Nasdaq Index was down in 6 out of 7 last weeks

Is the AI bubble bursting? Is there a bubble at all?

Hi everyone,

In the last three months, inflation data in the US has been surprising to the upside as was outlined below:

In effect, the Fed officials have started to backtrack their previous rate cut expectations suggesting higher for longer policy is back. These are a few US central bank policymakers’ comments during this week:

Chair Jerome Powell: There has been a 'lack of further progress' on inflation. Fed can keep interest rates high 'as long as needed' as recent data show it's 'likely to take longer than expected'.

Williams: Even a rate hike is possible if warranted but it is not a baseline expectation.

Bostic: It might be not appropriate to ease until the end of 2024.

Kashkari: The Fed may hold rates steady all year.

Goolsbee: So far in 2024, that progress on inflation has stalled. You never want to make too much of any one month’s data, especially inflation, which is a noisy series, but after three months of this, it can’t be dismissed. Right now, it makes sense to wait and get more clarity before moving.

As a result, markets reacted with Treasury yields rising and main stock indexes falling. The S&P 500 is down more than 5% from its peak. The Nasdaq index was down 6 out of 7 weeks.

Moreover, Magnificent Seven broke below the 50-day moving average for the first time since October 2023, and from the top, the group has lost more than $1 trillion in market capitalization.

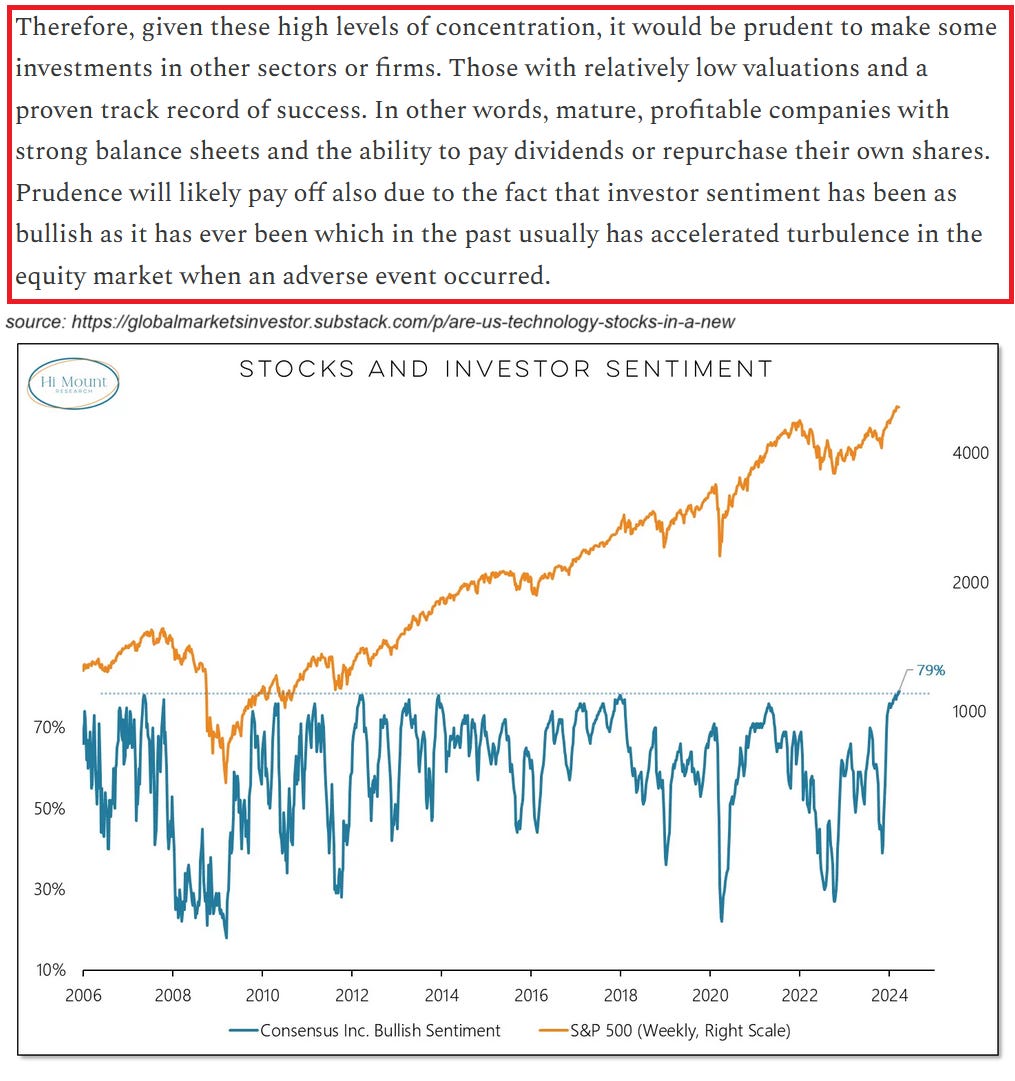

On April 4, paid subscribers received a warning about the US technology stocks, their concentration risks as well as where their valuations stand. Please find the excerpt below:

And link to the full analysis:

As you can see, an opportunity was clearly there. We don’t know whether it is a short-term correction or a similar price action like in 2022 but we’ll keep our subscribers updated.

That being said, you may consider a paid subscription to stay ahead in markets. You will get access to exclusive content for under 50 cents a day.

Here are the benefits you unlock with a paid subscription:

Subscriber-only posts, financial markets, and major economies analysis (primarily US); as well as the full archive

Educational posts about long-term portfolio construction - more unbiased insight than FT, Bloomberg, WSJ, and others

Option to ask questions, post comments, join the community, and access the paid subscribers’ chat

The community already has almost 500 free subscribers. Join the many readers who pay for the full access and redeem your special offer today!

Thank you for following.

Global Markets Investor