Nothing changes sentiment like price

Is this the most euphoric market in modern history? Let's find out

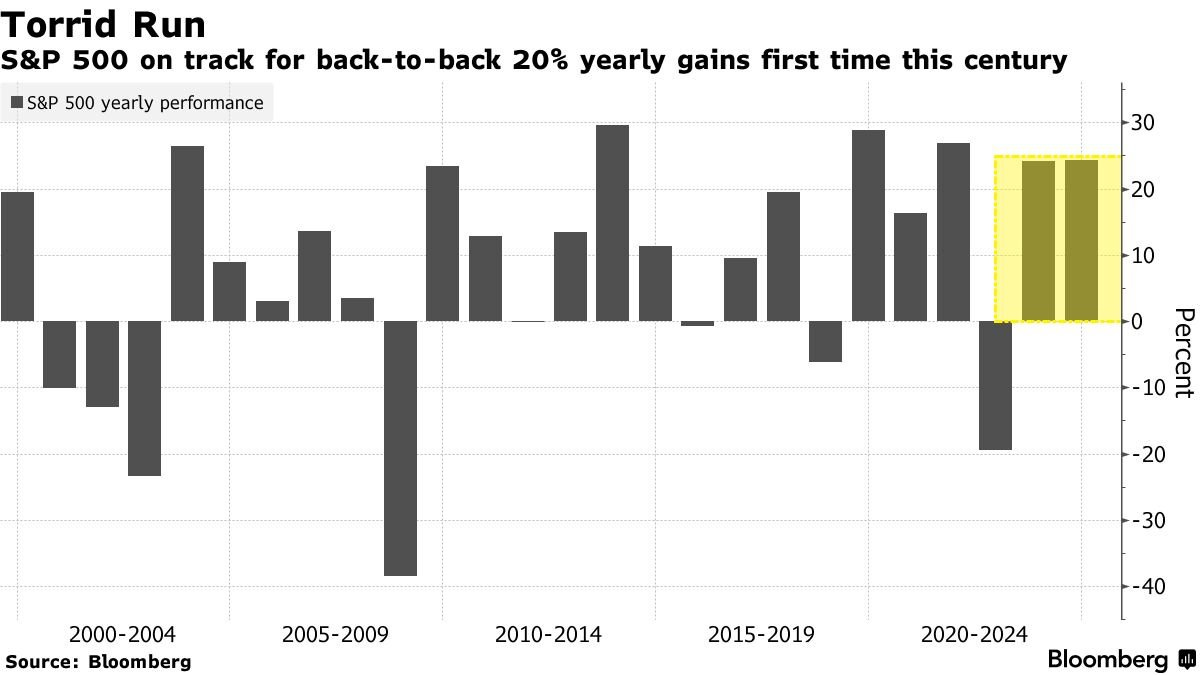

The S&P 500 is on track for 2 straight years of over 20% yearly back-to-back gains for the first time since 1998-1999.

Since the beginning of 2023, the S&P 500 has rallied 56% in total after the market bottomed in October 2022. Over the last 75 years, there were only eight other times when the index soared at least 20% two years in a row.

Back in 2022, the investors' sentiment was very poor, especially among retail investors. Many of them have even sold stocks near the lows, just before the market bounced.

After 2 years, sentiment has recovered as the market experienced one of the best rallies in its history.

Most recently, the sentiment has gotten to unbelievable levels as FOMO took over many investors’ minds.

The fear of missing out (FOMO) is one of the most dangerous phenomenons in the investing world. Plenty of people often base their investment decisions on emotions rather than rational and comprehensive analysis. It appears that over the recent weeks, we have reached some extremes in this behavior.

This article reviews retail and institutional investors' sentiment and their market expectations. It goes through the positioning of households and professionals. It analyzes the speculative market behavior of individual investors and the losses that have already been made.

It also assesses how much powder may left to drive stocks and how bad such extreme speculation usually ends up.

INDIVIDUAL INVESTORS HAVE ALMOST NEVER BEEN SO OPTIMISTIC