Don't be fooled by Wall Street analysts

In the past six years, Wall Street professionals have been always putting the wrong targets for the S&P 500

As we are approaching the year-end it would be a good time to have a look at the performance of the most widely watched stock index in the world, the S&P 500 and compare it to the forecasts of the most famous financial markets community, Wall Street. To avoid accusations of cherry-picking (choosing specific data points or datasets that support a desired conclusion) let’s compare Wall Street projections with the S&P 500 performance over the last five years as well as the current one.

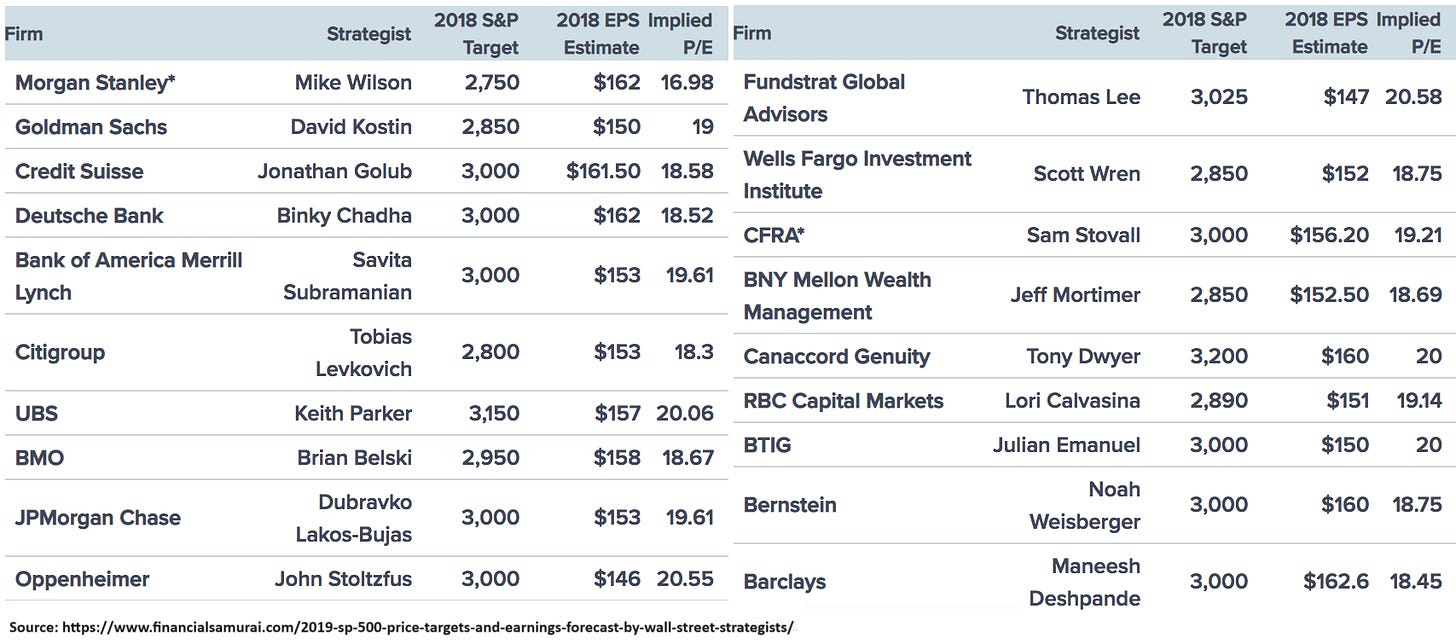

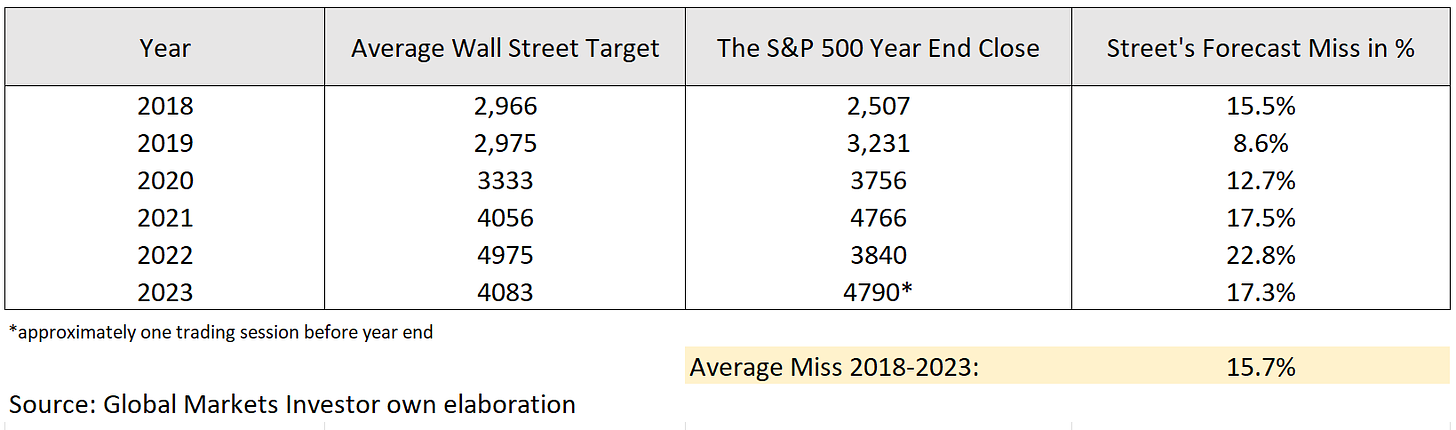

In 2018, the S&P 500 closed at 2,507 points with an annual loss of -6.2%. In the below table, we can see that the average estimate on Wall Street was 2,966 points or 3,000 using the median (the value in the middle of a data set). When comparing the former with the index year-end close we see that the world’s largest financial institutions were wrong about the S&P 500 target by 15.5% on average.

The closest to the year-end close projection made by Morgan Stanley was wrong by 8.8%.

