Gold is making history

Time to revisit an outlook of the so-called barbarous relic

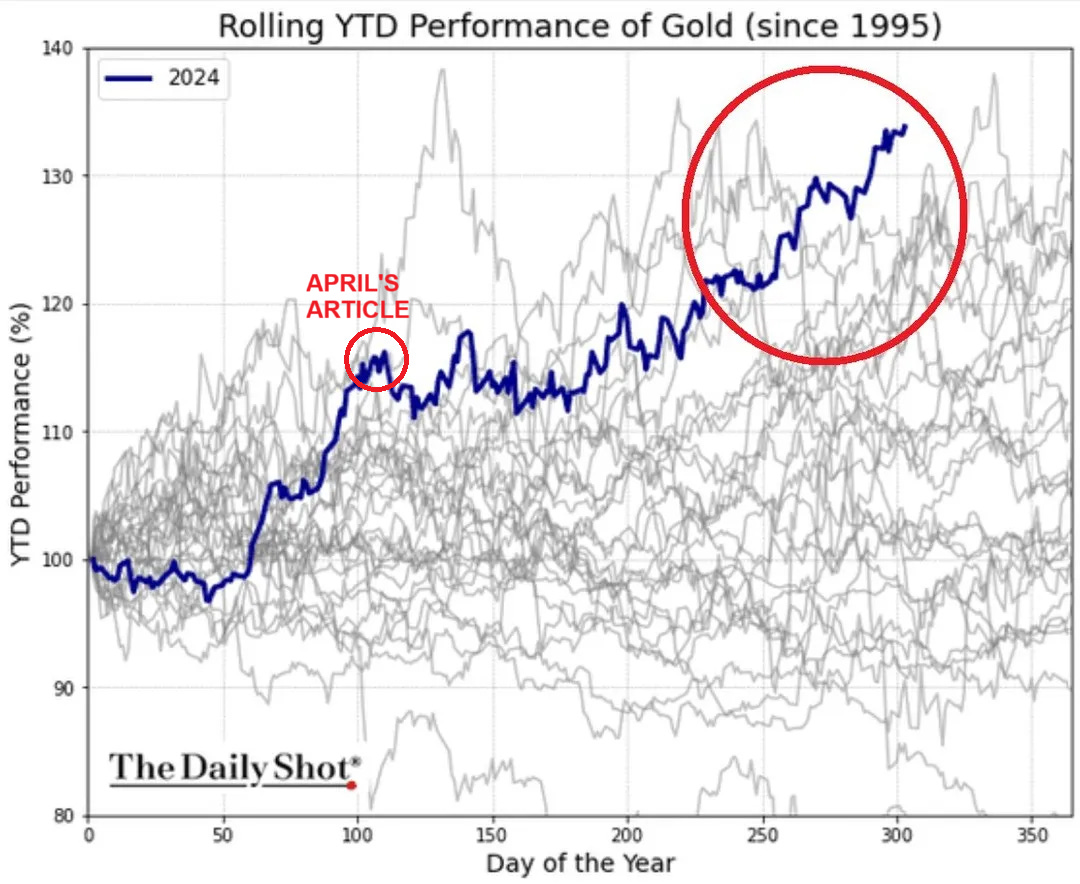

On April 19, I released gold analysis where I highlighted that some short-term pullback should be expected but the medium and long-term outlook for the metal is very promising.

Interestingly, gold consolidated for a couple of months and subsequently continued its phenomenal run as outlined in the analysis.

