Follow closely the Fed Chair Powell's language during his conference today

The Federal Reserve is expected to hold interest rates steady and signals rate cuts ahead

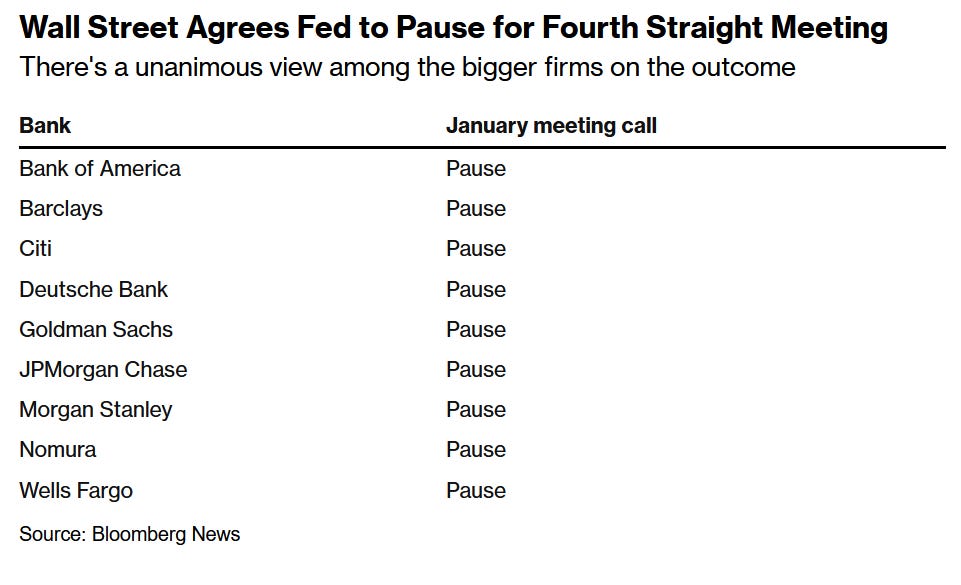

The Federal Reserve will announce its interest rate decision along with the statement at 2 PM ET today (Wednesday). The consensus expectation is that the Federal Open Market Committee (FOMC) will keep rates steady in a range of 5.25% to 5.5% following its two-day meeting.

