Is the US stock market in a BUBBLE?

Time to review valuations of the world's largest stock market once again

First of all, I would like to express my profound gratitude to all of you for subscribing to this content. The number of subscriptions and followers has recently exceeded 1,200! Additionally, the follower count on X (formerly Twitter) has crossed above 13,000! As a token of appreciation please find a 10% discount for an annual subscription. ONLY 7 DAYS LEFT!

This analysis is an update to the previous piece linked below.

Over the last several years, the US stock market has experienced an incredible run. This is despite that, in the meantime, it has also seen a bear market in 2022.

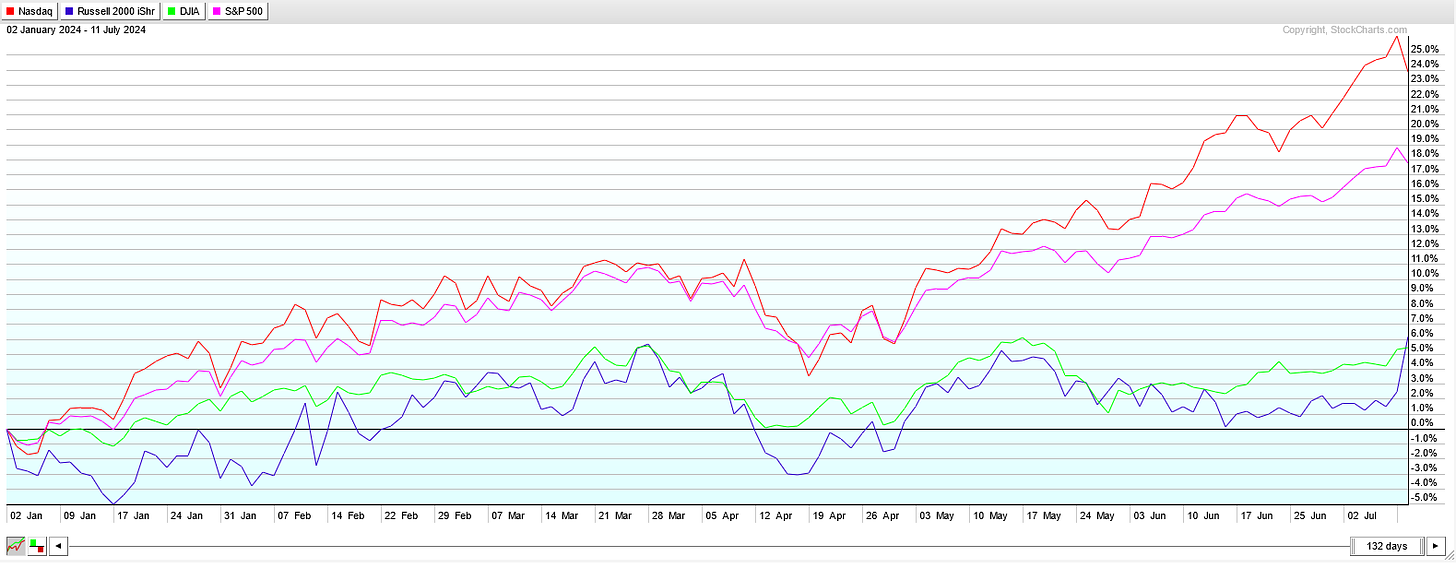

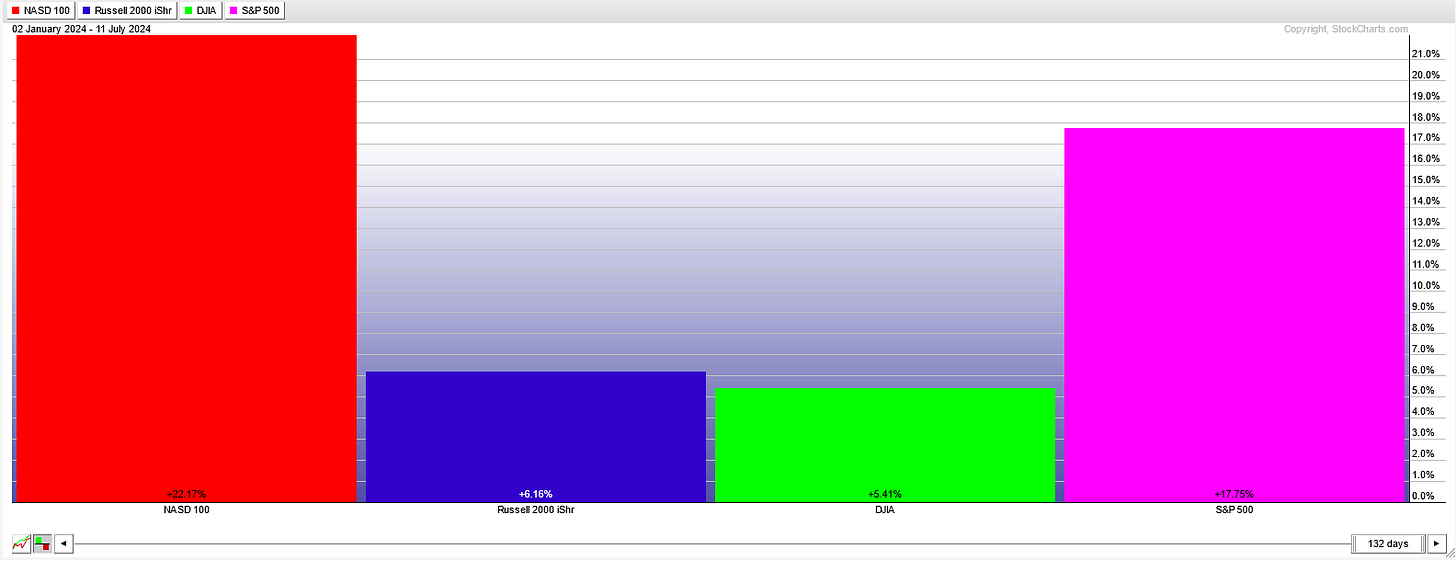

Since the 2020 Pandemic Crash low, the Nasdaq 100 has rallied by 188%, the S&P 500 by 150%, small-cap stocks by 124% and the Dow Jones Industrial Average by 114%.

Additionally, year-to-date, these indexes are up 22%, 18%, 6%, and 5%, respectively.

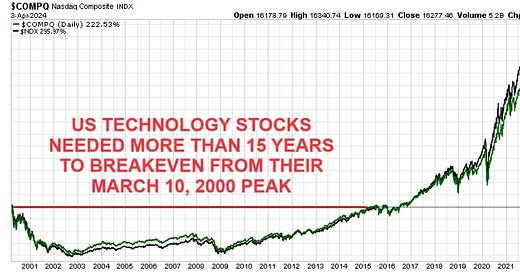

As you can see, the stock market has been almost entirely driven by US technology stocks. Notably, 40% of the S&P 500 stocks are still down year-to-date.

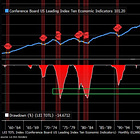

Given this incredible run and deteriorating economic prospects…

Is the US stock market overvalued?

Is the US stock market in a bubble similar to the 1999 Dot-Com?

Answers to these questions are especially important for medium and long-term investors. Please find the full analysis below:

EXTREME DIVERGENCE BETWEEN US STOCKS AND THE ECONOMY