How dangerous the US debt crisis has become? Part 1/2

The US government is spending as if the economy is in a recession. What are the consequences for ordinary people, taxpayers, savers, and investors?

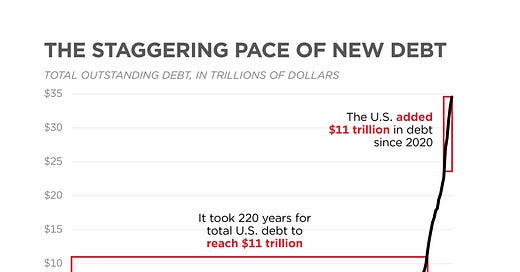

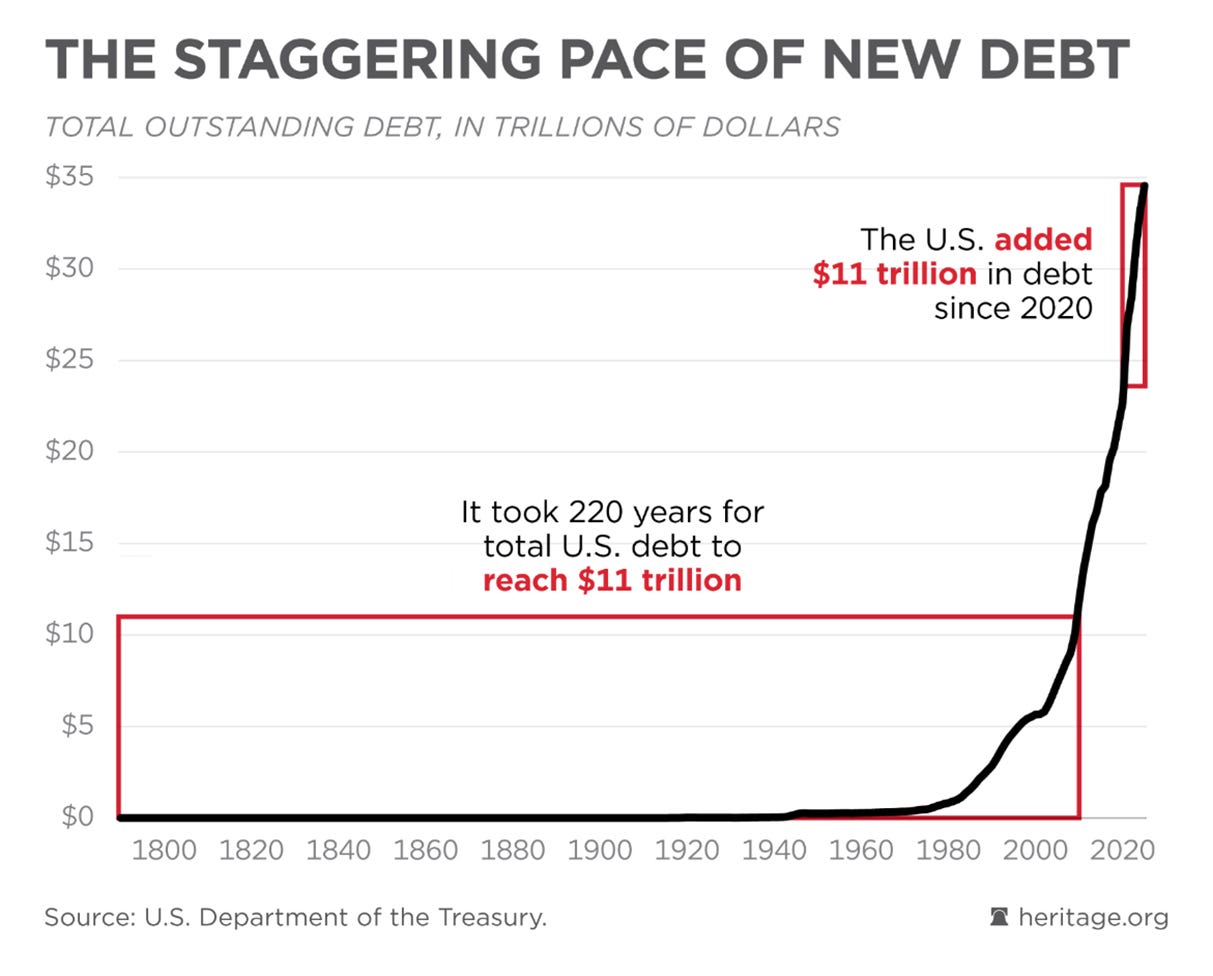