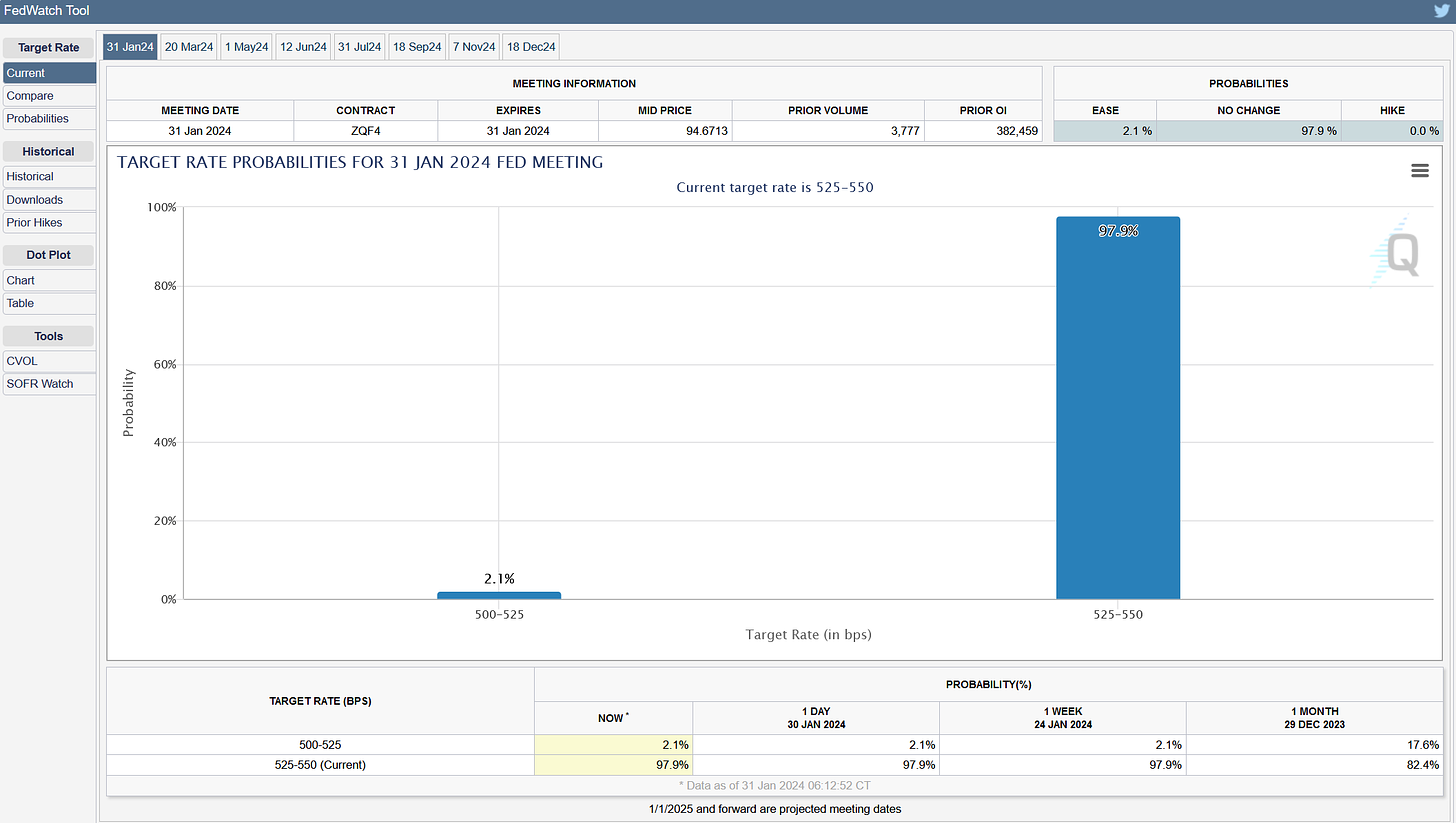

The market itself is also pricing in a no movement in rates at today’s meeting giving a 98% probability for this scenario.

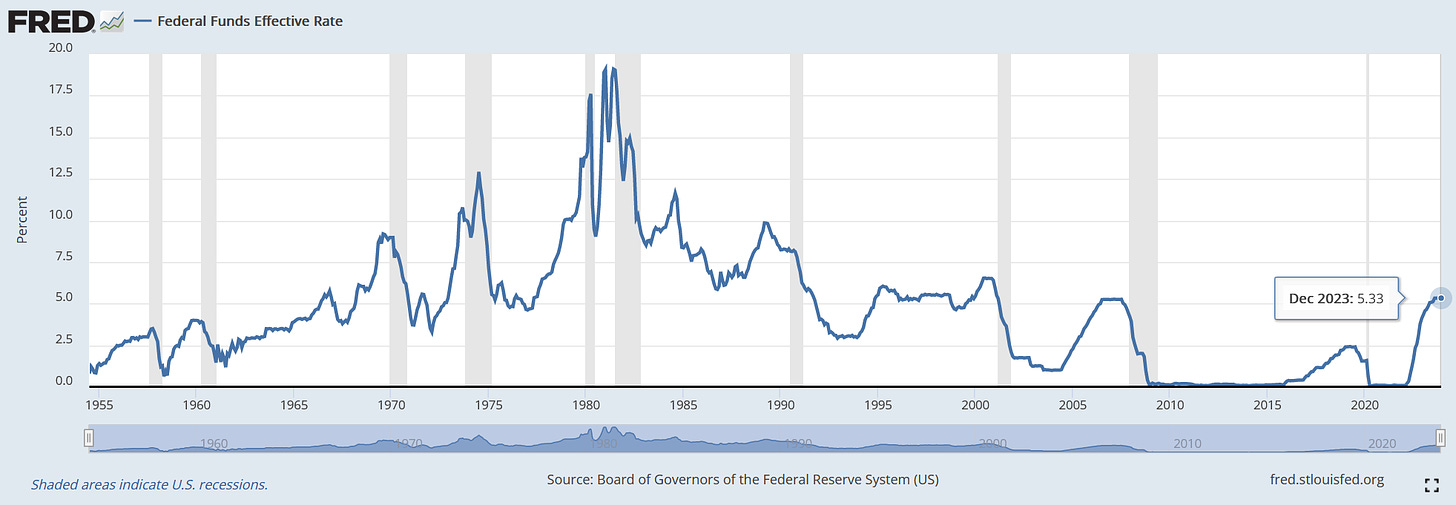

As you can see on the chart below, if rates won’t change that would be a 22-year high that first occurred in July.