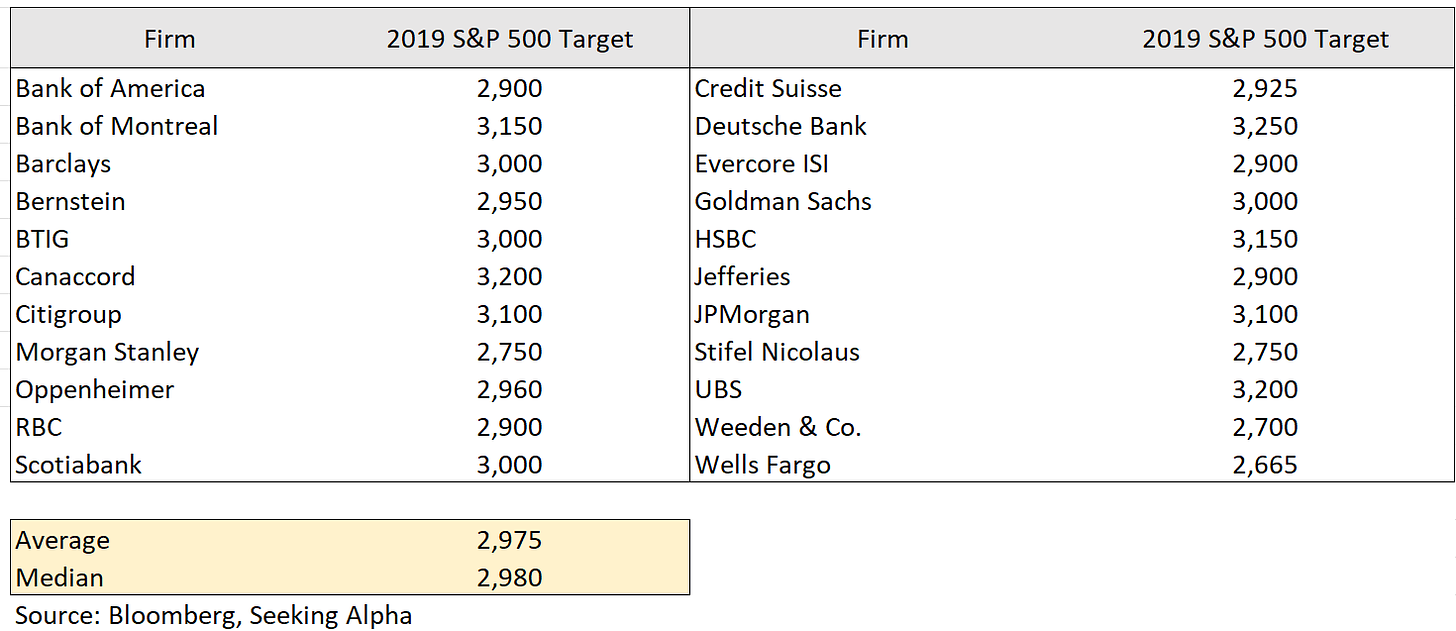

For 2019, the average Wall Street forecast for the S&P 500 was 2,975 as you can see in the table below whereas the index closed the year at 3,231 points with a 28.9% gain. This is an 8.6% miss when taking into account the average of presented projections.

This time the most accurate forecast came from Deutsche Bank at 3,250 points just 19 points away from the year-end close.

Subsequently, for 2020 the average Street’s target for the S&P 500 was 3,333 points with the median coming at 3,375. The index closed the year with a 16.3% gain at 3,756 points. That’s 12.7% higher than the average consensus estimate.

In this case, it turned out that Piper Jaffray Research was the most close to the outcome but still missed by 4.3%.

