Is the Fed going to HIKE rates this year?

Previews of the Fed's favored inflation gauge data release and the FOMC May meeting

On May 1 at 2 p.m. ET, the Fed is set to announce its interest rate decision which will be followed by the central bank Chair Jerome Powell press conference at 2.30 p.m. The market is currently pricing a 99% chance that the Federal Reserve will hold its rates steady at this meeting.

There will be not much new information at the event, apart from the Chair press conference, as the Fed economic and rate forecasts (Summary of Economic Projections and Dot-Plot) are announced at every other meeting. This was done at the last meeting in March. See the recap of this event below:

The Fed left rates steady as expected at 5.50%, stocks and gold at all-time highs

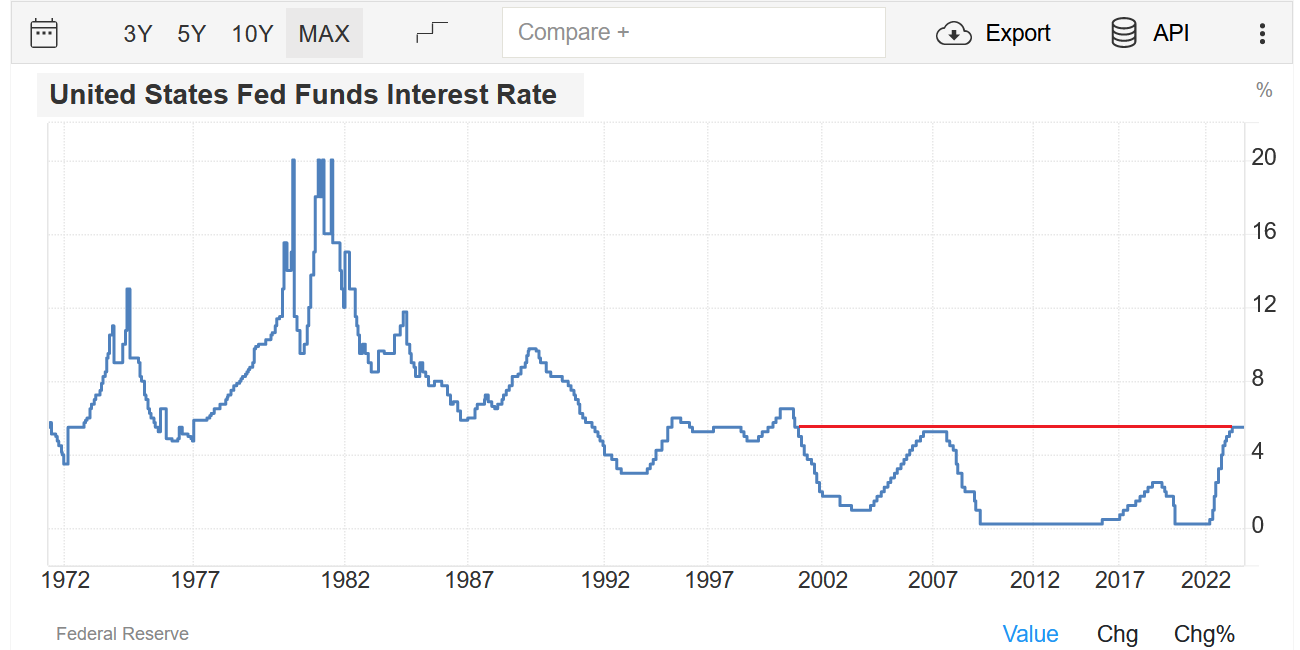

On Wednesday, March 21 the Fed unanimously decided to leave interest rates unchanged at a range of 5.25% to 5.5%, the highest since 2001, for a fifth consecutive meeting. The FOMC (Federal Open Market Committee) members also reiterated that the Fed will continue shrinking its balance sheet by as much as $95 billi…

All eyes then will be as always on Chair Powell and his views regarding inflation, interest rates, the labor market, the Fed balance sheet, and the economy as a whole. And this might be tricky given the recent inflation pick-up. More details in the below article:

What exactly to watch for during his conference? What investors, asset managers, and other market participants will be looking at? What does the market think right now? What are the probabilities of the Fed’s rate cuts or perhaps even rate hikes? How could different asset classes react in the upcoming weeks?

You will find answers to these questions in the following sections.