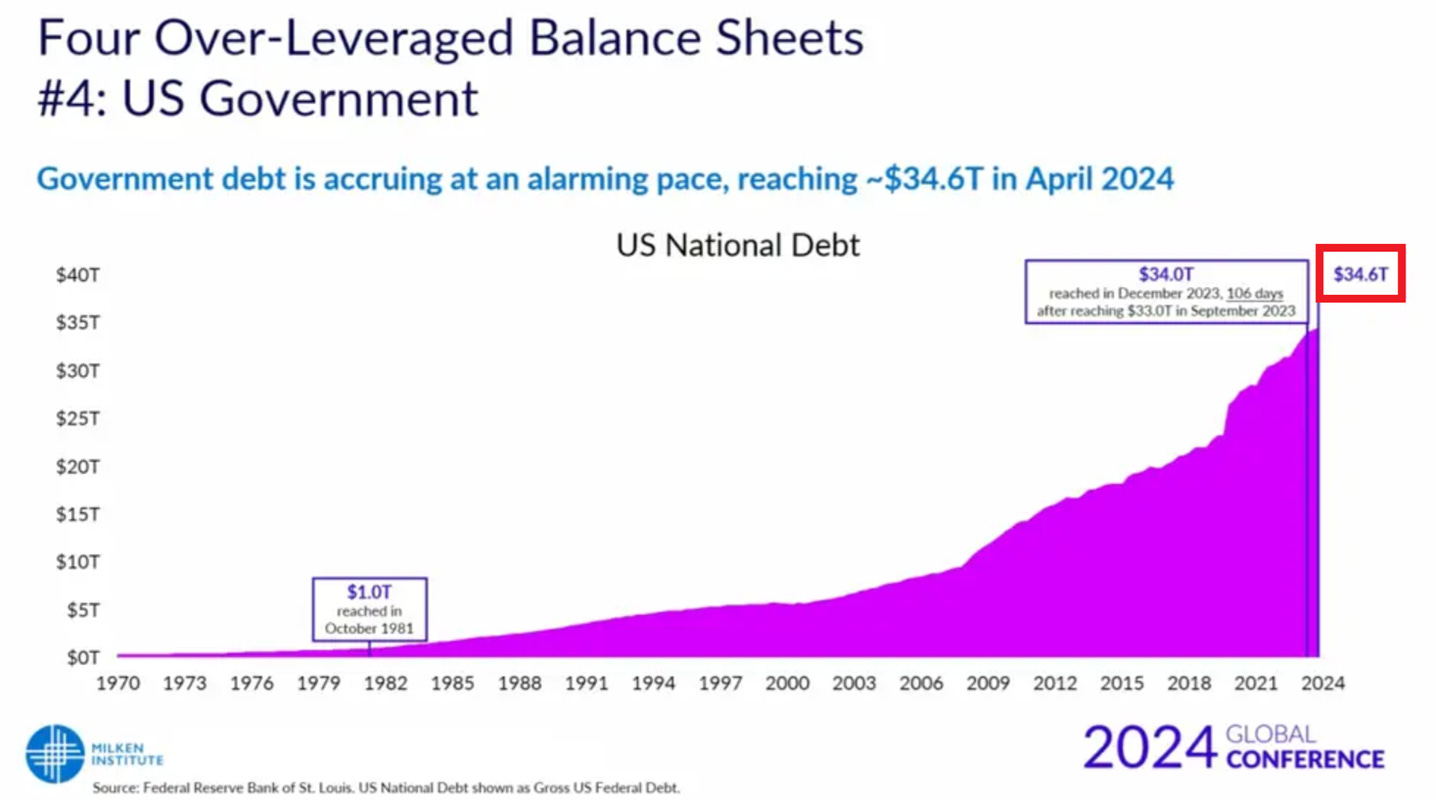

Over the last 4 years, the US national debt has skyrocketed by a whopping $11 trillion. This is the size of 40% of the US economy’s GDP. By comparison, to reach the first $11 trillion of debt it took 220 years.