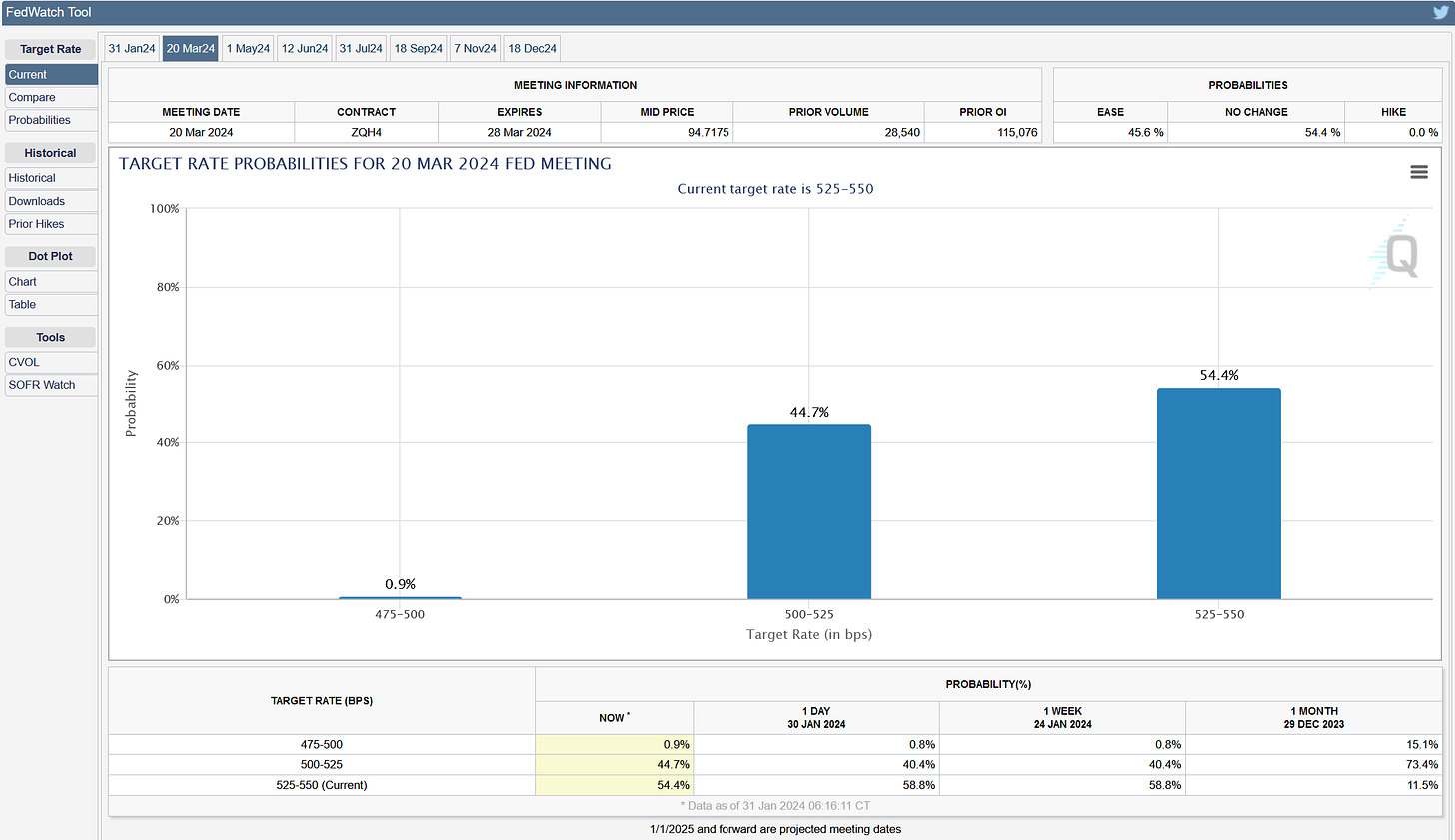

Going forward, investors currently see a 45% chance the Fed will cut rates for the first time in March and any switch in these expectations is what matters the most around this decision for markets.

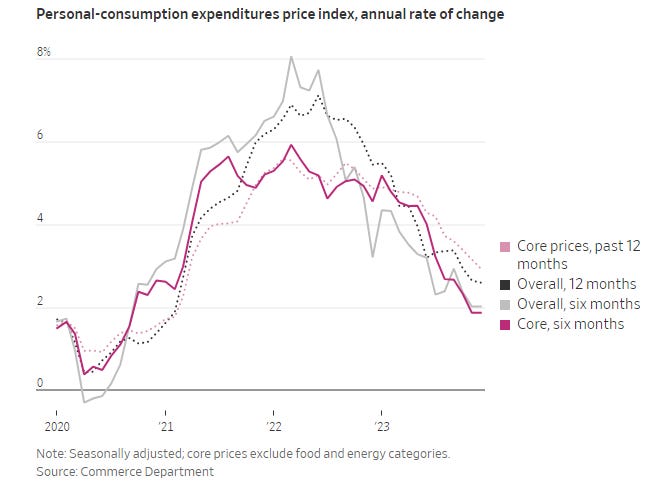

This is why the most important is to follow closely the Fed Chairman Jerome Powell’s wording during his conference 30 minutes after the statement release. He’s likely to be pleased with the improvement in inflation falling, especially considering the Fed’s preferred measure which is PCE (Personal Consumption Expenditures) excluding food and energy. Although the year-over-year change in this metric was up 2.9% in December, the six-month annualized PCE excl. energy and food was 1.9%, hitting the Fed’s 2% target.

