Carry trade unwind is still a major risk for global markets

The Bank of Japan has put itself into a corner after decades of monetary policy easing

On August 5, global markets have seen one of the largest turmoils in at least 4 years. See the full recap below:

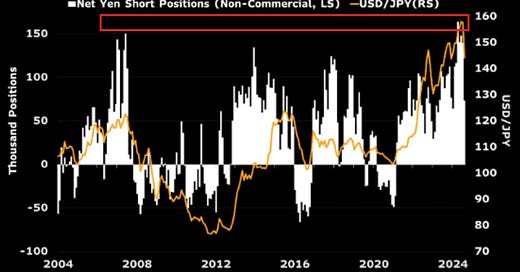

One of the largest factors (apart from the US economic slowdown and mixed 2Q 2024 earnings season) was the so-called carry trade starting to unwind.

Carry trade is an investing strategy that involves borrowing in a currency with a lower interest rate to buy an asset with a higher interest/return. Taking Japan as an example it would be borrowing at a low interest rate in Japan, selling the Yen for USD (or other currency), and investing in bonds, stocks, commodities, or other assets.

Notably, leverage (investing using borrowed money) can also be used and in practice, in this strategy, there is a massive amount of leverage exploited.

For a better understanding of these dynamics, find out below how the Japanese authorities have led to such a situation that carry trade has become so popular worldwide and become one of the largest global risks in today’s markets.

This piece will go over the Bank of Japan’s last few decades’ policies, the size of the carry trade, what are the risks and what may potentially happen next in the financial markets.

Furthermore, if you are interested in what happened during the 1980-1990s housing and stock market bubble in Japan I highly recommend the below document as a prolog.

Additionally, you can find more analysis about the Bank of Japan’s balance sheet and its asset holdings below.

JAPAN’S HOUSING BUBBLE BURST, THE ERA OF NEGATIVE INTEREST RATES AND LARGE-SCALE ASSET PURCHASES