NVIDIA is one of the largest threats to the US stock market

The company's market cap is now larger than the stock market in Germany, South Korea and Australia

Before you proceed with reading, here’s the analysis of the company’s Fiscal Q2 2025 earnings results (released August 28):

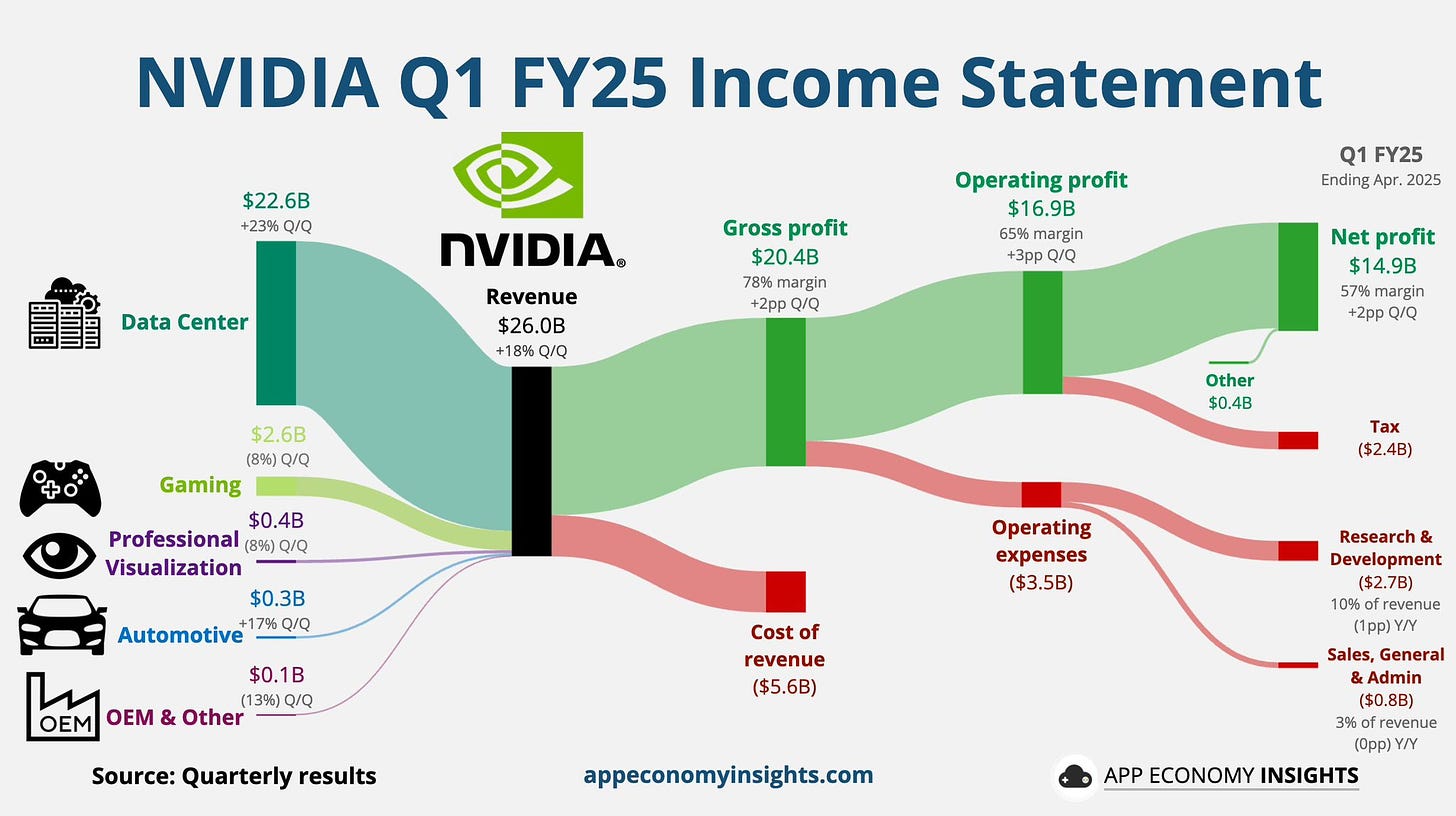

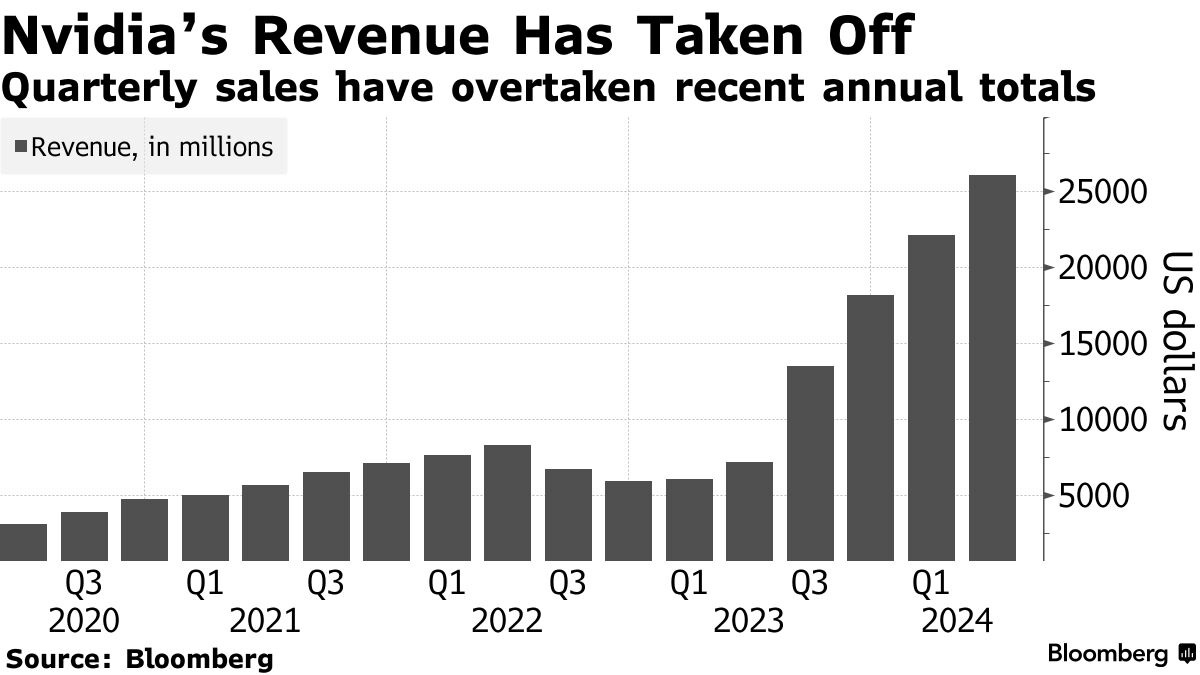

On Wednesday (May 22), after the market closed, Nvidia released its financial report for the fiscal Q1 2025. The company’s earnings per share came at $5.98, above Wall Street estimates of $5.57. Revenues in Q1 were $26.04 billion, beating average forecasts of $24.55 billion. Adjusted gross margin came at 78.9%, above the analysts projected 77%. As you can see, these are really great results and substantially exceeded expectations.

Moreover, in the last 4 quarters, Nvidia's revenue has tripled year-over-year and reached $79.77 billion.

What caused the stock to move higher, however, was the 2Q 2025 sales outlook of $28.0 billion (plus, minus 2%) which came significantly above Wall Street estimates of $26.8 billion. The chip-maker also announced a 10-for-1 stock split and raised its quarterly dividend by 150% to 10 cents a share.

As a result, Nvidia rallied by 9.3% on Thursday and closed above the $1,000 per share mark for the first time ever. The company added $217.7 billion to its market value in just one day, more than the combined market cap of McDonald’s and Ford and almost $80 billion more than the value of Intel.

The below meme perfectly shows Thursday’s and the last few quarters of US stock market developments.

On Thursday, the S&P 500 closed down by 0.7% and the Nasdaq by 0.4% as recent economic data showed that inflation has not been easing. However, if not for Nvidia’s 9% gain the stock market would have easily dropped by more than 2%.

Nvidia’s performance, indeed looks great and the company has been materially exceeding market expectations for the last 2 years. However, have the things not moved too far and too quickly?

The company has become so great that it should be considered as the largest threat to the US stock market performance in the months ahead. Why? You will find out in the below analysis.