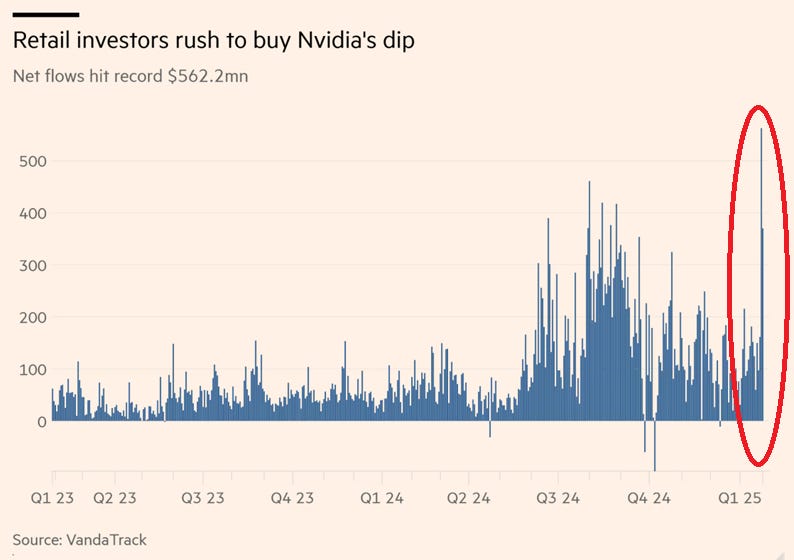

⚠️CHART OF THE WEEK: Retail investors are buying NVIDIA stock like never before

Mom-and-pop investors bought a huge amount of NVIDIA stock this week despite the drop

Retail investors purchased a at least $900 million of NVIDIA stock this week.

On Monday alone, retail traders bought a record $562 million of $NVDA shares.

This exceeded a previous high posted last year by ~$100 million, according to Vanda Research data.

Subsequently, retail investors purchased $362 million of the chipmaker’s stock on Tuesday.

Notably, in Q3 and Q4 2024, individual investors purchased a massive ~$14 billion and $7 billion worth of NVDA 0.00%↑ shares, respectively.

As a result, mom-and-pop investors' trading activity on NVIDIA skyrocketed this week after the stock was clubbed like a baby seal.

The last two years have taught many individual investors to buy every dip. One would even say that the buy-the-dip strategy has worked pretty well since the 2009 Great Financial Crisis low.

Meanwhile, $NVDA stock prices have gone nowhere for 8 months and are down ~22% form its January peak.

Investing in popular themes has become extremely dangerous.

It seems like diversification is still largely underappreciated in the markets.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?

I hope they are not leading the sheep to the wolf den. Time will tell.

I wish you well.