IMPORTANT ANNOUNCEMENT:

Our community has grown very rapidly over the past year and has reached 3,000 subscribers! As a token of appreciation please find below a 10% discount for an annual premium subscription. 24 HOURS LEFT!

On January 16 gold prices broke through a key trading level which opened the room for hitting a new all-time high. More details in the below short piece:

Two weeks later gold prices hit a new record of ~$2,850 after rallying ~2% today.

Gold prices have risen ~10% in 6 weeks and ~56% since October 2023.

The yellow metal performance clearly sends a signal that public debt in major economies is expected to skyrocket and central banks will continue cutting rates this year.

Some small contribution into the price could also had the following development.

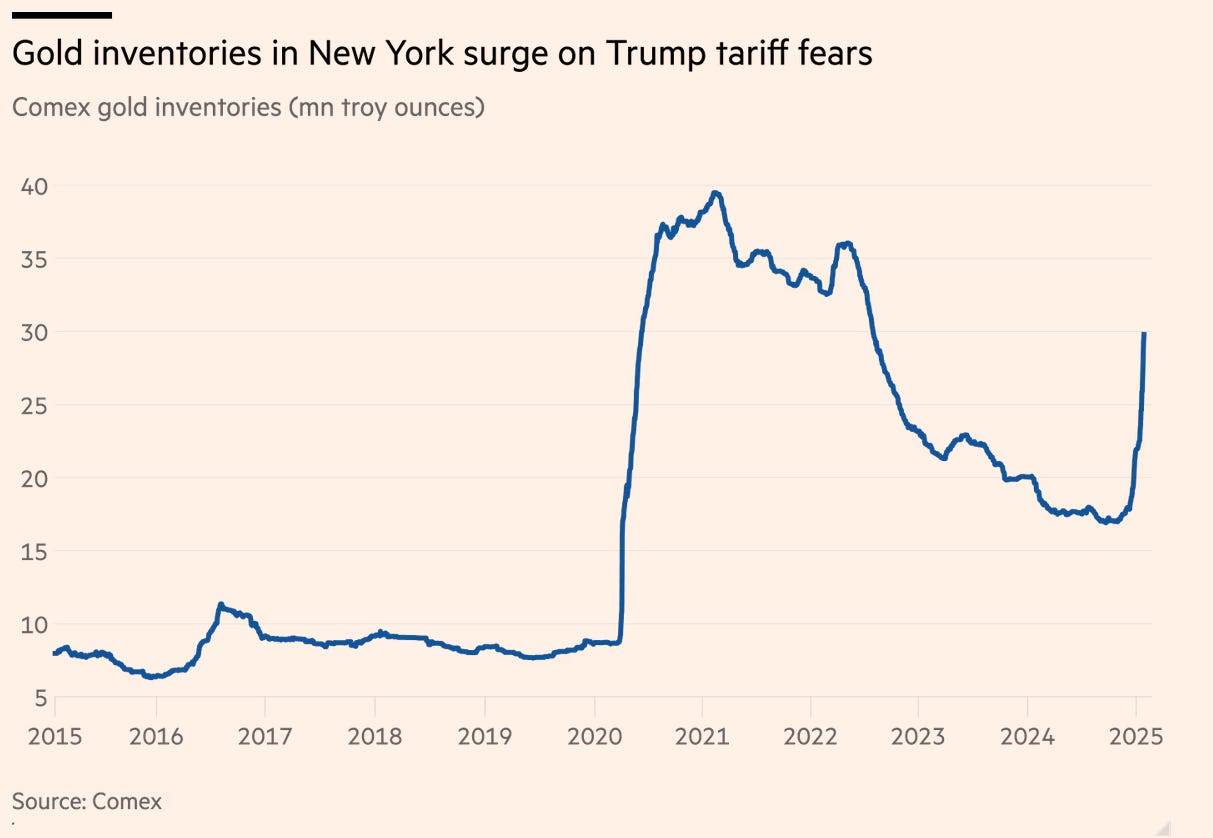

Gold inventories on The Commodity Exchange - COMEX have spiked to 30 million troy ounces this month, the highest since August 2022.

Inventories have almost doubled over the last several weeks, posting the largest inflows since the 2020 crisis.

Total flows to the US are even larger as there have been additional shipments to private vaults in New York owned by JPMorgan and HSBC.

These shipments have been likely driven by fears of potential tariffs imposed by the new Administration on raw materials including gold.

This, in turn, created a shortage of bullion in London, and the time to withdraw gold stored in the Bank of England’s vaults has increased from a few days to a few weeks.

In other words, demand for gold has rapidly surged but this might be a temporary phenomenon.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?