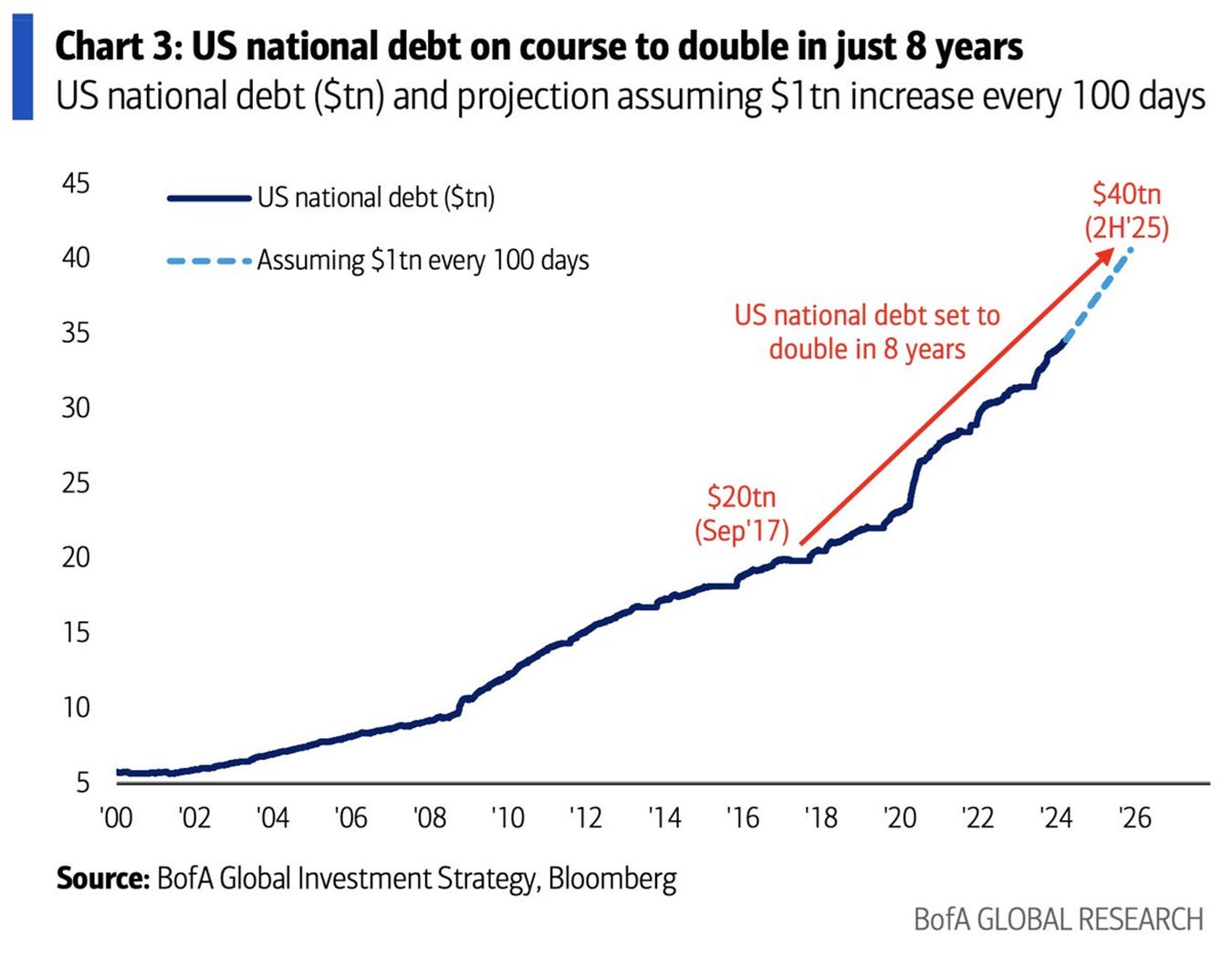

It means that on average national debt has increased by $2.75 trillion a year. Since June 2023, the US federal debt has increased by $3.1 trillion and hit a record $34.6 trillion. In other words, it has been increasing by roughly $1 trillion every 100 days.

