IMPORTANT PERIOD AHEAD FOR MARKETS - PORTFOLIO PERFORMANCE REVIEW (September 10, 2024)

Given the recent volatility, it is a good time to present my long-term portfolio performance year-to-date

Remember that all information provided here is for educational and entertaining purposes and is not investment advice. By investing in the financial markets I risk my own money. Past performance is no guarantee of future results.

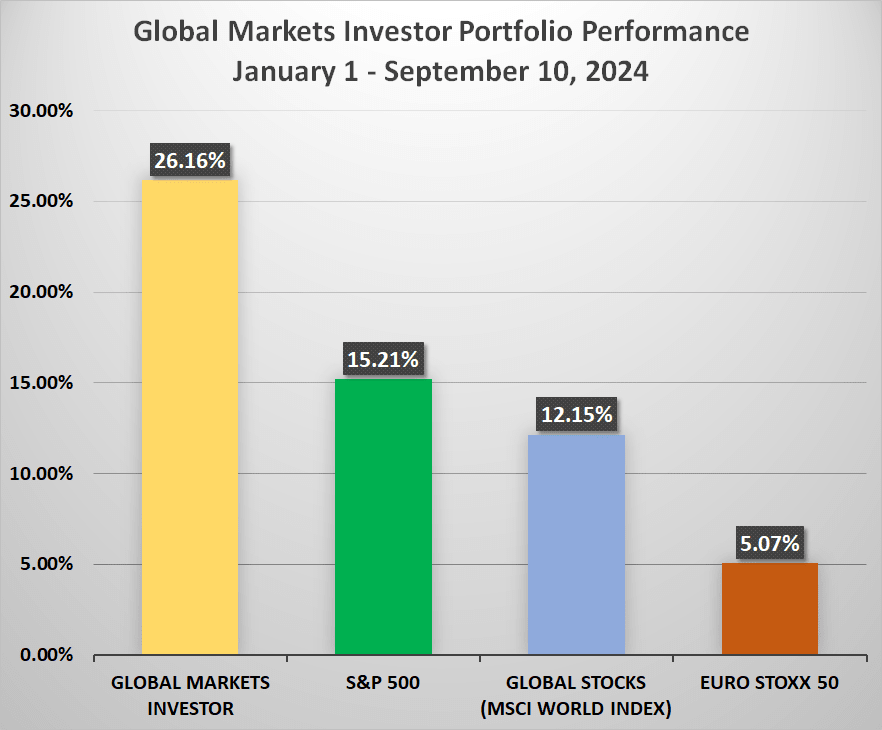

I would like to present to you my year-to-date investment portfolio performance against the major stock indexes in the US, Europe, and globally.

