Gold, Silver and Bitcoin skyrocketed. S&P 500 hit its 47th all-time high this year. Weekly market recap, trading week 42/2024

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the largest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

The past week was rather muted in terms of volatility with US stocks slowly grinding higher as Q3 2024 earnings season kicked off. Notably, gold, silver, and Bitcoin were skyrocketing and all have outperformed the S&P 500 year-to-date. Meanwhile, US retail sales data slightly beat economists' expectations while industrial production data disappointed.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was up 0.8% and hit its 47th all-time high this year.

- Nasdaq index increased by 0.8%

- Dow Jones rose 0.9%

- Russell 2000 (small caps) was up 1.9%

- VIX index fell 11%

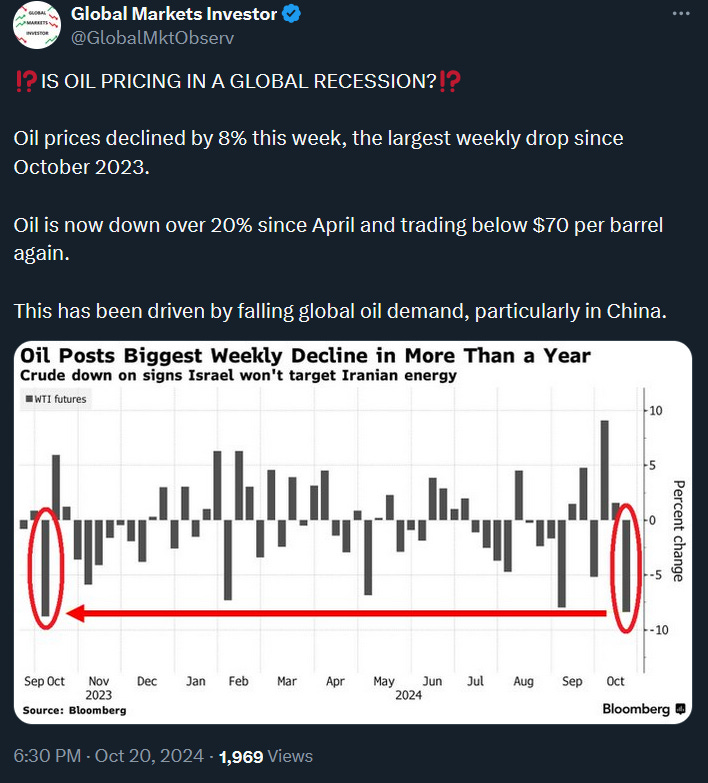

- WTI Crude Oil dropped 8.1%

- Gold was up 2.2%

- Bitcoin increased 8.3%

For the trading week ending October 25, key events are:

- US Existing Home Sales on Wednesday

- US New Home Sales on Thursday

- US S&P Global Manufacturing and Services PMIs on Thursday

- US Durable Goods Orders on Friday

- University of Michigan Consumer Sentiment on Friday

- 8 Fed Speakers

- ~33% of the S&P 500 companies reporting Q3 2024 earnings

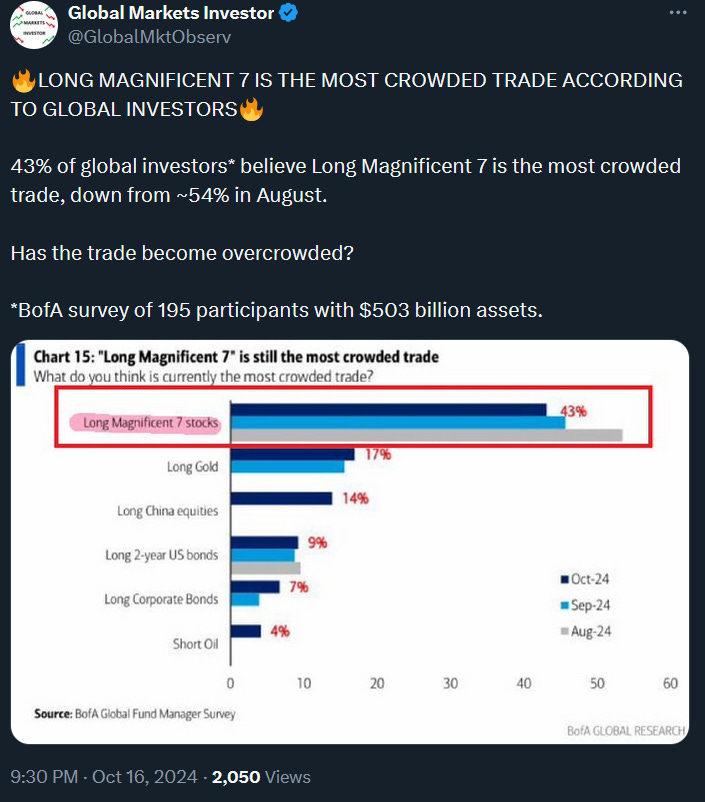

2) Investors' euphoria is everywhere except for one very important group.