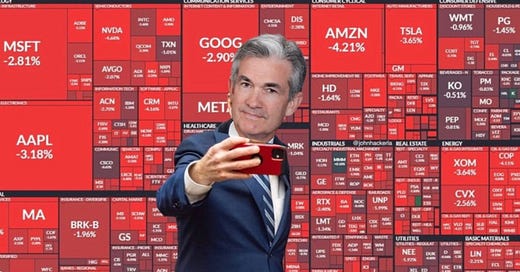

You have probably heard about the global market turmoil happening today. Here’s a quick summary of the events:

1. S&P 500 dropped 2.9% and erased $1.4 trillion in Market value, the worst day since September 2022.

2. VIX was up as much as 190% intra-day, 3rd largest spike in history after the 2008 Financial Crisis and 2020 COVID Crisis but finished the day 'just' +58%.

3. Nasdaq 100 was down as much as 6% intra-day but managed to bounce and ended the day down 2.9% erasing $900 billion in market cap. Overall it is 13% below its all-time high - correction territory.

4. Magnificent 7 stocks are down a WHOPPING $3 trillion in market value from their record highs.

5. NVIDIA is down 28% from its peak and lost over $1.1 TRILLION in market cap.

6. The Japanese Government's gross size of its balance sheet is $20 trillion or 505% of the Japanese GDP or 72% of the US GDP - a gigantic carry trade.

7. The Nikkei 225 index just saw the largest 2-day drop in the ENTIRE HISTORY of 19% and fell into a Bear Market.

8. Circuit breakers were seen in Japan, South Korea and Taiwan

9. USD/JPY is down 1.8% today and 13% over the last 5 weeks.

10. Bitcoin and Ethereum were down 9% and 20%.

We are witnessing massive moves in the markets and some major indexes are near entering a bear market.

Remember, however, even bear markets experience abrupt and massive rallies.

In other words, we will see more volatility on both sides going forward. Buckle up.

How did I position myself in this volatile environment? Defensively. Founding Members have been updated with my portfolio in July:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?