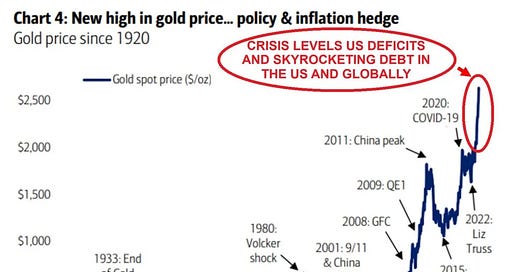

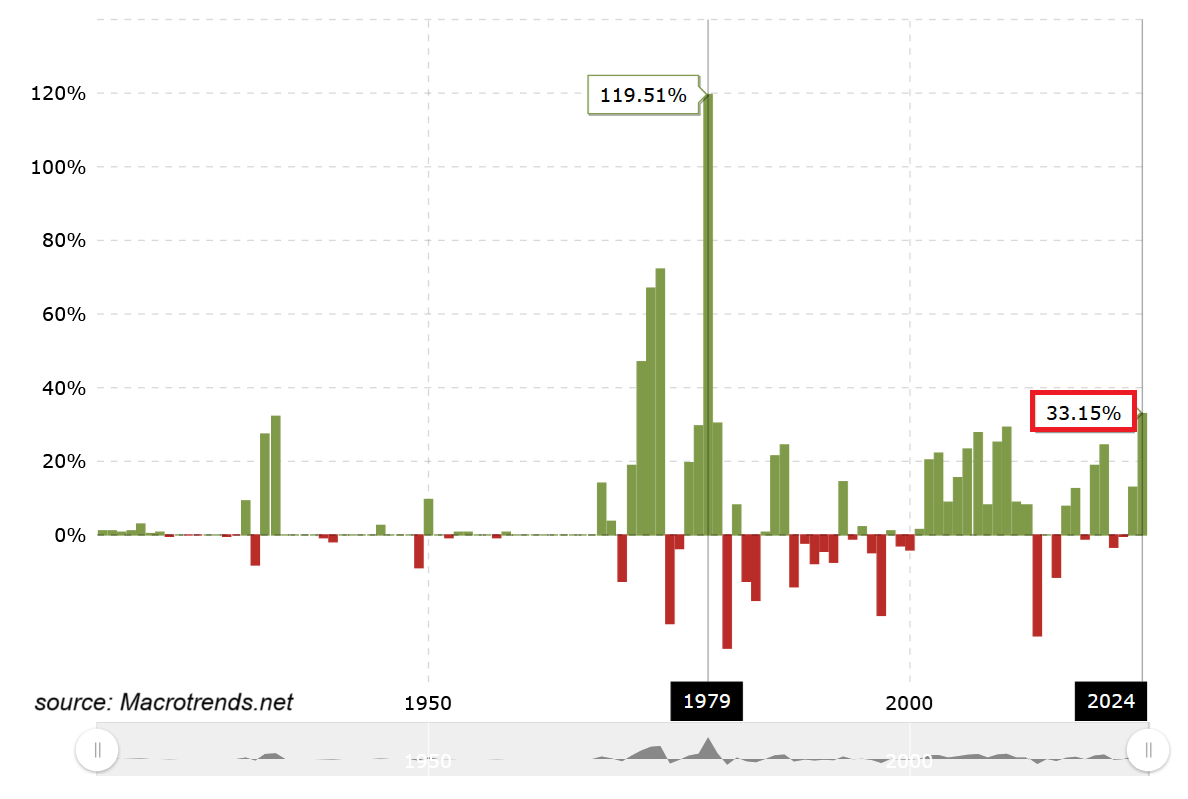

The so-called barbarous relic even briefly exceeded $2,800 per ounce for the first time in history and is up 33% year-to-date, marking the best performance in 29 years and beating the S&P 500 gain of 20%.

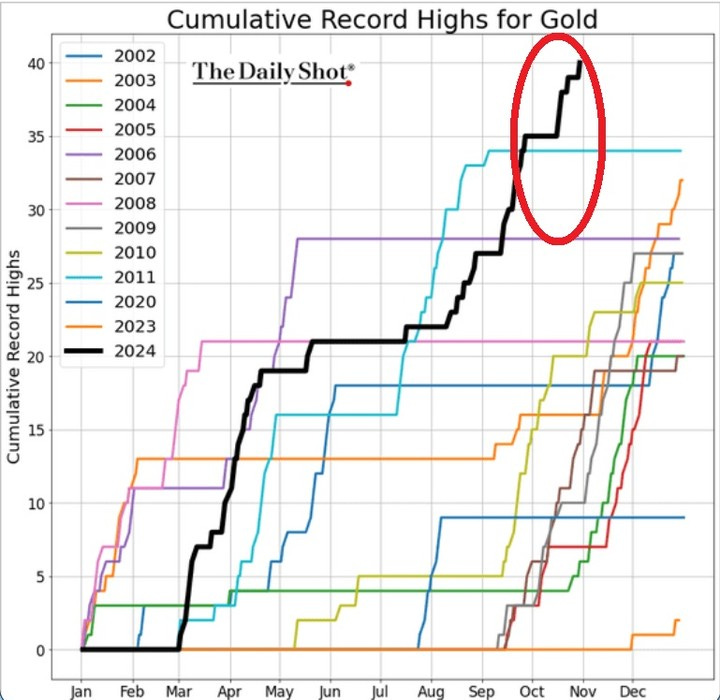

Gold has also recorded 41 all-time highs, the most this century.

As a result, the yellow metal is on track for the best annual return in 45 YEARS.

What have been the major drivers of this historic gold run? Has gold become expensive? What is the medium and long-term outlook for gold prices? You will find the answers in the below piece.

MAJOR DRIVERS BEHIND GOLD OUTSTANDING PERFORMANCE