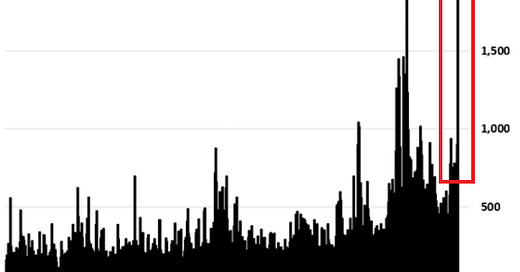

Chart of the week: Call options volume in US small-cap stocks spiked to the highest-ever

iShares Russell 2000 ETF (Ticker: IWM) saw on Thursday the largest call options volume activity in its history of existence

First of all, I would like to express my profound gratitude to all of you for subscribing to this content. The number of subscriptions and followers has recently exceeded 1,200! Additionally, the follower count on X (formerly Twitter) has crossed above 13,000! As a token of appreciation please find a 10% discount for an annual subscription. ONLY 6 DAYS LEFT!

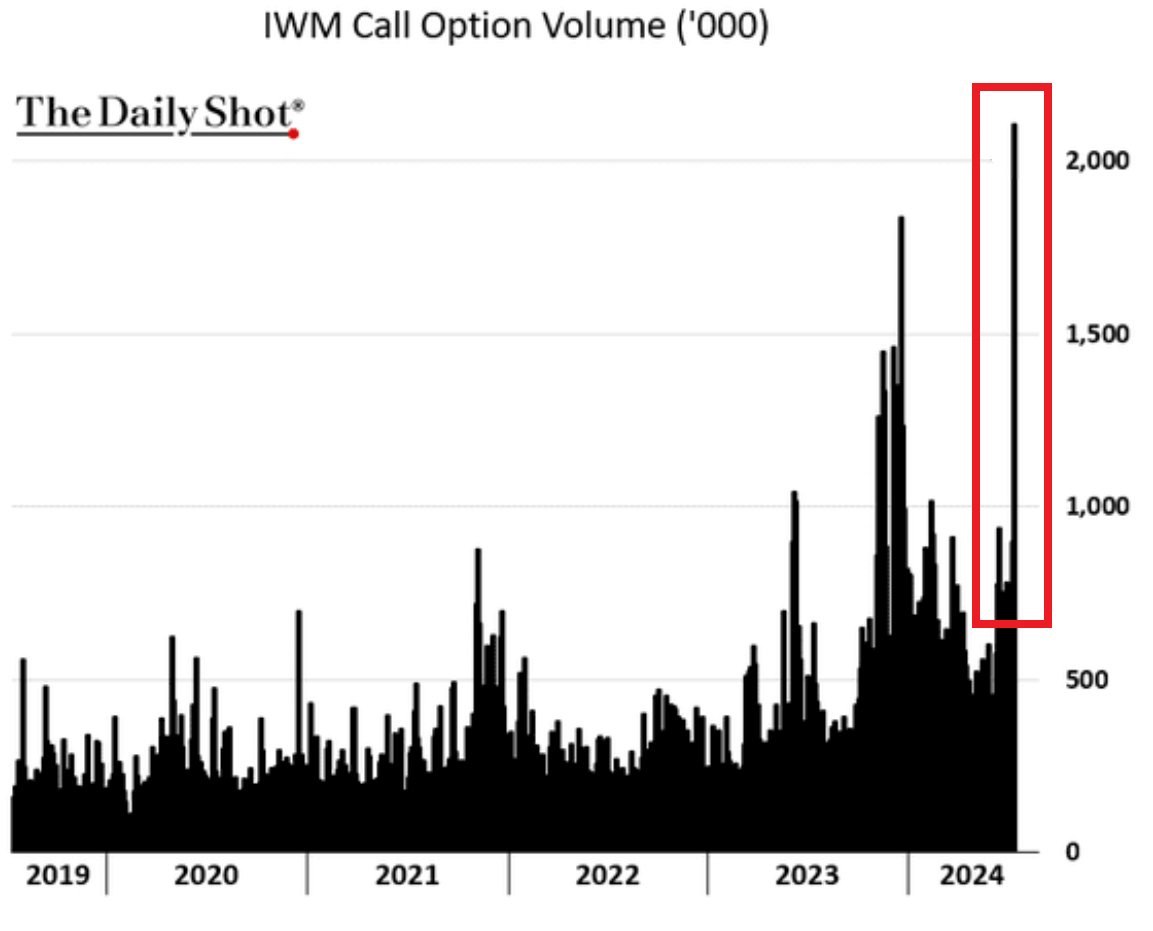

Call options volume in Russell 2000 ETF (Ticker: IWM) of small-cap stocks spiked to the highest ever on last Thursday.

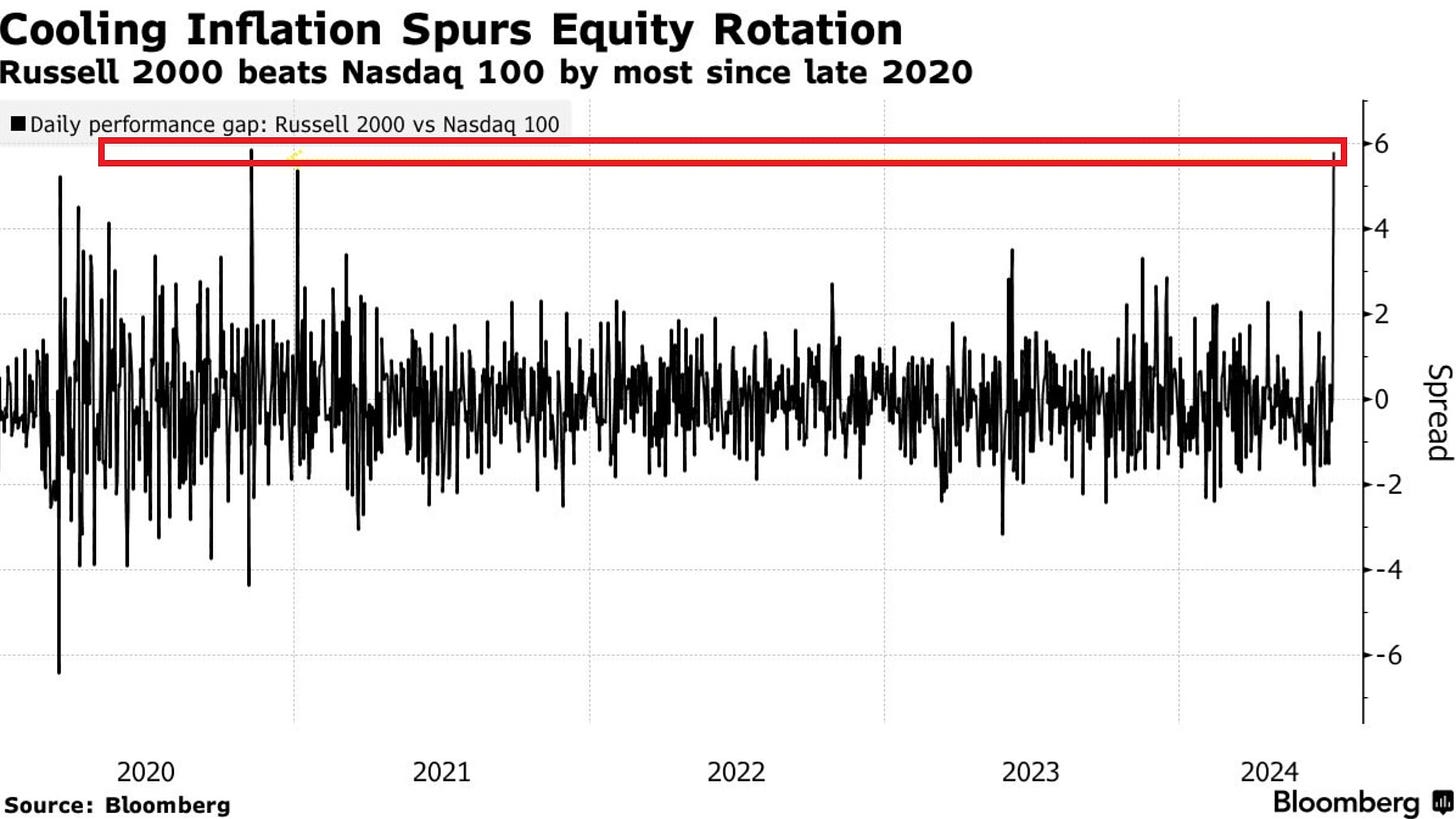

This comes after the index rallied by a massive 3.8% and outperformed the Nasdaq 100 index of technology stocks by ~6 percentage points, the most since 2020.

