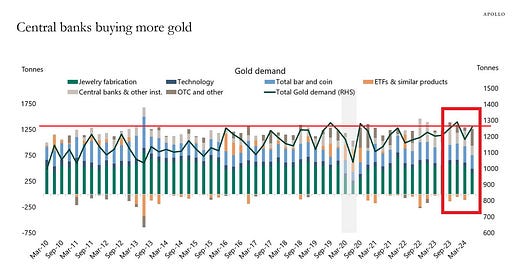

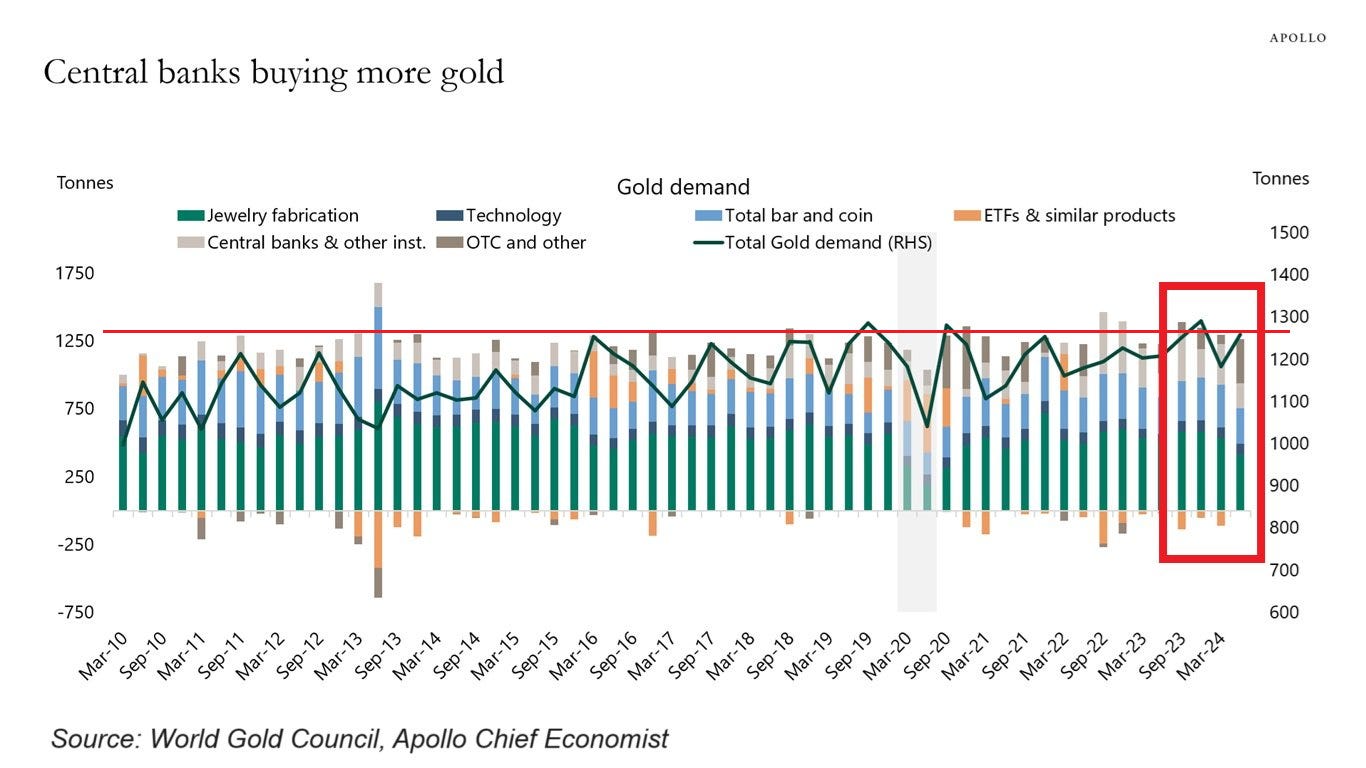

CHART OF THE WEEK: Gold demand jumped to near the highest level in 14 years in July

Total gold demand has oscillated around 1,200-1,300 tonnes over the last 3 years

Gold demand increased to ~1,280 tonnes in July, near the largest level in at least 14 years.

As you can see on the above graph, gold demand has been steadily rising over the last 4 years.

As a result, gold prices hit another all time record on Friday of $2.546 and rose during that day by 2.2%.

Year-to-date, gold prices have already risen by 22.5%, beating the S&P 500 gain of 16.5%.

Over the last 3 years, the gold outperformance has been even more evident. The yellow metal has rallied by 42% and the S&P 500 by 24% during this time.

In other words, gold has been a great asset to own in an investment portfolio.

To find out the long-term gold perspectives and when the so-called barbarous relic can potentially reach $3,000 please read the below article:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?

Interesting times ahead.

A hype bit more up followed by a large downfall would sound logical as institutions would use hype and fomo as exit liquidity. Let’s see.