NVIDIA's Fiscal Q2 2025 earnings report is due on Wednesday (preview)

The second world's largest company is going to release its quarterly results after the market close

On Wednesday, after the market close, one of the most anticipated quarterly reports this earnings season is due. In other words, NVIDIA is scheduled to report its Fiscal Q2 2025 results.

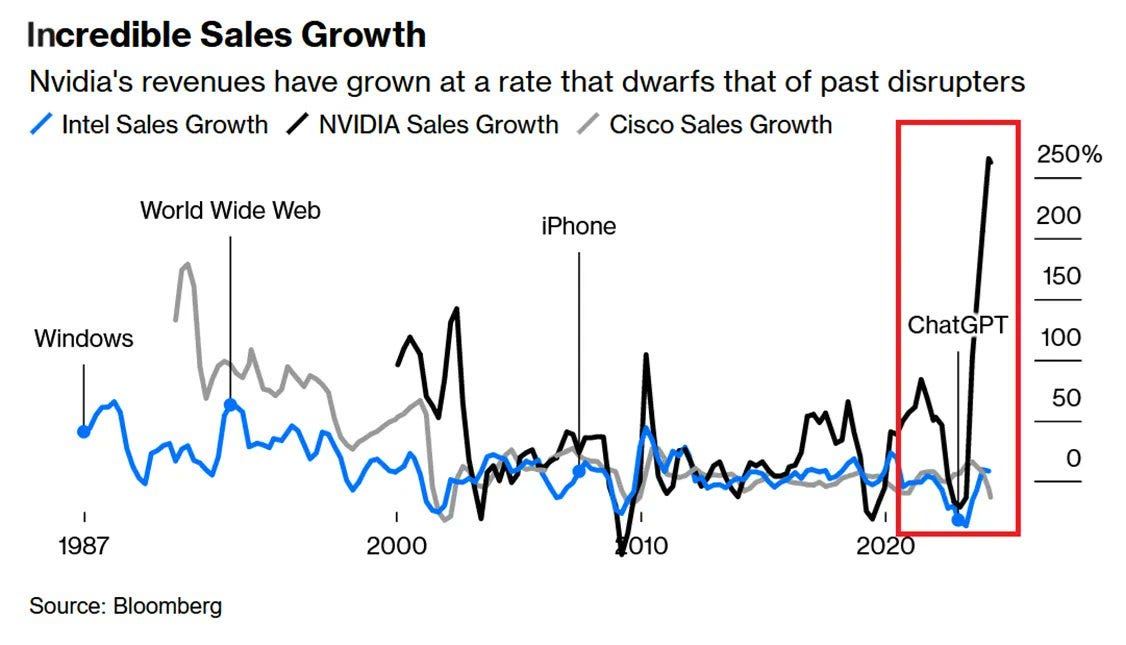

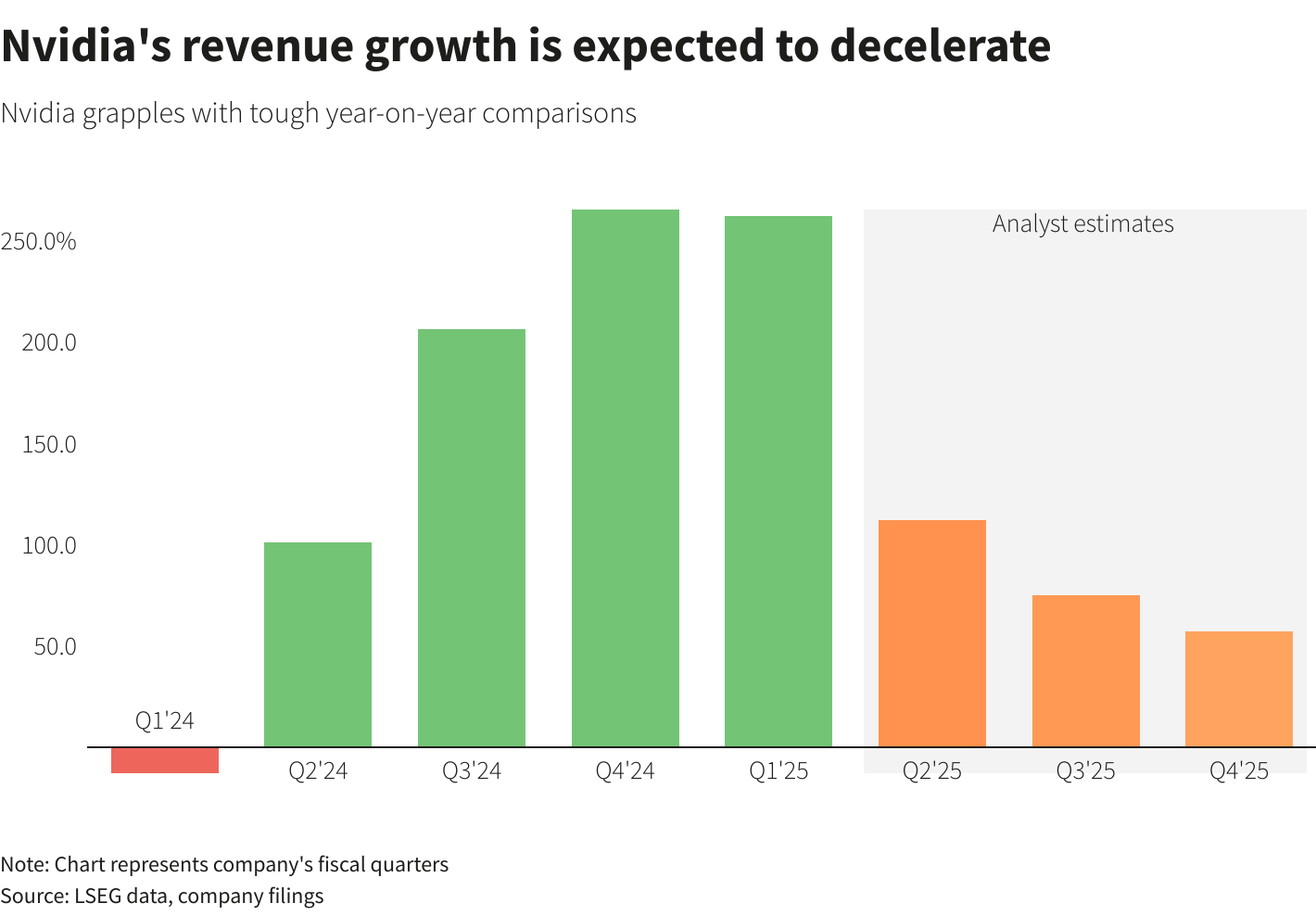

Analysts estimate the chipmaker grew sales by 112% year-over-year to $28.7 billion. This is still a massive jump but much lower than the ~260% rise seen in Q4 and Q1.

Additionally, NVIDIA’s most important segment, data center is expected to bring in $24 billion in revenue, a 142% increase from the $10.3 billion saw in Fiscal Q2 2024. This would be lower than the 426% in revenue growth in Q1 and 408% in Q4 last year.

Adjusted gross margin (revenue minus costs of goods sold divided by revenue) is forecasted to drop to 75.8% from 78.5% in Q1, apparently burdened by the cost of a production surge to meet growing demand.

Lastly, adjusted earnings per share (EPS) is projected to come at $0.65 a 139% increase from $0.27 profit in Fiscal Q2 2024.

