Is the US economy falling into a recession?

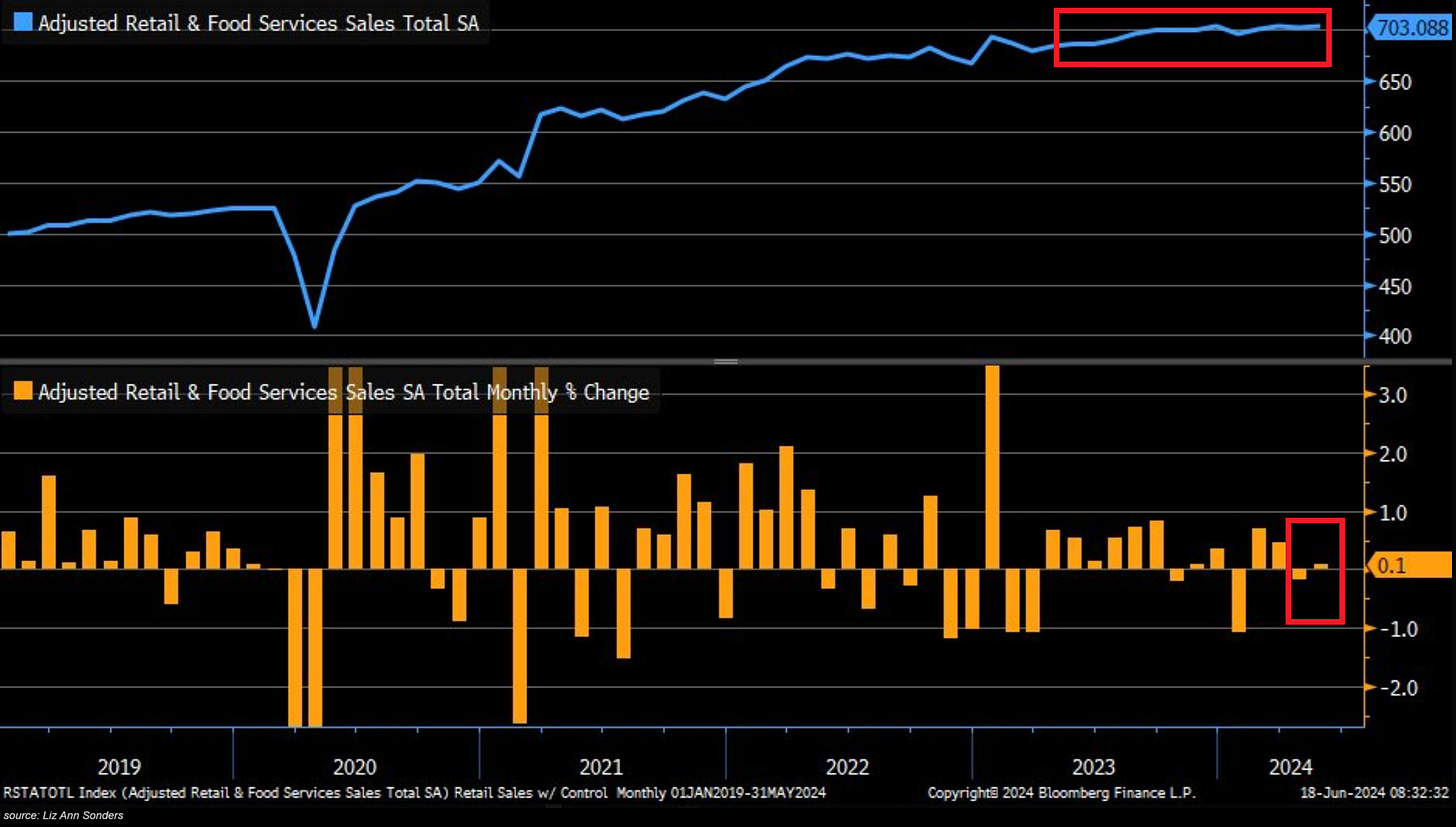

US retail sales were weaker than expected in May and April data has been revised down

US retail sales for May came at +0.1% month-over-month, below expectations of +0.3%. Notably, April’s initial print was revised downward to a -0.2% month-over-month.

