How do US stocks perform after the Fed cuts interest rates?

Time to have a closer look at the historic stock market performance following months after the Fed's first interest rate reduction

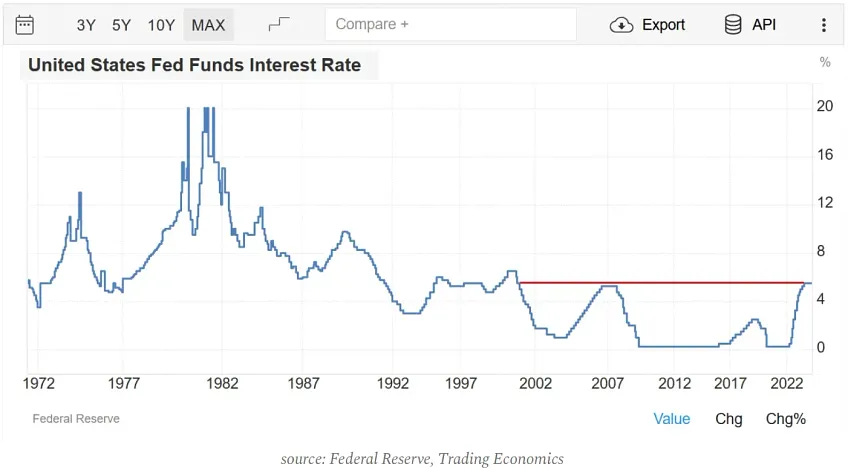

“The time has come for policy to adjust,” said the Fed Chairman Jerome Powell during his annual speech at the Jackson Hole Economic Symposium about the economic outlook on August 22. In other words, the Fed Chair gave the green light to start cutting interest rates in the United States for the first time in 4.5 years. Summary of the speech is available in the 34/2024 market recap:

Therefore, it is almost certain that the Fed will start cutting rates at its next meeting on September 18.

Currently, the market is pricing in a 71% probability that the first reduction will be by 0.25% and a 29% chance that it will be by 0.50%. It will definitely change over the next 10 days as there is still some data scheduled during this time such as Inflation CPI and PPI as well as retail sales.

Notably, since 1929, there have been 22 rate-cutting cycles conducted by the Federal Reserve. Sometimes it is claimed that there have been 14 cycles. The performance differed depending on the US economy and geopolitical climate.

Let’s examine then how US stocks behaved during each cycle and what we could expect after the Fed cuts for the first time on September 18.

SHOULD SMALL, MID, OR LARGE CAPS BE THE PRIMARY CHOICE AFTER THE FIRST CUT?