Is the Fed making a mistake by cutting rates this year?

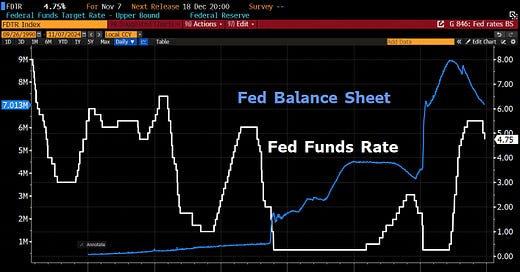

The US Central Bank lowered rates by 0.25% on November 7, conducting the second consecutive reduction this year after a 0.50% cut in September

The Federal Reserve cut its interest rates by 0.25% on Thursday, November 7th, conducting the second reduction in 2024. Unlike in September, there were no dissents to this decision.

The central bank highlighted that it will continue to reduce its balance sheet at the current pace of up to $60 billion per month.

The Fed made marginal changes to the statement between September and November. This time they wrote that the “labor market conditions have generally eased” instead of “slowed” and repeated that “the unemployment rate has moved up but remains low”.

Interestingly, the Fed removed the saying “gained greater confidence” that inflation is moving toward the 2% target.

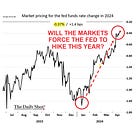

Following the meeting, more concerns were raised about whether the Fed is making a mistake by cutting rates as progress on inflation has slowed. Keeping that in mind, let’s review the November Fed meeting including the conference of the Fed’s Chair Jerome Powell.

If you would like to see how the previous meetings had shaped, please find below the last 6 recaps:

CHAIR POWELL CONFERENCE, GOVERNMENT BOND YIELDS RISING, CAREFUL APPROACH NEEDED