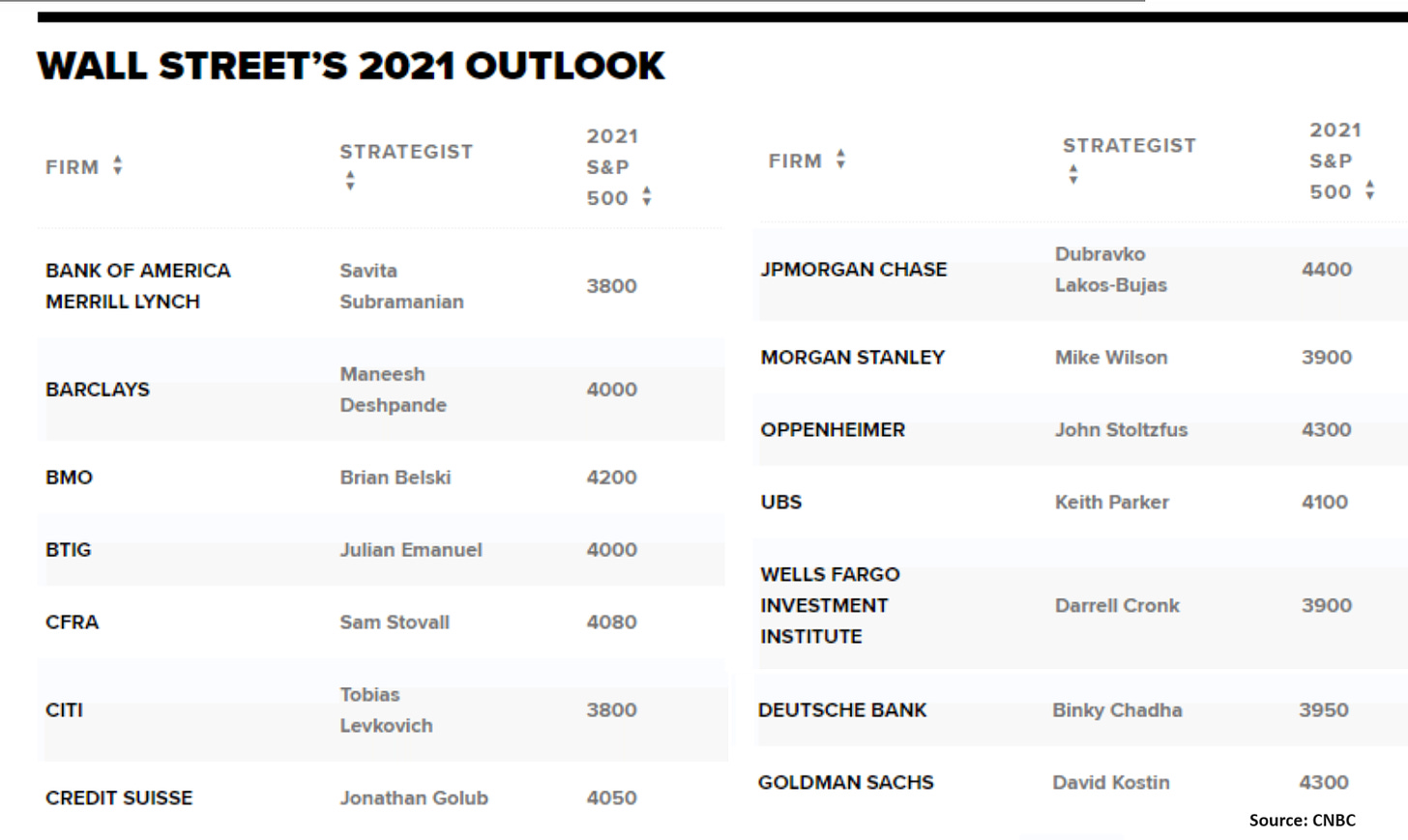

Moving to 2021, we can see that the average outlook of the most-paid financial analysts in the world came at 4,056 points with a 4,025 median. The S&P 500 ended the year at 4,766 points, advancing by 26.9% from 2020 and providing a 17.5% miss in average predictions.

The most accurate was JP Morgan Chase but came short of 8.3%.