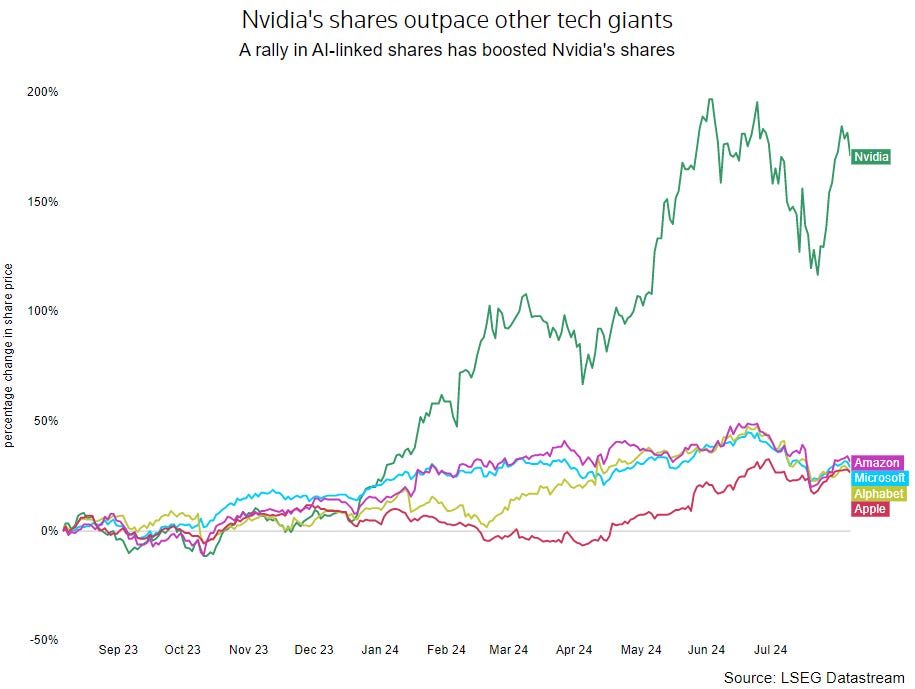

As a reminder, the stock has skyrocketed ~160% year-to-date and 1,000% from its October 2022 bear-market low.

As a result, the stock has become the 2nd largest in the world.

This earnings release will be a big test for the markets. Expectations are again sky-high. Wall Street anticipates that the company will beat Q2 results and also raise its Q3 guidance.

If the chipmaker disappoints, the entire semiconductor sector and most AI-related stocks will plummet. This, in turn, may bring the whole stock market down.

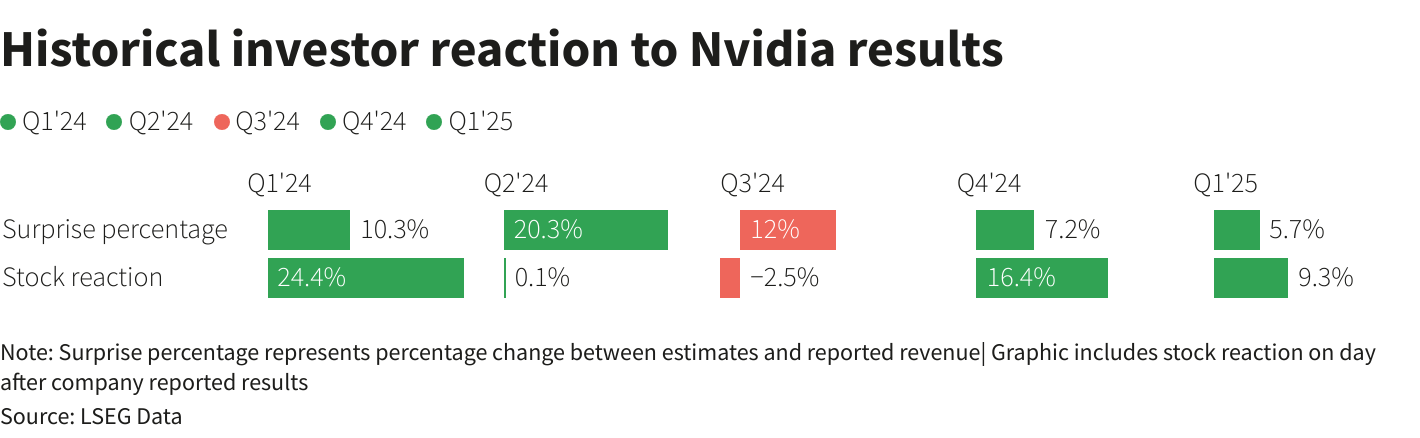

Notably, in the last 5 quarters, the company always exceeded expectations - see ‘surprise percentage’ section in the following graph:

More long-term analysis of the company can be read in the below piece:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?