Is the US labor market in a recession mode?

A real banger research piece is coming next week.

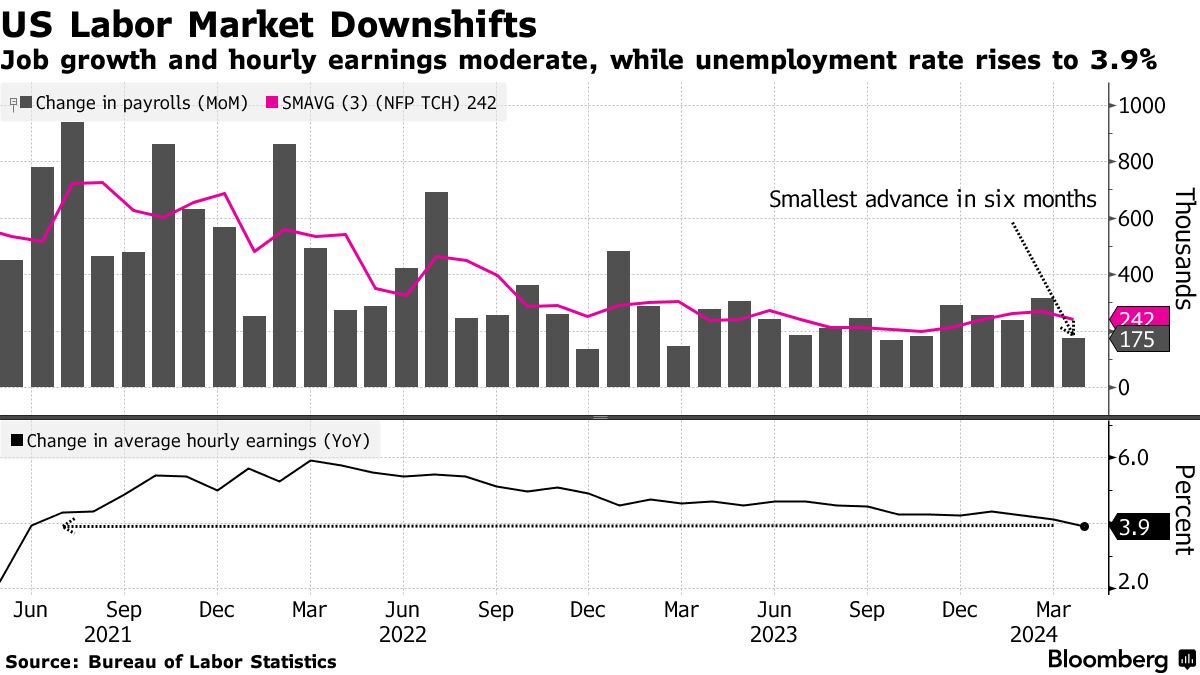

On Friday, the Bureau of Labor Statistics reported that the US economy added 175,000 new jobs in April, the smallest addition in 6 months. This is still a pretty decent number and nowhere near the levels that should be worrying. Furthermore, the unemployment rate ticked up slightly to 3.9% from 3.8% in March. At first glance, everything looks great. The US labor market reality, though, is completely different.

This will be the topic of the next piece which will be sent to paid subscribers early next week.

The article will answer the below questions:

1) Is the US labor market in a recession mode?

2) How many revisions there have been so far in 2024?

3) How flawed the current methodology of counting jobs is?

4) What is driving the headline jobs number?

5) How does the data affect the stock and bond markets as well as other asset classes?

6) How is this possible that the US economy is adding jobs on a net basis despite hundreds of thousands of job cuts?

And probably many others related to the Fed, the economy, and the financial market in general.

Meanwhile, if you are a free subscriber you can read the US labor market data analysis for February and March if you have not already:

If you find the work informative and helpful you may consider starting a premium subscription or buying me a coffee, and following me on Twitter:

Why subscribe?

I remember do you have 20% discount for an annual subscription.Is it still valid?