On the other hand, Powell may stay cautious with his wording given how solid the labor market has been in terms of official data releases which are closely watched by the Fed (though under the surface the picture does not look so solid). If he expresses a more careful stance and does not provide any hints in terms of the potential March rate cuts then the market might be disappointed. I think this is a likely scenario given the fact that Powell is expected to give a Humphrey-Hawkins testimony in late February or early March. This is a two-day hearing before the US Congress required under the Humphrey-Hawkins Act. Therefore, we might expect more talking about potential March moves during that hearing.

BALANCE SHEET

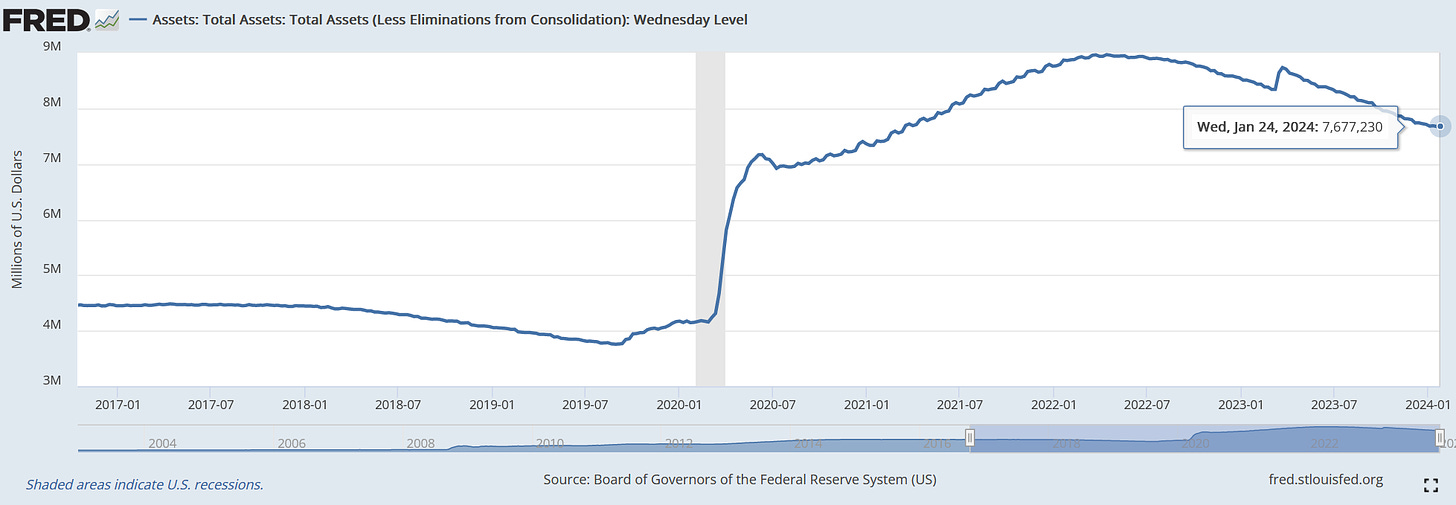

The Fed is also expected to provide some communication about the tapering beginning of Quantitative Tightening. In other words, slowing the pace of shrinking its balance sheet size. Lorie Logan, the Fed President in Dallas said at the beginning of the year that the Federal Reserve may need to slow the pace at which it reduces its portfolio of assets due to declining liquidity in financial markets. The chart below presents that the current size of the balance sheet is roughly $7.7 trillion.

Additionally, more and more financial analysts argue that we are getting closer to the point when the Fed would have to slow the pace of shrinking and even stop it in several months. Jerome Powell will definitely be asked about this topic during the conference.

SUMMARY

From the market point of view, there should not be much of a surprise in the Fed’s statement. Therefore, all eyes will be turned on the chairman looking for forward guidance in terms of future interest rate cuts and tweaks in the balance sheet. One thing to keep in mind is that expectations are already high and the market expects almost seven rate reductions this year. The Fed might want to temper those somewhat as the market has gone ahead of itself. Just to clarify, any disappointment would mean a shift towards lower rate cut expectations, a stronger US dollar, higher US government bond yields, lower stocks and gold prices as well as higher volatility (VIX index). Also, remember that the true market reaction usually comes a day or two days after the Fed event. Good luck.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: