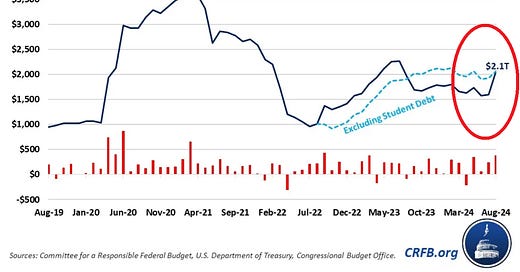

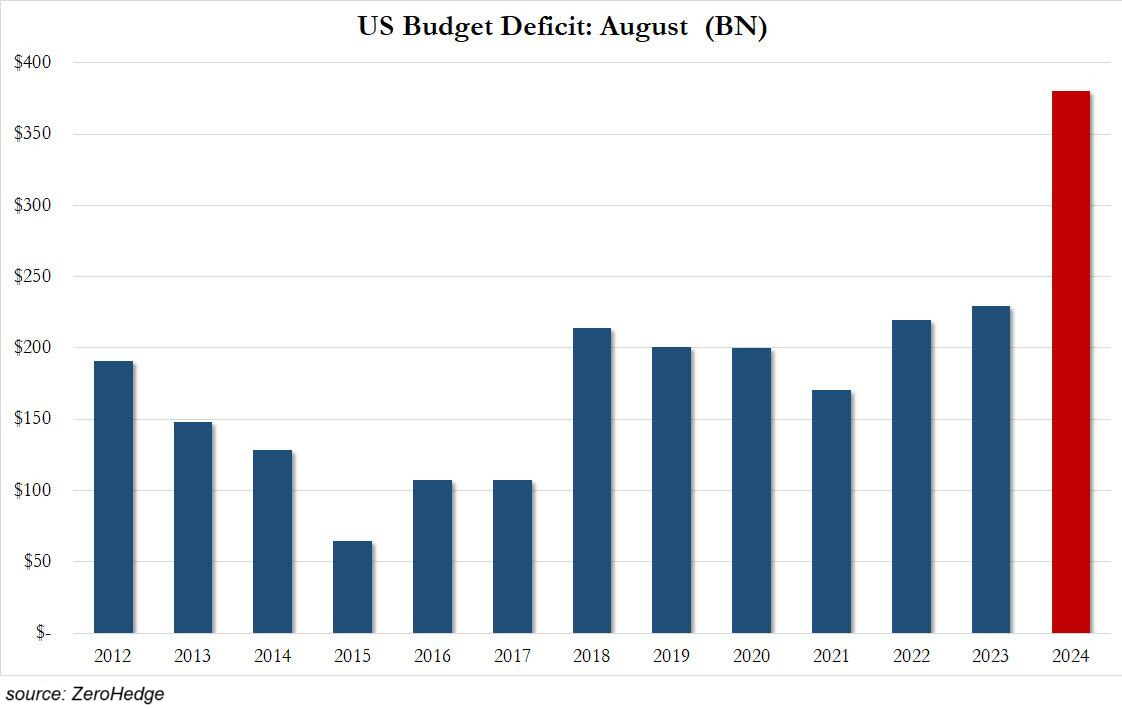

CHART OF THE WEEK: US government deficit hit a whopping $2.1 trillion over the last 12 months