Additionally, retail sales excluding autos and gas came at +0.1%, below forecasts of +0.4% whereas core retail sales (included in GDP calculation) excluding automobiles, gasoline, building materials, and food services rose +0.4% below estimates of +0.5% expansion.

Overall, the data presented a pretty soft picture of US consumer spending. Moreover, as you can see on the above chart, retail sales have been flat for the last several months and this is not even adjusted for inflation. What does it look like then when this data is adjusted for rising prices?

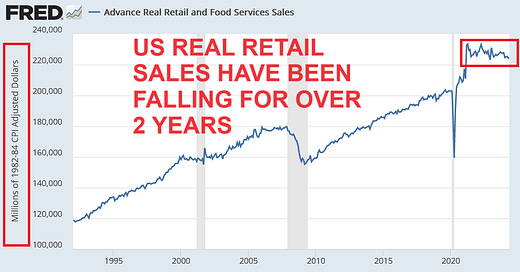

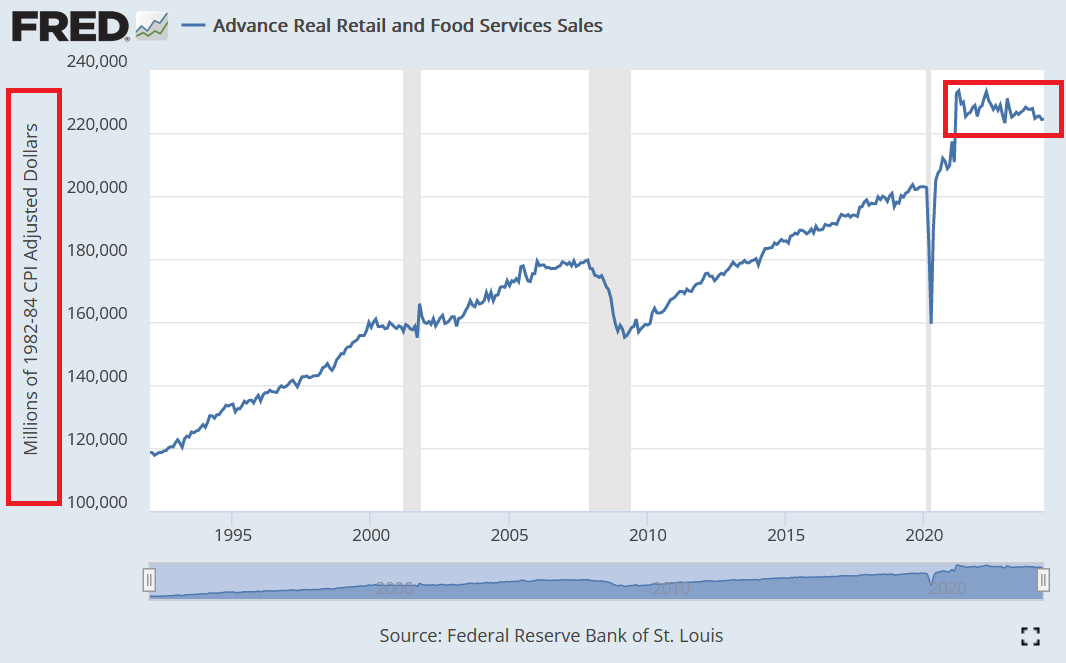

Namely, real retail sales have been falling for over 2 years and are now nearly 4% below the 2021 and 2022 peaks.

Furthermore, real retail sales are on track for 2 straight quarters of year-over-year declines. This certainly does not look like a “strong” economy.

As a reminder, the previous 2 years of deteriorating commercial real estate sector and manufacturing recession were offset by labor market data and US consumer spending.

Recently, these 2 have also started to weaken as expected. Back in March, you could already read about consumer weakness in one of the analyses here.

To find out more details and see whether the US economy is falling into a recession as well as how to invest in such an environment, please read the below articles:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), buying me a coffee, and following me on Twitter:

Why subscribe?