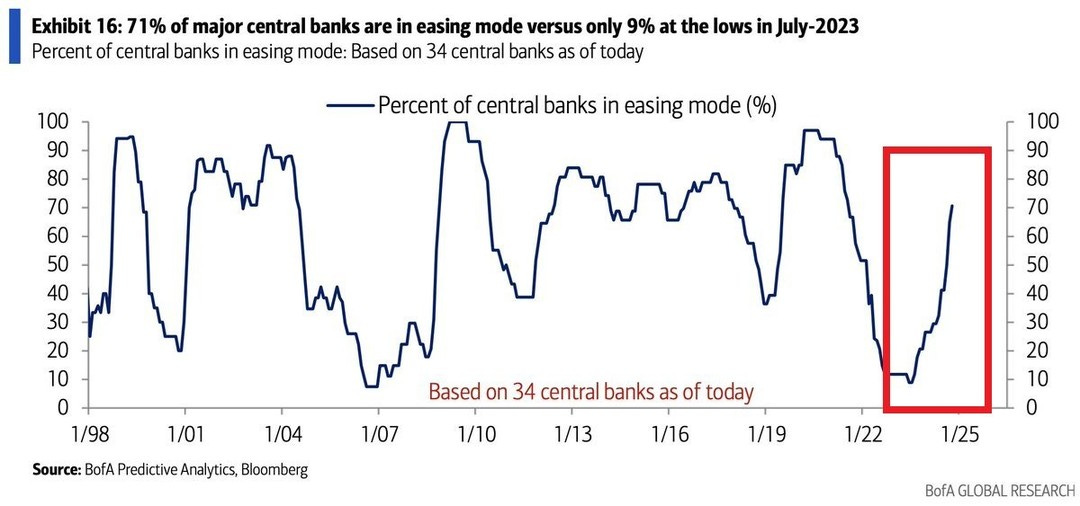

Major central banks are cutting rates as if there is a global recession

71% of global central banks have cut rates this year, the most since the 2020-2021 pandemic crisis.

The global rush to cut interest rates has started, as expected.

Year-to-date, 71% of major central banks have cut rates, the most since the 2020-2021 response to the COVID Crisis.

The percentage is also in line with the Great Financial Crisis of 2007-2009 and the 2001 recession. In other words, world central banks are cutting rates as if a recession is here.

Which banks have been cutting the most aggressively and why? What we could expect from them in the coming months? Please find the full analysis below.

This piece covers the recent moves conducted by: the Federal Reserve, the European Central Bank, the Bank of Japan, the Bank of Canada, the Bank of England, the Reserve Bank of Australia, the Reserve Bank of New Zealand, the People’s Bank of China, the Reserve Bank of India, and the Swiss National Bank.

THE FED JOINED OTHER CENTRAL BANKS IN SEPTEMBER