For the first time in history, top global central banks are reducing their balance sheets at the same time

What are the implications for the markets regarding one of the greatest monetary policy experiments?

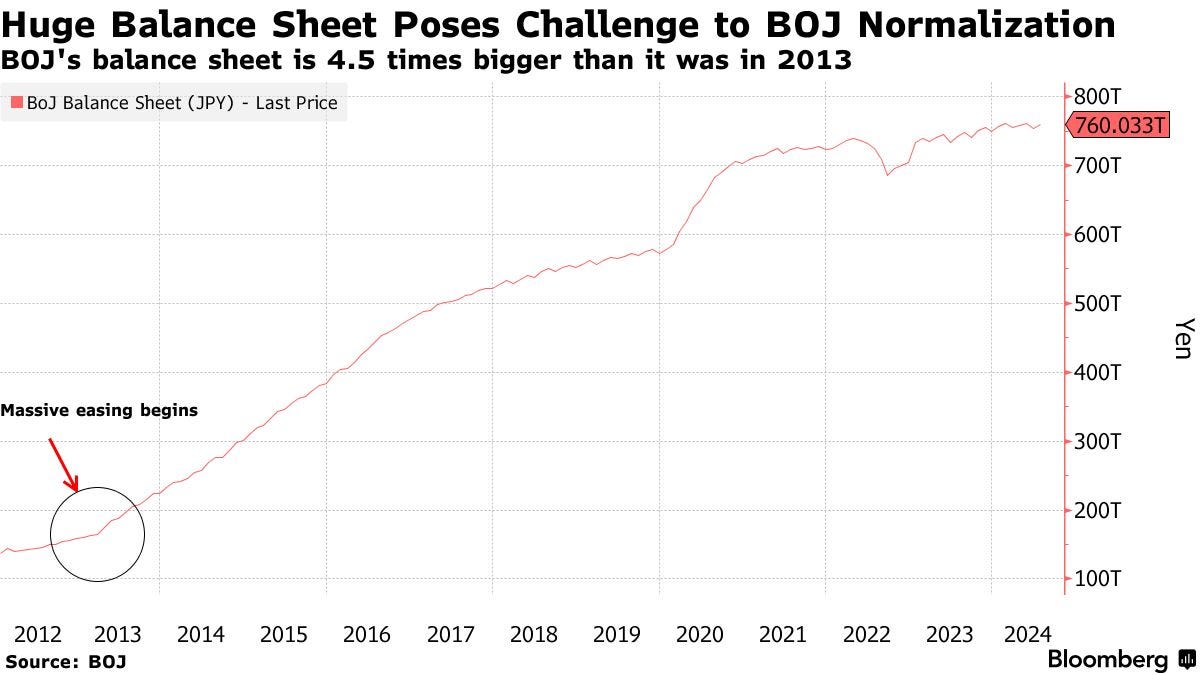

On July 31st, the Bank of Japan hiked its interest rates for the second time this year from a range of 0-0.1% to 0.25% and announced that it will reduce by half its monthly pace of bond purchases to ~¥3 trillion ($19.9 billion) by the first quarter of 2026.

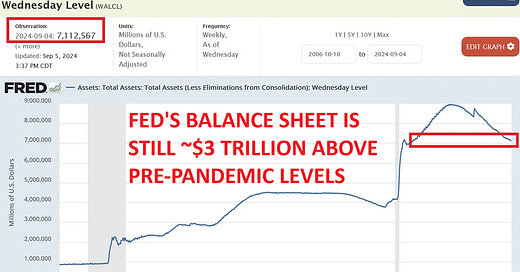

This means that the Bank of Japan's buying will be outweighed by the maturing bonds already held on its balance sheet. In effect, the size of the historic $6 trillion (or nearly ¥800 trillion) balance sheet has started to decline.

Thus, the Bank of Japan has now officially joined other major central banks, the Fed, the European Central Bank, the Bank of England, and the Bank of Canada in the so-called Quantitative Tightening (QT) program, the process of a central bank balance sheet reduction. In layman's terms, this is a process of withdrawing money (liquidity) from the financial system to prevent the economy from overheating. To put it differently, global central banks are again entering uncharted waters.

At this point, it is worth adding that when the pandemic hit in Q1 2020, the top central banks flooded the financial system with $11 trillion of money by expanding their balance sheets until Q1 2022.

All things considered, it is key to analyze the potential consequences of these phenomena. In this piece, you will learn about different ways of conducting QT. How much has already been withdrawn from the financial system. What kind of cracks it has created in individual markets in the past and what could be lying ahead.

HOW DOES THE QUANTITATIVE TIGHTENING (QT) WORK IN PRACTICE?