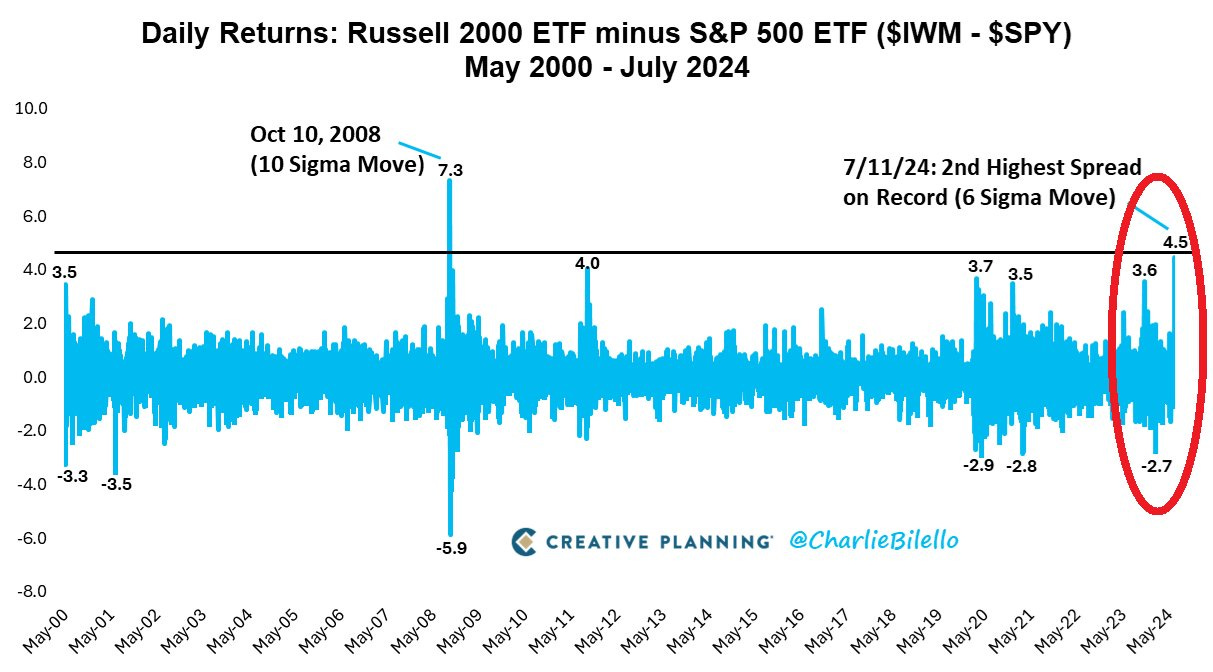

Moreover, on that day, the Russell 2000 ETF outperformed the S&P 500 ETF by 4.5 percentage points.

This was the largest outperformance since October 2008, and 2nd highest on record.

Overall, the Russell 2000 index ended the week up by 6.1% while the Nasdaq 100 finished down by 0.3%. This comes after the US 10-year Treasury yield declined by 10 basis points to 4.187% in the last 2 trading sessions.

US small capitalization stocks are the most sensitive to any changes in rates and it appears that investors started to believe that the US economy will avoid a recession and at the same time the Fed will start cutting rates in June as inflation came below expectations on Thursday. That is why they piled into small caps. This sounds like a Goldilocks scenario.

Investors should carefully evaluate why the yields have fallen and what will be the reason for the Fed cutting rates. It is still too early to tell that with 100% conviction. More details about small-caps in the below article:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?