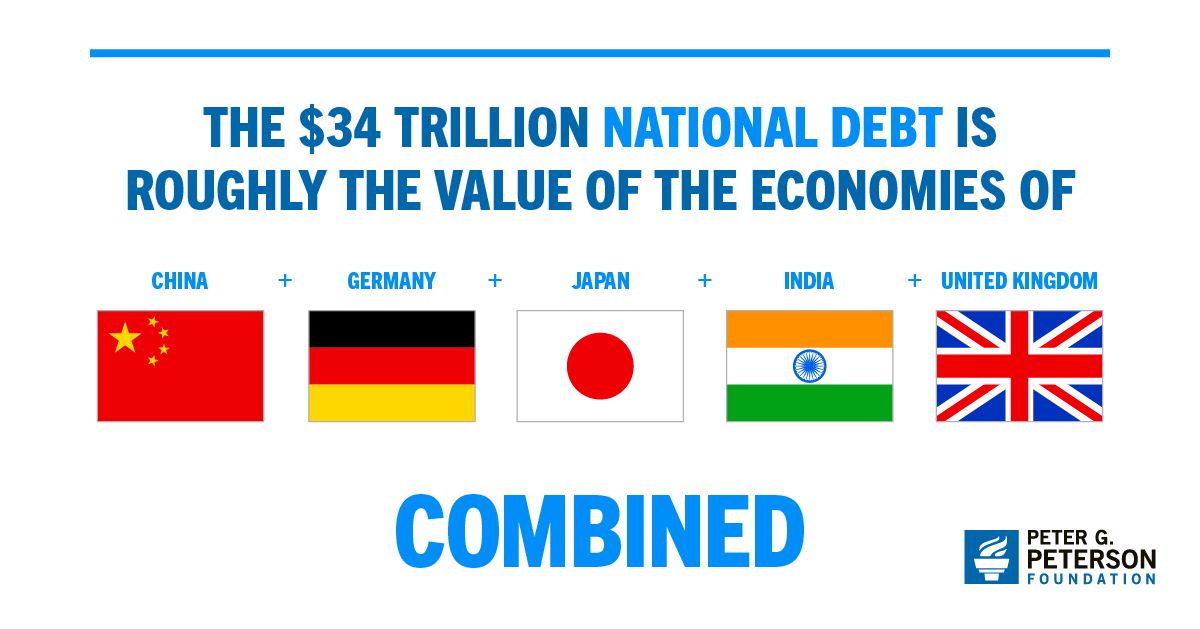

If the US debt was an economy then its value would equal China, Germany, Japan, India, and the UK COMBINED.

If the current pace continues, the US debt will reach as much as $40 trillion by 2025. This would be doubling the number in just 8 years since 2017.

That would also be a 16% increase from the current debt levels versus a projected 4% GDP growth. In other words, US federal debt is set to rise 4x faster than the economy. These numbers are staggering.

