Is it true that 10 gold bars of 1kg would buy you an average home in 1929 and 2024?

A quick analysis of gold value preservation and even increase over time versus other assets

I believe investing is more of an art than a science and that in the longer term, you will succeed no matter what if you stay consistent.

In this short piece, I would like to bring out the topic gold’s ability to preserve its value over decades while at the same time currencies devalue.

Is it true that 10 gold bars of 1kg would buy you an average home in 2024 in the US, the same amount as in 1929 when house prices peaked just before the Great Depression?

It turns out that, yes, and it is even more than true.

Median house prices were around $5,000-$8,000 ($6,500 at midpoint) in the US in 1929.

10kg (or 353 ounces) of gold was worth $7,297 or $20.67 per ounce in 1929.

Dividing $7,297/$6,500 gives 1.1 house for 10 gold bars.

Now in 2024, the median home price is at a record $420,800 while gold is at ~$2,360/ounce giving a $833,080 value per 10 kg of the yellow metal.

Dividing $833,080 /$420,800 gives 2 HOUSES (after rounding) for the same amount of bars as in 1929.

In other words, for 10kg of gold, you can buy now nearly twice as many homes in the US than at the onset of the Great Depression also called the National Mortgage Crisis.

The purchasing power of gold versus US homes has increased by almost 2 times in 95 years.

