Is the Fed heading towards another monetary policy mistake?

The May 1 FOMC meeting provided more questions than answers about the future policy path

On Wednesday, May 1, the Federal Reserve left its interest rates steady in a range of 5.25%-5.5% for a 6th consecutive meeting.

Notably, in the statement, the US central bank said that in recent months there has been a “lack of further progress” on inflation in reaching their 2% target. This was largely expected as roughly two weeks before the meeting, on April 16, Fed Chair Jerome Powell already mentioned such words.

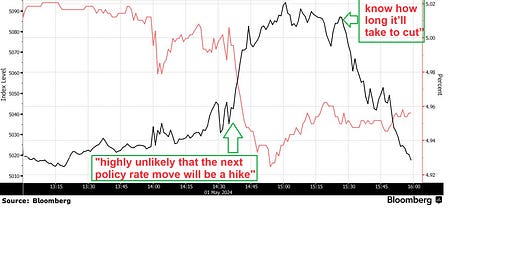

Following the event which included the Chair’s press conference, the S&P 500 finished the day down by 0.3% with gold gaining almost 1%.

What was the real trigger for the market? What important things did Chair Powell say during the conference? What to expect from the central bank going forward? These and other questions are elaborated below.

FEDERAL RESERVE BALANCE SHEET TWEAKS