Nasdaq 100 hits another all-time high. Weekly market recap, trading week 21/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

This was another intensive week with the most focus on Nvidia’s Fiscal Q1 2025 earnings results. The full recap of the results and analysis of the company’s performance below:

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin. There are so many market moves every week that it is better to list them all below (also see X attachments underneath):

- The S&P 500 finished the week basically flat after some volatility related to economic data and Nvidia earnings.

- The Nasdaq 100 index closed the week at all-time highs and has been up for 5 consecutive weeks driven by Nvidia and the semiconductor sector.

- Dow Jones was down by 2.3%

- Russell 2000 (small caps) is still underperforming and was down 1.2% this week.

- VIX again closed below 12, the lowest close since November 2019.

- Gold had a rough week and slumped by 3.4% over concerns about higher interest rates for longer in the US.

- Bitcoin saw an almost 3% gain driven by Ethereum ETFs approval by the SEC.

What’s interesting about the market performance is that the Dow Jones Transportation Average Index has recently diverged from the S&P 500. I am leaving this as a food for thought.

For the trading week ending May, 31 (the market is closed on Monday due to Memorial Day) key events are:

- Conference Board (CB) Consumer Confidence data on Tuesday.

- Second reading of Q1 2024 US GDP on Thursday

- 10 Fed speeches.

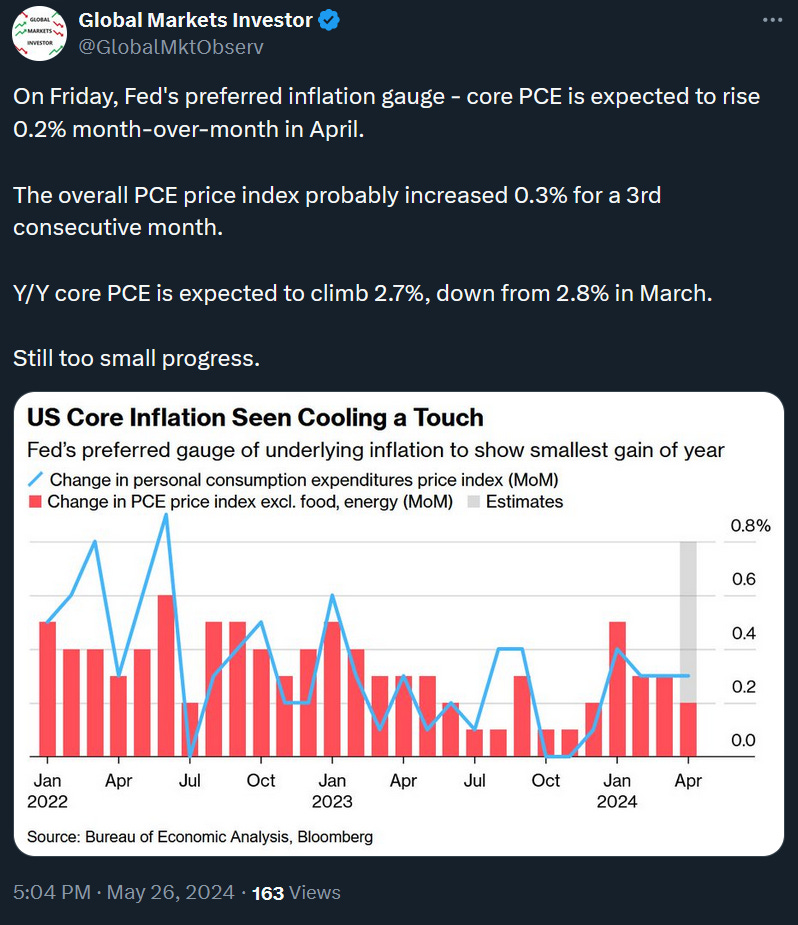

- April PCE Inflation (Fed’s preferred metric) data on Friday

The last one will be the most important event of the week as investors and market watchers look for potential signs of inflation easing. If the print comes materially above expectations US government bond yields and the US dollar will jump and that will trigger stocks, gold, and crypto to fall.

2) Global debt, G7 debt, and deficits.