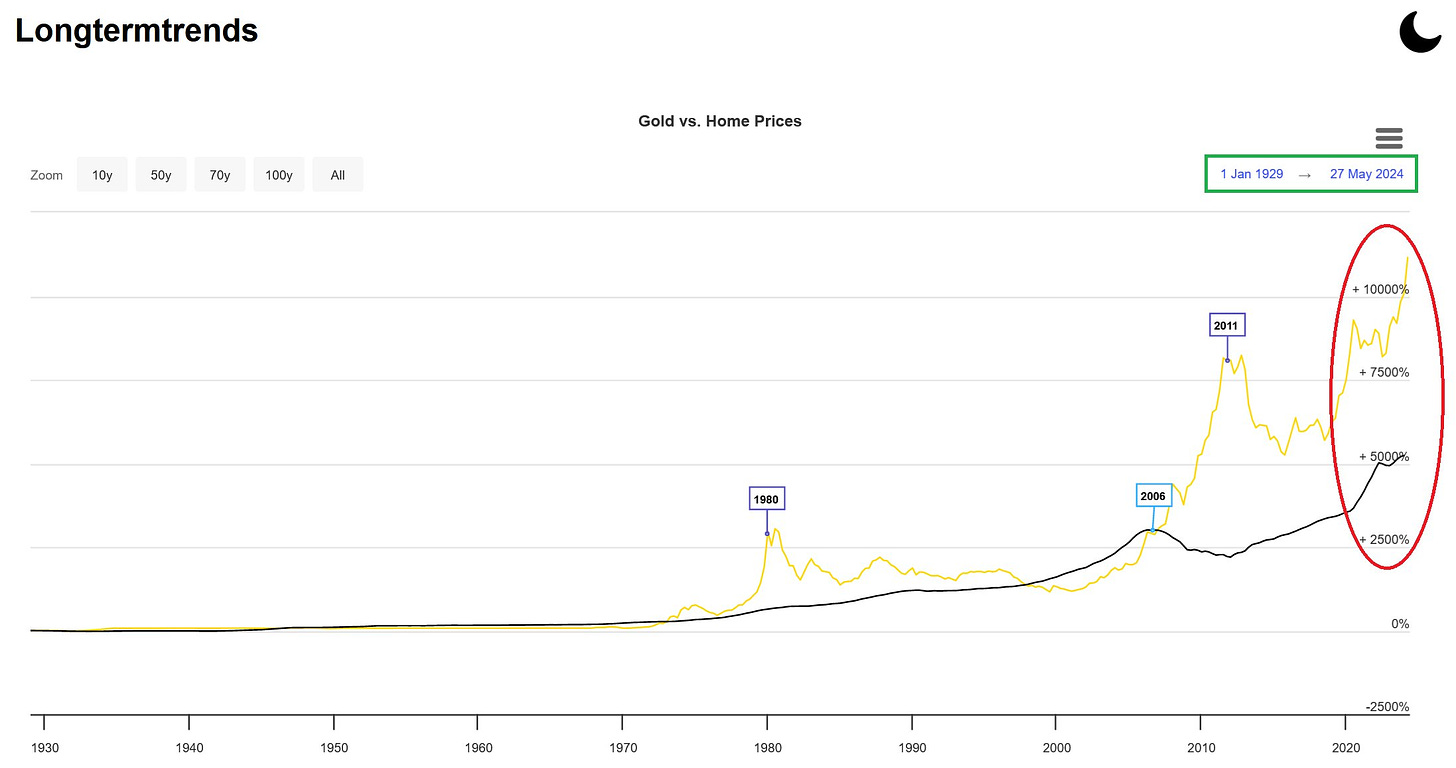

What does it look like over the last 30 years?

In the last 3 decades, gold prices have risen by ~500% while US housing prices (the Case-Shiller Home Price Index) by ~300%. Significant beat of the yellow metal.

Gold is therefore a great long-term store of value, next to stocks.

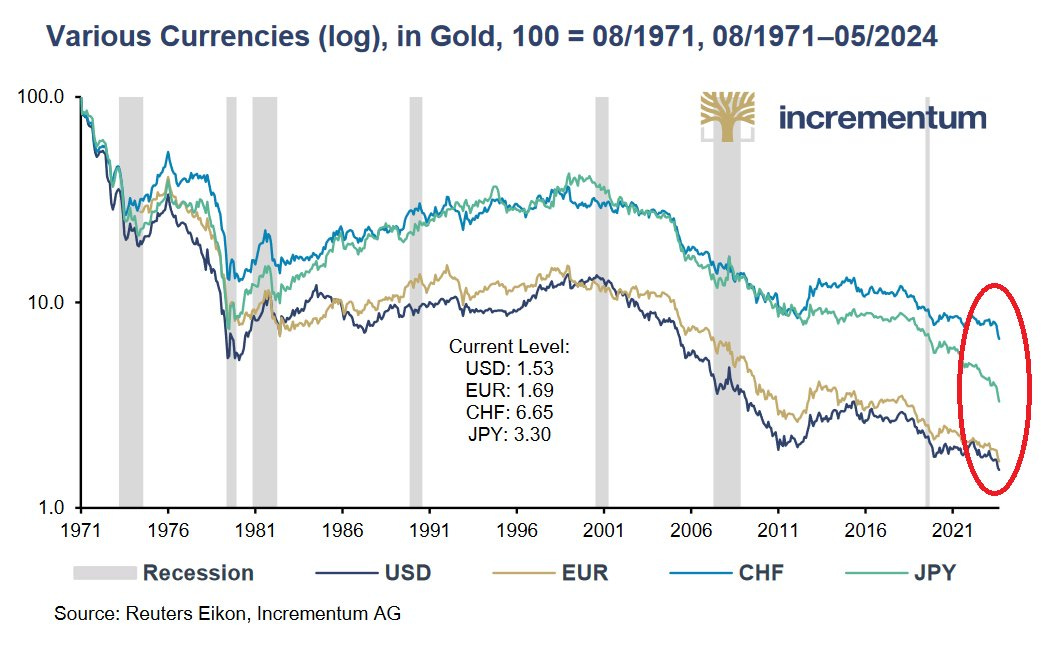

Another notable example of the so-called barbarous relic value preservation is currency devaluation.

Namely, the US dollar has devalued by 98.47% vs gold since 1971.

In other words, the USD lost 98.5% of its value vs the yellow metal in 53 years.

Meanwhile, the Euro and Japanese Yen lost 98.3% and 96.7% during the same time while the Swiss Franc lost 93.35%.

One could say that it's not that things are getting more expensive, it's rather the value of your money is declining. I completely agree.

