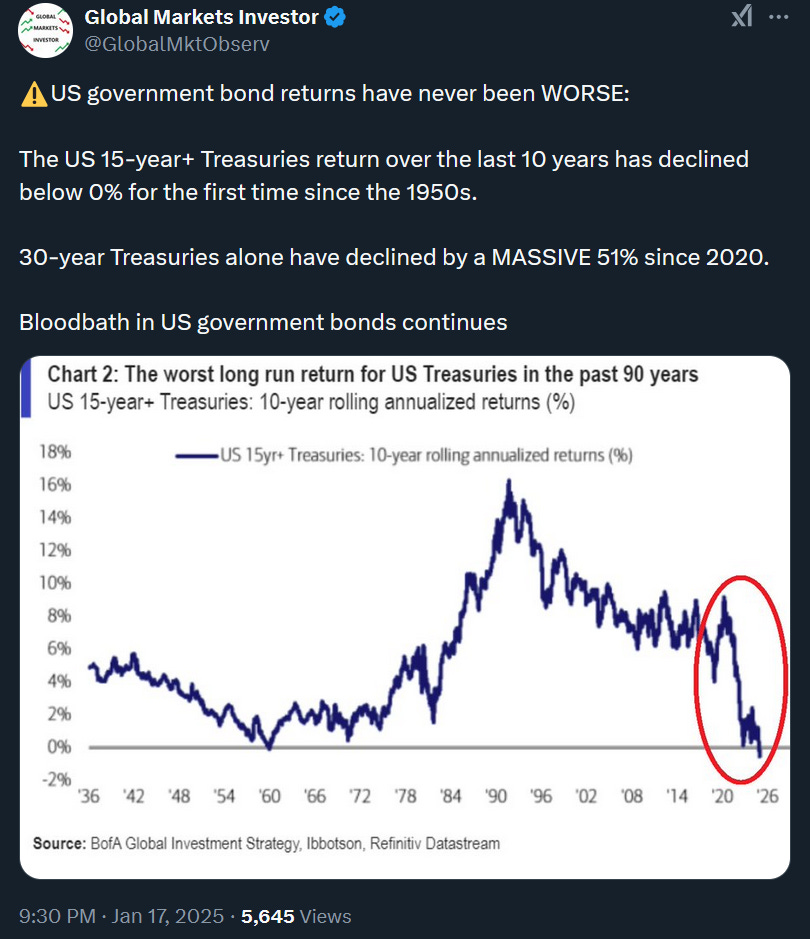

2) This is the LARGEST financial experiment in human history::