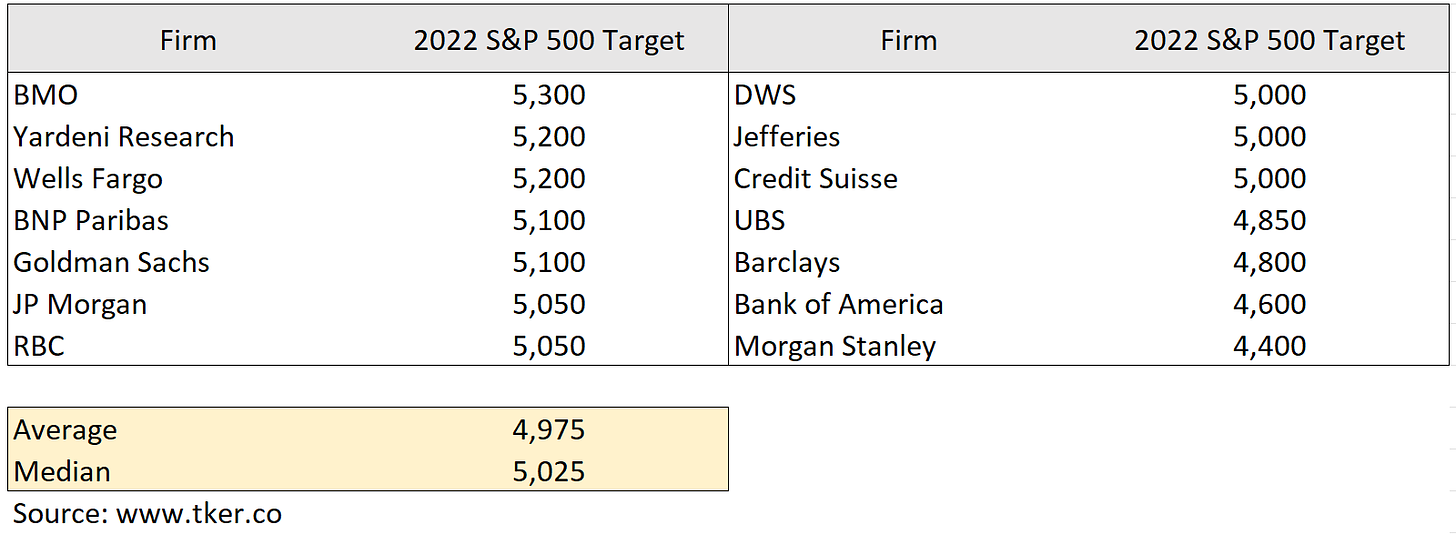

The next example is a total discredit of Wall Street analysts. As you can see below, the average estimate for 2022 issued at the end of 2021 was 4,975 (median of 5,025). In turn, the S&P 500 closed the year down by 19.4%, falling to 3,840 points. It means that the average Wall Street 2022 estimate missed the S&P 500 end-of-year close by 22.8%. It is a complete failure in forecasting which could have cost a significant amount of bucks if had not been updated during the year.

For the second time, the closest projection was made by Morgan Stanley which missed the year-end close by 12.7%.

Gradually heading towards a conclusion, this is the moment to dive into this year’s ‘guesstimates’. The below table exhibits 2023 Wall Street targets for the S&P 500 released at the end of 2022. Out of 22 firms presented, the average target was around 4,083 points with a median of 4,100. The index is currently trading around the 4,790 level, having just one session before the year ends. This simply implies that the average target was missed by 17.3%. Not much of a surprise.

The most bullish Fundstrat was the only one correct with his projection being just 0.8% below the current index value.

CONCLUSION

In the period 2018-2023, Wall Street analysts have missed the S&P 500 year-end targets on average by 15.7% with the ‘best year’ occurring in 2018 when the Street’s estimates fell short of the actual value of the index by 8.6%.

It is a quite significant deviation for anyone who would like to rely on the most rewarded financial analysts on the globe. Even if we tried hard to find one firm that has had a decent track record of estimating the S&P 500 targets it would be a really hard exercise to complete. At this point, I would like to highlight that the purpose of this analysis is not to completely discredit all the firms. It should be emphasized that it is almost