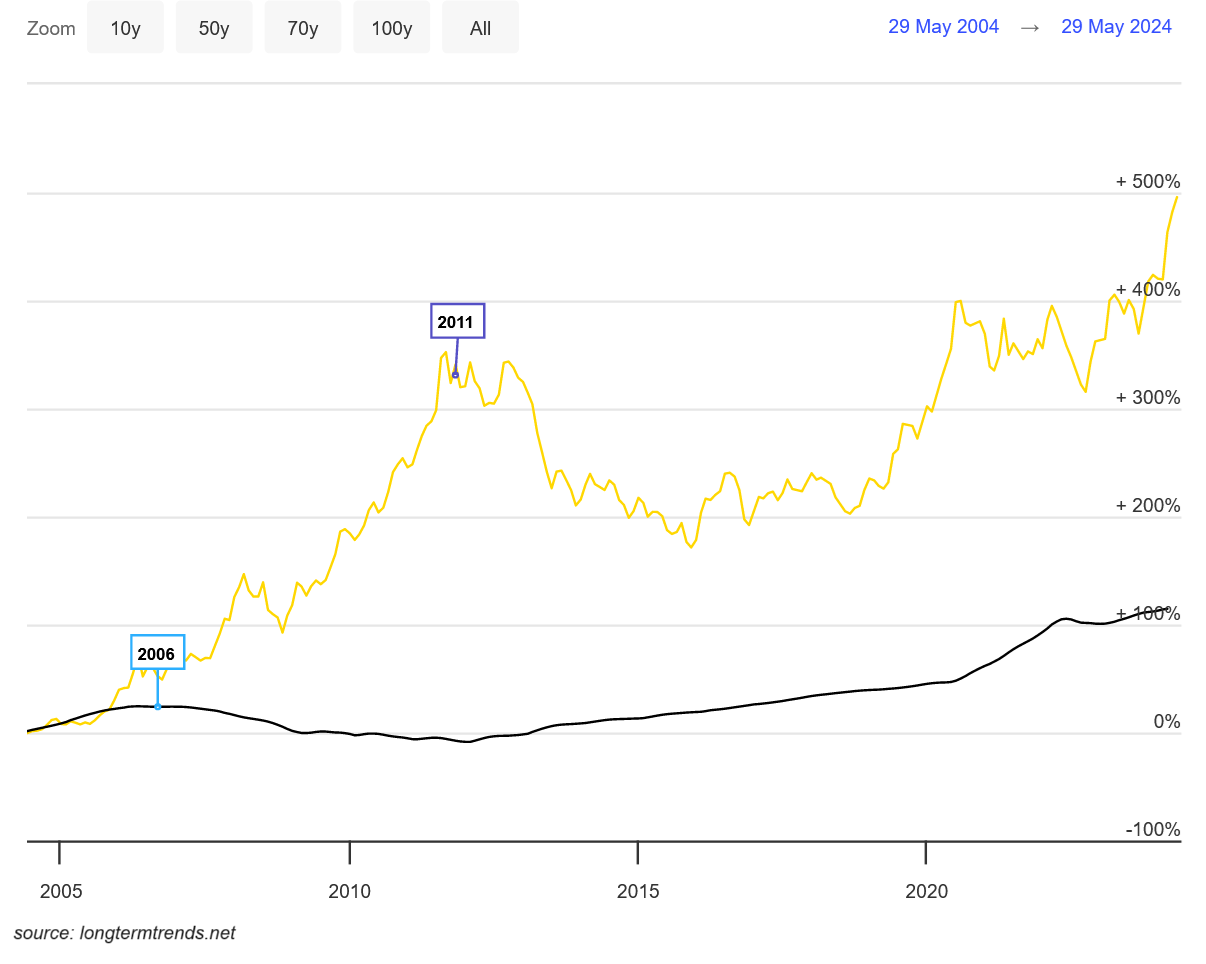

For a full clarification, let’s also look at how gold has performed versus US housing prices in the last 20, 10, and 5 years as more than 2 decades period seems to be pretty long when considering one generation of investing.

In the past 2 decades, gold has seen a nearly 500% advance in value versus the ~110% rise in US home prices.

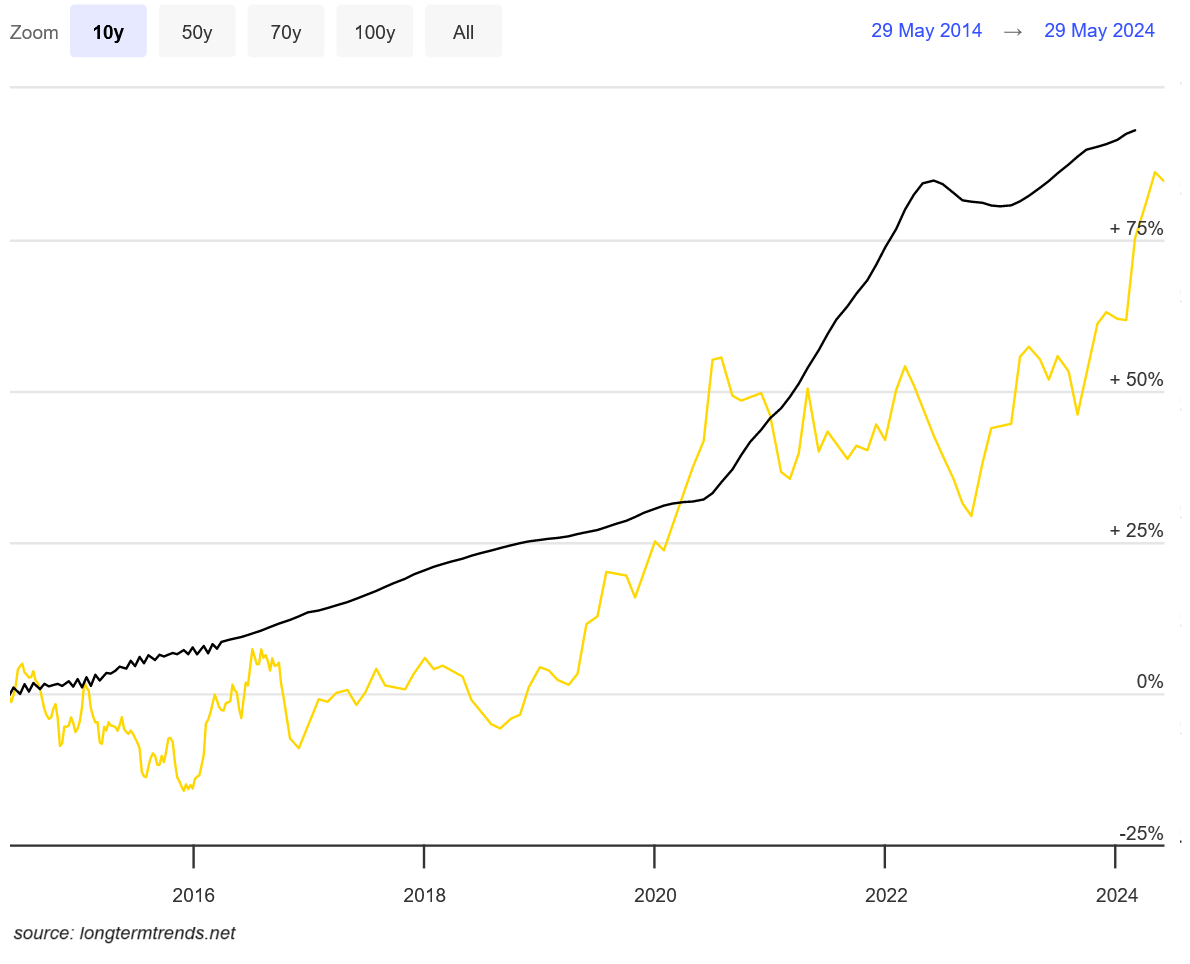

In the last 10 years, gold surged by 85%, slightly lower than the 93% increase in US housing.

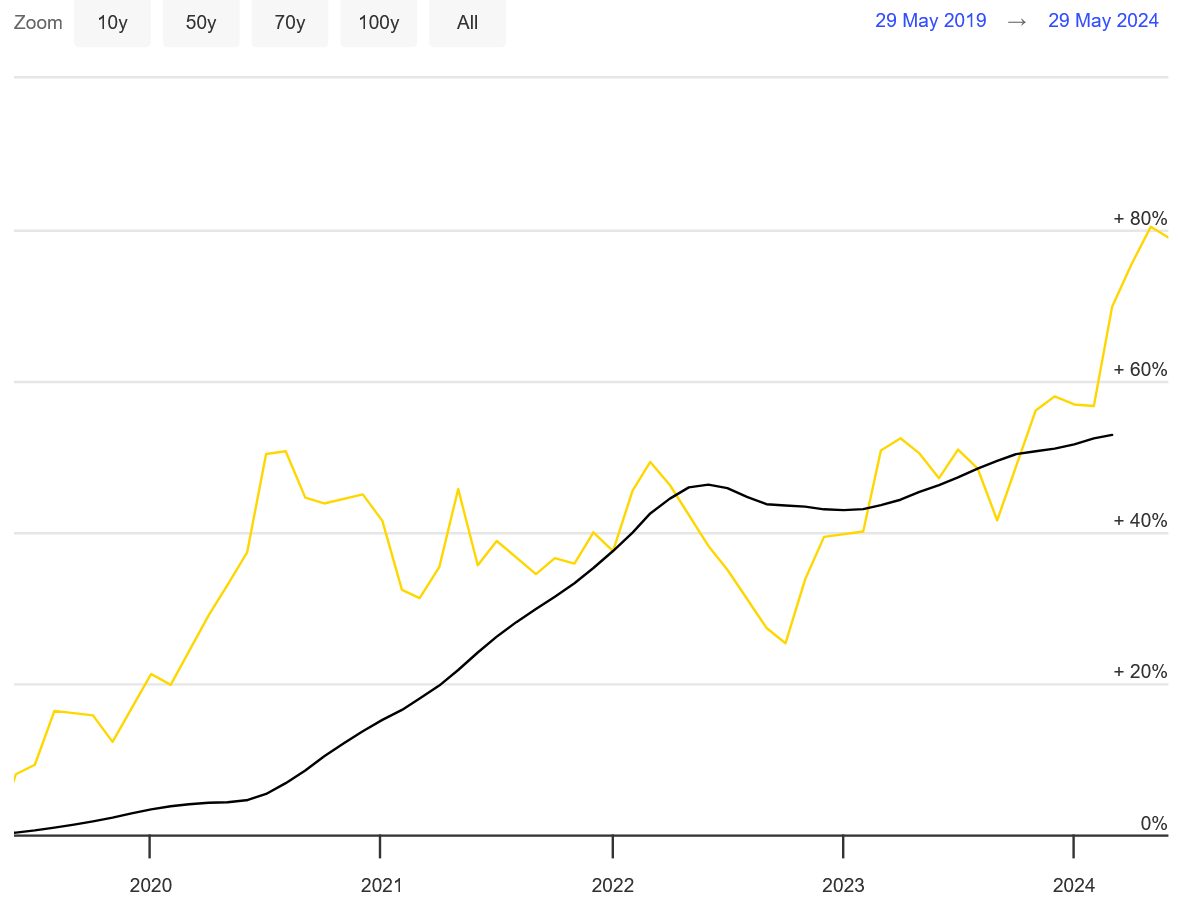

Finally, over the last 5 years, gold has outperformed average US home prices by 26% (the chart shows monthly closing prices). In fact, gold has outperformed by 36% as of today’s price.

As you can see, gold has seen one of the most remarkable performances in history and has been a great store of value, much better than real estate prices. It has to be emphasized, however, that in the short-term it can be susceptible to some sort of volatility, though usually lower than in stocks.

In the past 5 years, it has also outperformed the S&P 500 index by returning ~89% versus the S&P 500 gain of 83%.

Finally, it is worth noting that we live in an era when policies are continuously robbing citizens of hard-earned money through taxation, capital controls, and hidden taxes called inflation.

Gold is also a hedge against these relentless policies.

Is gold heading to $3,000? What’s next for gold? Find out below:

Final word: Protect your capital, educate yourself financially, and most importantly: stay invested.

If you find it informative and helpful you may consider upgrading to a paid subscription or buying me a coffee, and following me on Twitter:

Why subscribe?

I suspect the results would be different if you accounted for home sizes which have expanded dramatically even since the 50’s.

No claim to accuracy on this article, but it does suggest those price changes roughly correspond with size changes.

https://247wallst.com/special-report/2016/05/25/the-size-of-a-home-the-year-you-were-born/

LOL not even close!