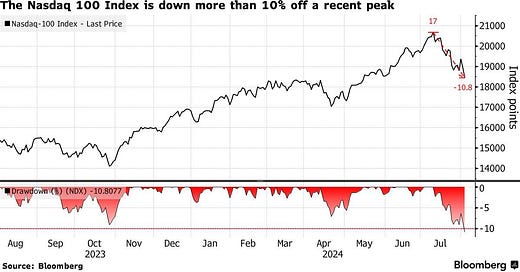

Magnificent 7 has erased $2.3 trillion in market value in one month. Nasdaq 100 entered a correction. Weekly market recap, trading week 31/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

That was one of the most intensive and volatile weeks of this year. Magnificent 7 earnings, the Federal Reserve meeting, tons of US economic data, including Manufacturing PMI, non-farm payrolls, job openings, and others. Below you can find out the Fed meeting recap including some macroeconomic and market events:

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 ended the week down by 2.1%. That was also the 3rd consecutive week of declines.

- Nasdaq index was down by 3.4%, marking the 4th straight week of decreases, the longest streak since September 2022.

- Dow Jones fell by 2.2%

- Russell 2000 (small caps) ended the week down 6.9%.

- VIX skyrocketed 45%.

- Gold rallied by 4.2%.

- Bitcoin saw an 8% drop.

For the trading week ending August 9, key events are:

- US ISM Services PMI for July on Monday

- US 10-Year Treasury Bond Yield auction

- US initial jobless claims on Thursday

- Q2 2024 earnings reports - ~15% of the S&P 500 companies are expected to release

The next week is pretty light in comparison to how intensive the previous week was. Investors will be focusing on the US services industry data as it accounts for ~70% of the economy. It will also turn out whether recession worries are real and the stock market will correct even further in the next several trading sessions.

In terms of earnings, would be interesting to see what Caterpillar will say as it is sometimes considered a global economic bellwether.

2) Warren Buffett’s Berkshire Hathaway just sold 50% of its Apple shares.