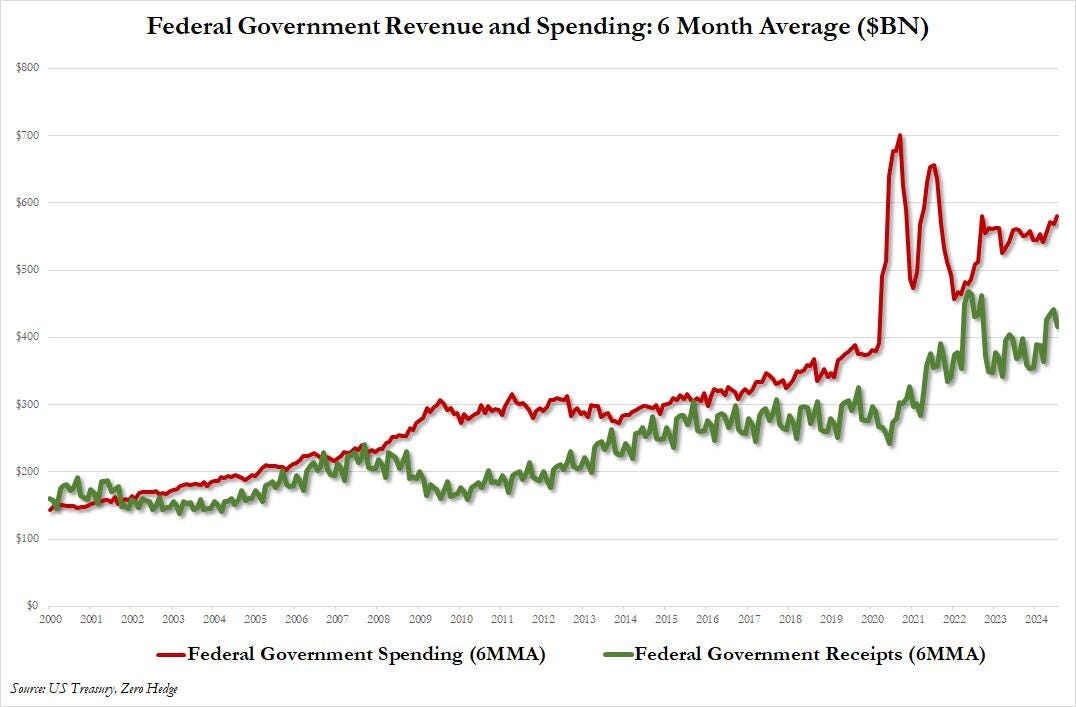

The government spending reached $6.9 trillion over the last year, an equivalent of 24.4% of GDP, and exceeded revenues by $2.1 trillion.

The US government budget gap hit $2.1 trillion over the past year, according to the latest Treasury Department report. This reflects 7.3% of GDP, much more than in 2023 and 2022.

This comes after the government spent $6.9 trillion over the past year, an equivalent of 24.4% of GDP and 7.1% more than in the previous year. This has been partially driven by the interest expense which soared to a record $1.12 trillion over the past 12 months, double the amount seen in 2 years.

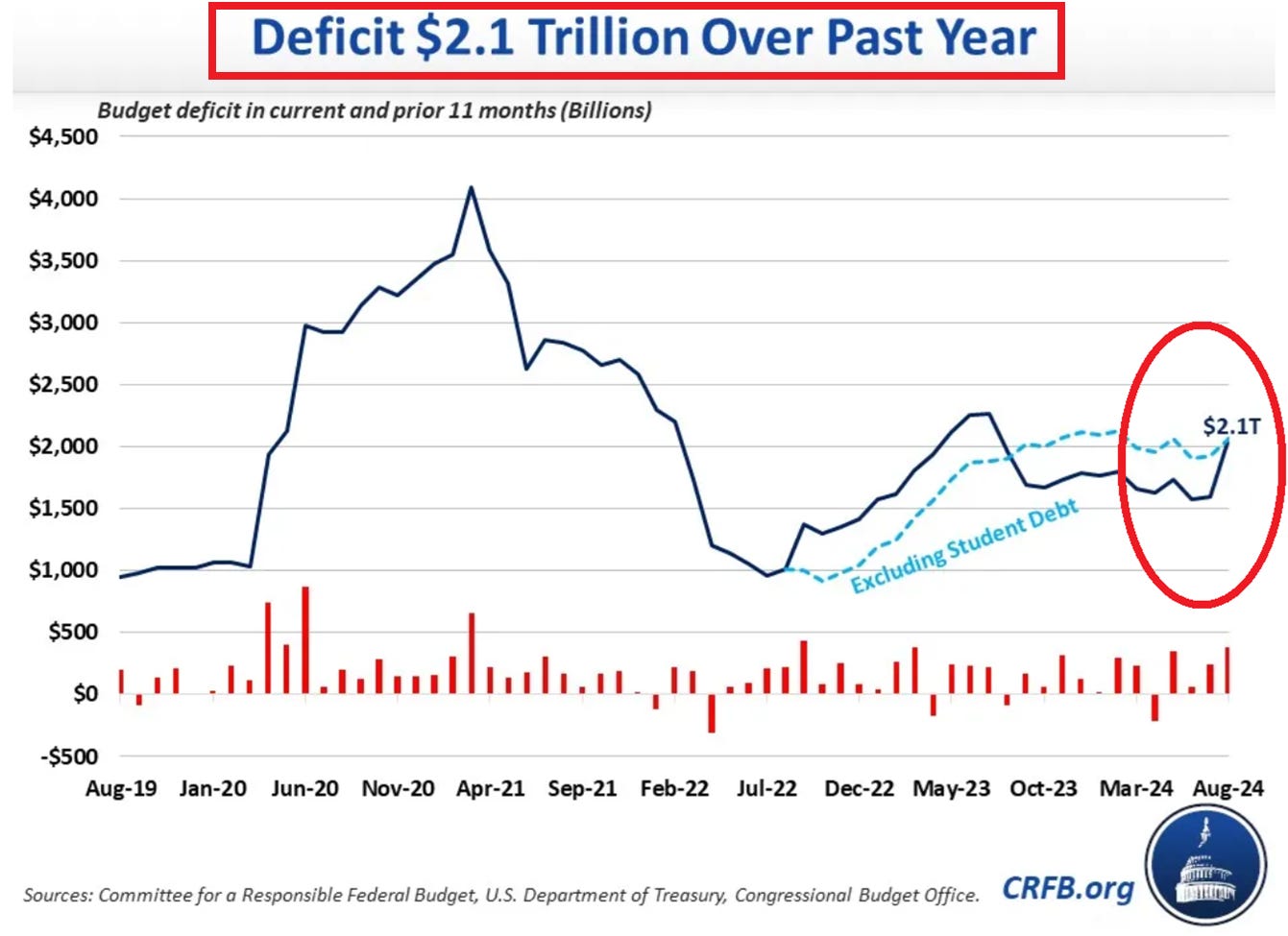

In August alone, the deficit was $380 billion or $12.3 billion A DAY posting the highest August on record.