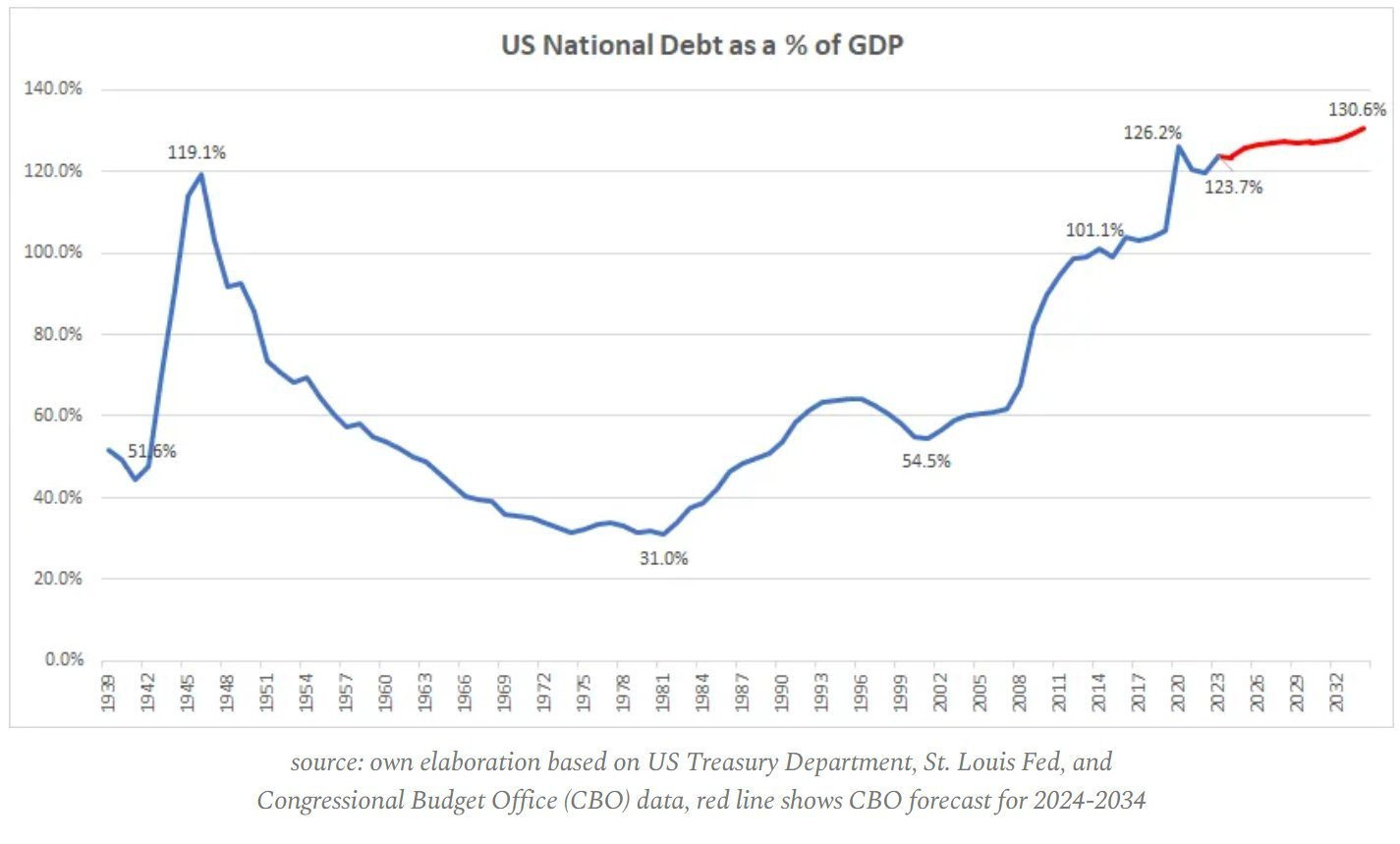

Nevertheless, a better way to measure a country’s debt is using the debt-to-GDP ratio as it helps to understand a country's ability to service and pay back its debts (interest and principal) in the future. In other words, how much financial obligation a country has in comparison to the size of its economy and which of the two is growing faster. In this case, the overall picture does not either look healthy.

The US debt-to-GDP ratio is at 123.7%, near the all-time record of 126.2% seen in 2020. This measure is also higher than during World War II when the United States was financing the war with record budget deficits (spending more than bringing in taxes) of 27% of GDP. As you can see, since the 1980s the ratio has rapidly increased meaning that debt has risen much faster than the economy has grown.

This was a pretty long but necessary introduction. One could say that he has heard about the US national debt crisis for the past 10 years or so and nothing has happened. This is not true. It has already affected millions of US citizens, especially savers as well as US government bond investors (cash and bondholders). This has also affected other asset classes which will be covered later. Overall, many consequences have been explained in the below article:

The above piece, however, does not contemplate how significant those repercussions might become in the future and does not cover many other key points regarding the US and global financial system as well as the economy.

At this point, it has to be emphasized that this update is extremely important for ordinary people all over the world, US taxpayers, savers in all parts of the globe, investors, global policymakers, and future generations. This analysis is so comprehensive that it had to be divided into 2 parts.

The 1st part analyses the level of US federal debt, government spending, and budget deficits as well as their consequences and outlook. Moreover, it deep dives into potential future debt scenarios and contemplates ever-rising debt interest costs including how scary levels they have reached and could reach in years ahead. Simply, it answers the first three questions from the following list:

1) How bad the US debt crisis has become?

2) What is the outlook for the budget deficit, government spending, total national debt, and interest costs?

3) Why does the US government need lower interest rates more than anyone?

4) What does an 'unsustainable debt path' mean?

5) Who/what will decide how much more the US government can spend in the future?

6) Where do the first signs appear that something has broken?

7) How much debt needs to be refinanced, at what cost (rates), and who is going to buy this new debt?

8) How major asset classes (stocks, bonds, precious metals, crypto) will perform in such an environment?

In the 2nd part of the analysis, the remaining questions will be answered.

I warmly invite you to read this piece.

US GOVERNMENT IS SPENDING AS IF THE ECONOMY IS IN A RECESSION