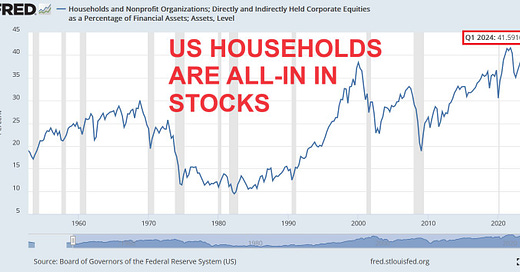

Chart of the week: US Households participation in the stock market just hit an all-time high

Americans' allocation to stocks as % of financial assets reached an all-time record in Q1 2024 of 41.6%.

Americans’ share of financial assets in US equities has reached a new record of 41.6% in Q1 2024, according to the latest Federal Reserve data.

This is up from the 30.5% recorded during the 2020 COVID crash and higher than in the 1990s Dot-Com bubble peak of 38.4%. Moreover, since the Great Financial Crisis, this share has more than DOUBLED.

This was the effect of incredible stock market gains. Since the March 2009 low, the Nasdaq has rallied 1738% and the S&P 500 by 702%.

Also since October 2023, the Nasdaq and S&P 500 saw 40% and 32% gains, respectively.

This has been undoubtedly a great period to invest in stocks.

Usually, euphoric sentiment in the stock market occurs near the tops but it is extremely difficult to identify whether the top has hit or not. Therefore, it is always great to have some cash on the sideline in case of a potential bear market if you have already invested. It is sometimes also useful to realize some profits and wait for a better market entry.

Nevertheless, is this now a time to pause and reflect? Is this a time to be prudent? We can somewhat answer these questions when looking at valuations that have been analyzed in the below article.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), buying me a coffee, and following me on Twitter:

Why subscribe?