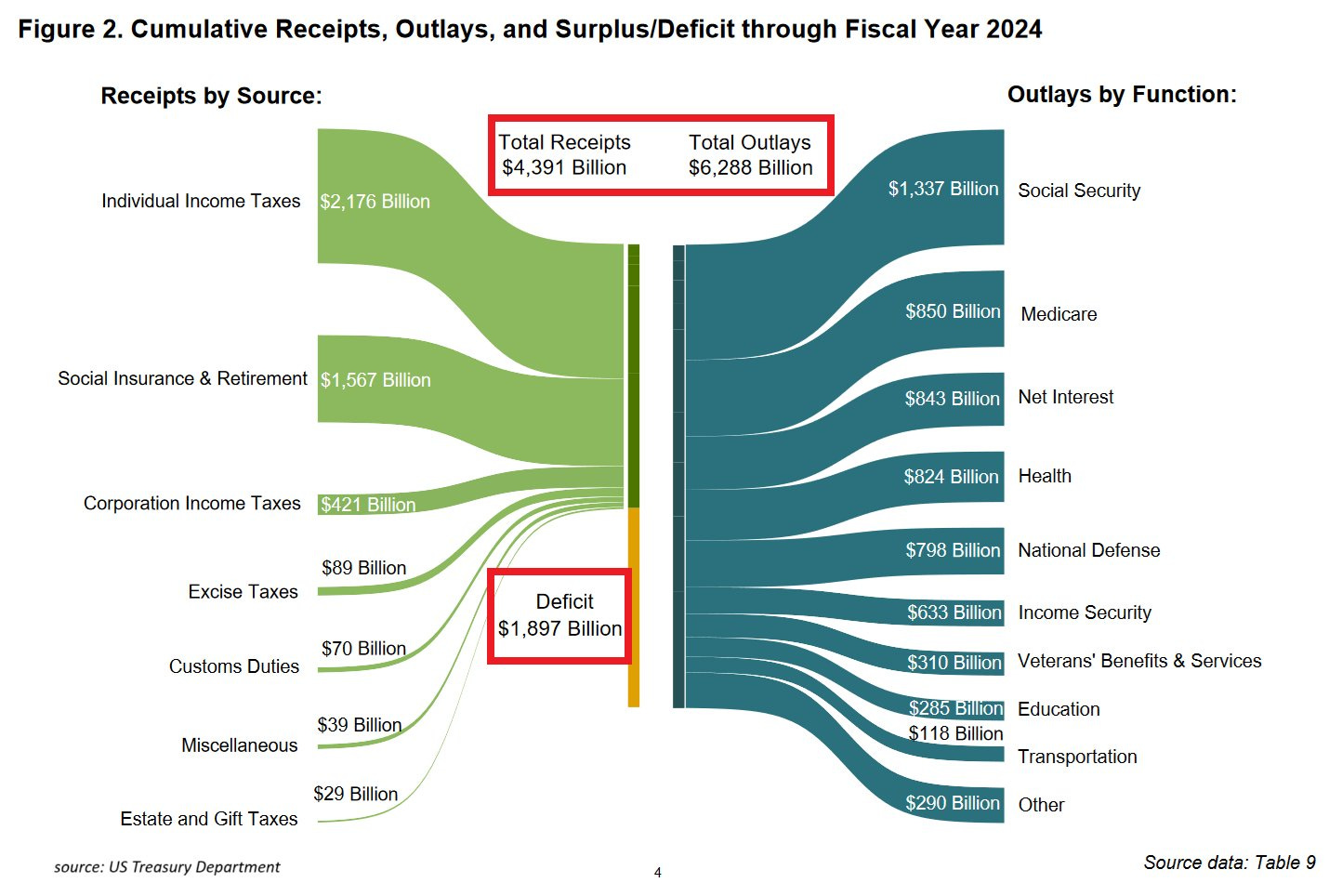

Moreover, in the first 11 months of the Fiscal Year 2024, the public deficit reached $1.9 trillion. Here is the full breakdown of receipts and outlays:

As we already know, the government has a significant spending problem. Over the last few decades, spending has materially exceeded revenues.

The government simply chooses to kick the can down the road instead of implementing real solutions. This is a debt crisis.

How bad it has become and what are the consequences for Americans and global investors? You can find the answers in the below piece. It has to be emphasized that this is an extremely important topic even if you do not invest in the markets.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?