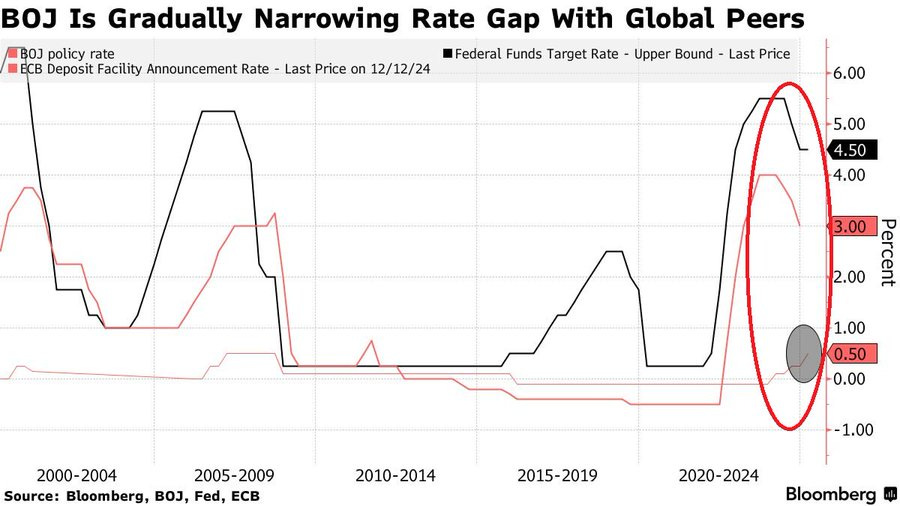

CHART OF THE WEEK: The gap between the US, EU and the Japanese rates is closing

The Bank of Japan raised rates for the third time this cycle

IMPORTANT ANNOUNCEMENT:

Our community has grown very rapidly over the past year and has reached 3,000 subscribers! As a token of appreciation please find below a 10% discount for an annual premium subscription. 7 DAYS LEFT!

The Bank of Japan raised rates by 25 basis points to 0.50% as expected, bringing the benchmark to the highest level in 17 years.

The central bank expects more rate hikes this year if the economic outlook remains unchanged and global markets will continue to be stable. The market also believes more hikes will occur this year.

Meanwhile, the Bank of Japan analysis suggests the neutral rate could be between 1% and 2.5%.

As a result, the gap between the US, the EU, and Japanese rates has substantially narrowed which is important for the so-called carry trade.

Nevertheless, Japan still has one of the lowest rates in the world among developed economies.

Will this be enough to strengthen the Yen going forward? Will the markets remain stable?

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?