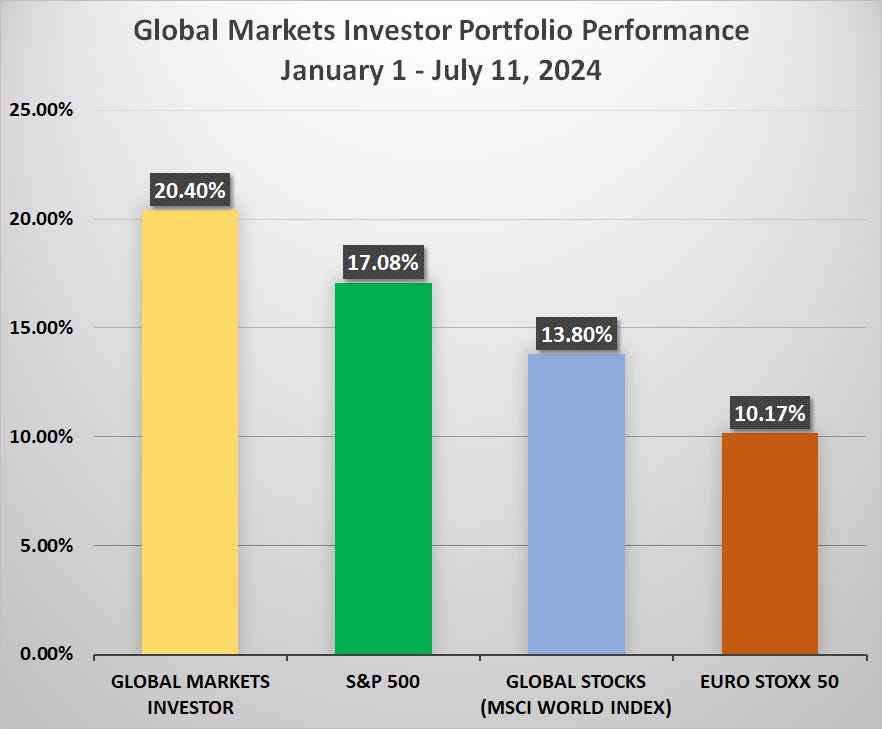

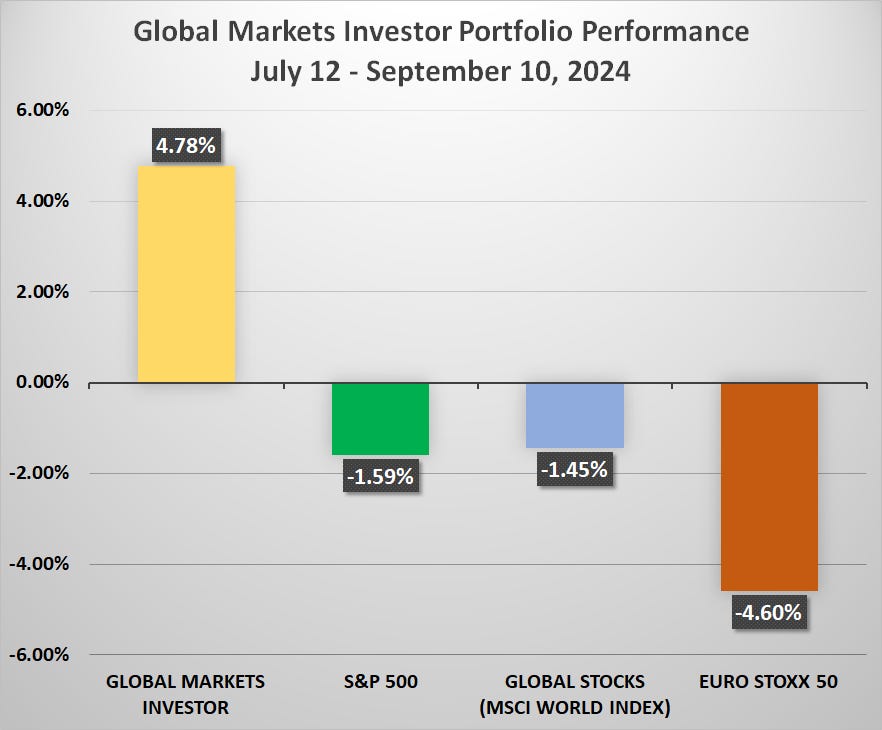

As you probably know, I made some changes to my holdings on July 11 and have moved my capital into more defensive assets given what has been happening lately in the markets and the US economy. Full portfolio composition is available for Founding Members.

Overall, the switch to a defensive mode has paid off. As a result, my long-term investment portfolio is up 26.16% year-to-date, beating the S&P 500 gain of 15.21%. This is also twice above the performance of the MSCI World Index representing global stocks (mostly driven by the US) and 5 times more than European stocks.

Now, looking before the July 11 changes, the portfolio still beat all aforementioned indexes, though, by a smaller margin. It is not easy to beat markets during times when almost everything is going up. Still made it thanks to some slightly riskier exposure.

Lastly, the performance after July 11 changes. It has been two months and the portfolio was able to return 4.78% whereas major indices have not managed to provide any gains. This is proof of why going defensively pays off if we have a high conviction that the market could underperform.

Nevertheless, until the year's end, everything can happen. As of today, I do not expect any portfolio changes until there is more clarity around the next Federal Reserve moves, the US economy performance, and the presidential election.

I hope you find it useful and enjoyable at the same time. Thank you.

Global Markets Investor

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?

Man those are some impressive numbers!

Congrats! 👍🏻