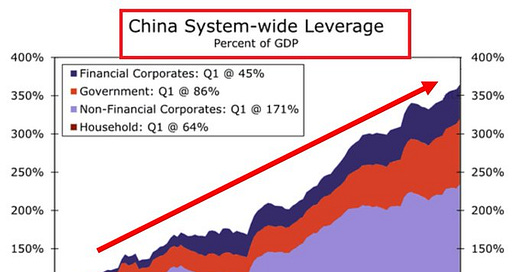

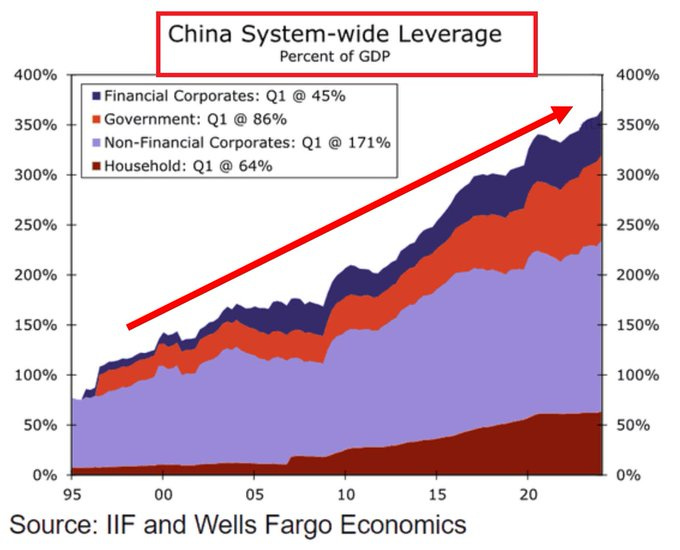

China's debt-to-GDP ratio hit a jaw-dropping 366% in Q1 2024, a new record.

China's debt size is absolutely mind-blowing

China's debt-to-GDP ratio hit a massive 366% in Q1 2024, a new record. Since the 2008 Great Financial Crisis, the ratio has more than doubled.

To put this differently, for 1 unit of GDP the Chinese economy has produced 3.66 units of debt burden.

By sector, non-financial corporates have the highest ratio, at 171%, followed by the government’s 86%.

Households and financial entities debt-to-GDP is 64% and 45%, respectively.

What does it mean for the world’s second-largest economy?

You can find out the answer below along with what I thought about the Chinese economy in general as well as the stock market. This was written even before China’s stocks started to decline again.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?