impossible to project an exact value of the index or a share price and we should rather try to identify trends or perhaps even turning points. However, those research teams have been wrong multiple times even with trying to find the right direction going forward. We have also to keep in mind that those forecasts are regularly adjusted throughout the year as market and economic conditions change. For the long-term investor, however, those changes might not be very useful because the costs of rebalancing a portfolio too frequently could be significant.

The key takeaway from this analysis is to encourage investors to do their own research, even small but based on different sorts of analyses they consider as useful. There’s no more satisfaction than getting it directionally right while most large investment funds and banks do struggle with their forecast and subsequent returns. And even if one is sometimes wrong that’s completely ok because at the end of the day, as you have seen, even sophisticated professionals get it wrong - in the case of the S&P 500 almost always.

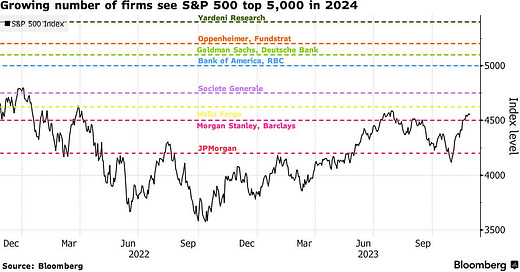

Heading to an end, I am leaving here an extra attachment showing the most recent Wall Street 2024 targets for the S&P 500 - but you probably know what to do with them now. :)

As you can see, the Street’s analysts in the opposite of 2023 forecasts are bullish with Ed Yardeni expecting even 5,500 points next year. Exceptions are Morgan Stanley, Barclays, and JPMorgan. These elevated expectations should be put into question for those who have read my recent analysis implying that the forward outlook is not that bright:

In the last word, I would like to bring you a quote that perfectly fits the above analysis and overall financial market environment:

“It's Difficult To Make Predictions, Especially About the Future” Niels Bohr

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: