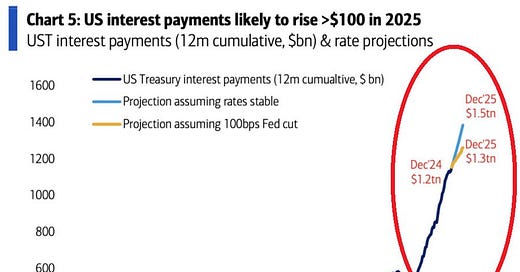

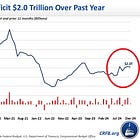

⚠️CHART OF THE WEEK: US interest payments on public debt will rise by at least another $100 billion in 2025

The US Government needs lower interest rates more than anyone.

US interest costs reached a record $1.2 trillion over the last 12 months and largely exceeded defense spending of $900 billion. Interest expense is now the second-largest outlay of the US government after Social Security even exceeding spending on healthcare.

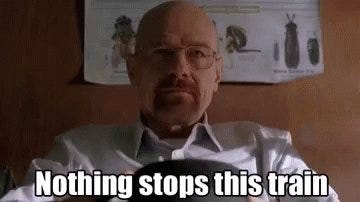

Given that a few trillions of debt is maturing this year, the US government will have to refinance at higher interest rates. This means interest costs will rise even further.

If rates remain stable, interest payments will reach a whopping $1.5 trillion by the end of the year.

Even if the Fed cuts rates by 100 basis points from 4.5% to 3.5%, interest costs will still hit ~$1.3 trillion by the end of 2025.

Given this trend as well as the spending needs on Social Security, Healthcare, Defense, and Infrastructure it will be difficult to materially lower the US budget deficit.

As Lyn Alden has said many times:

Full analysis of the US debt situation in the first listed article below:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?