Can the Fed avoid a recession?

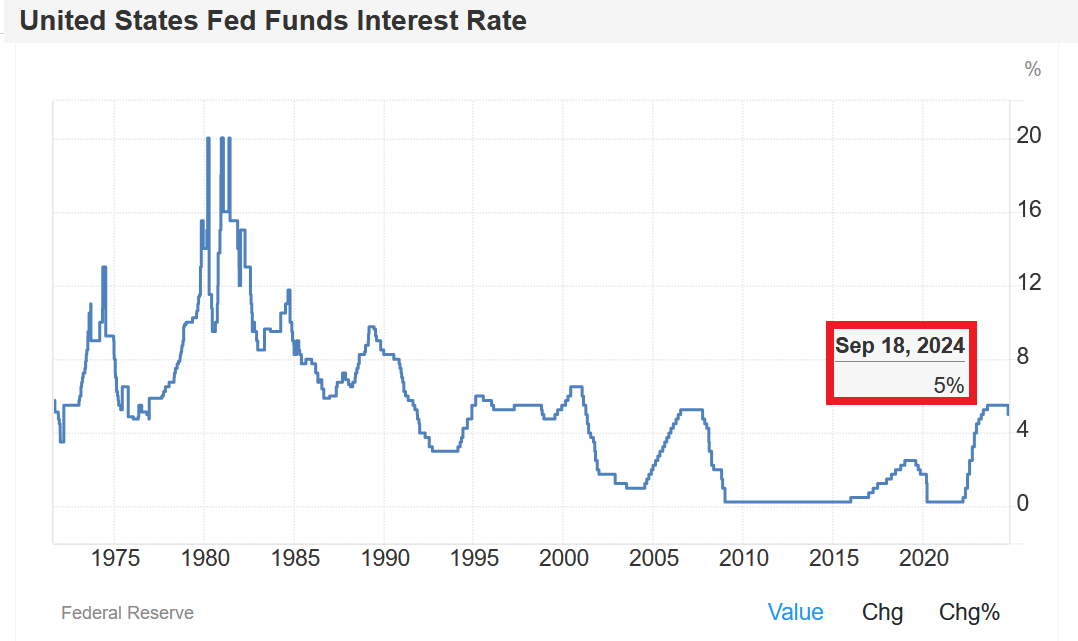

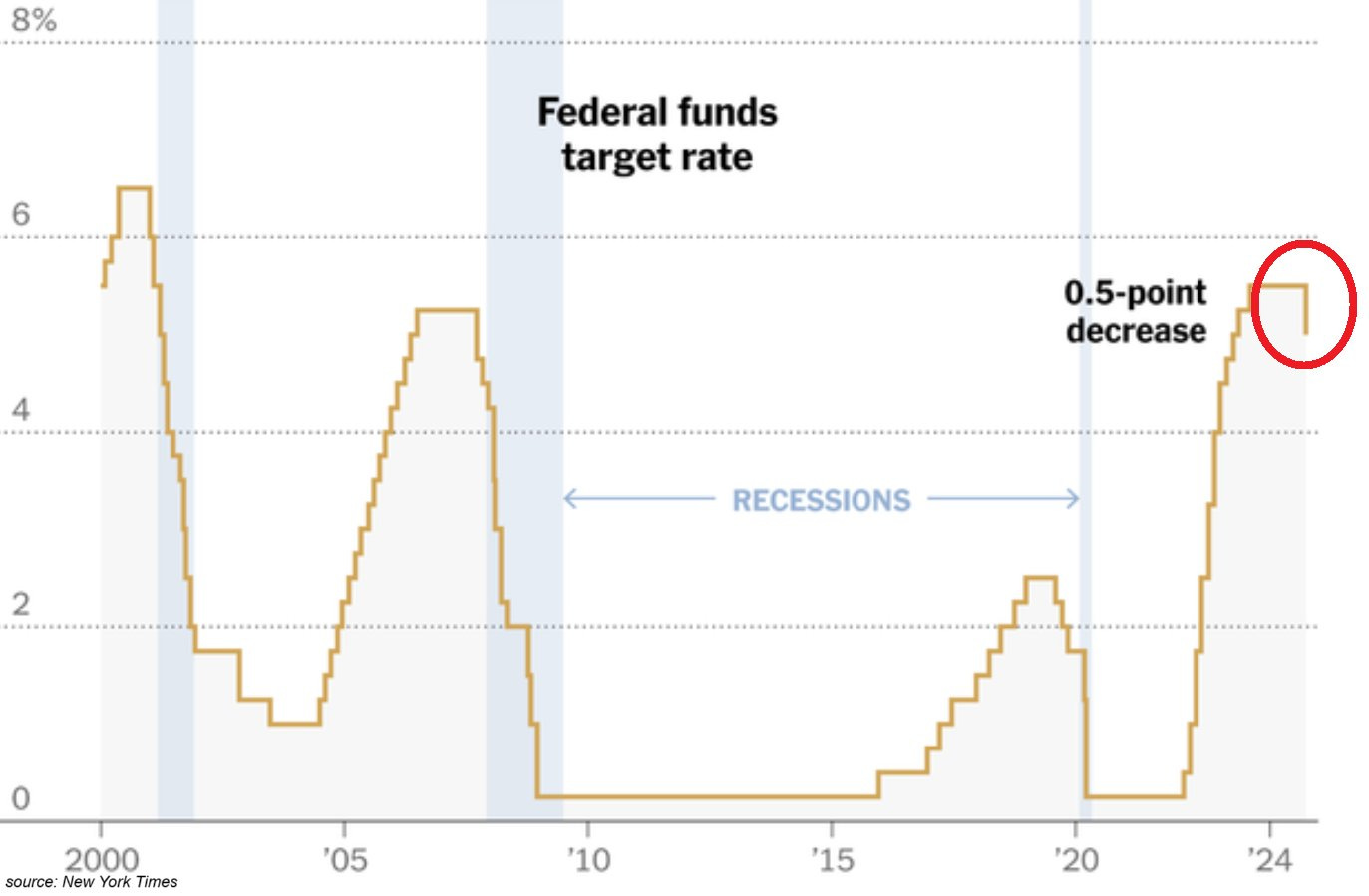

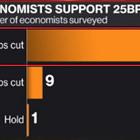

The US Central Bank cut rates by 0.50% on September 18, which was the largest surprise since 2008.

Before you proceed with reading the article, below you can find the most recent analysis of the US job market:

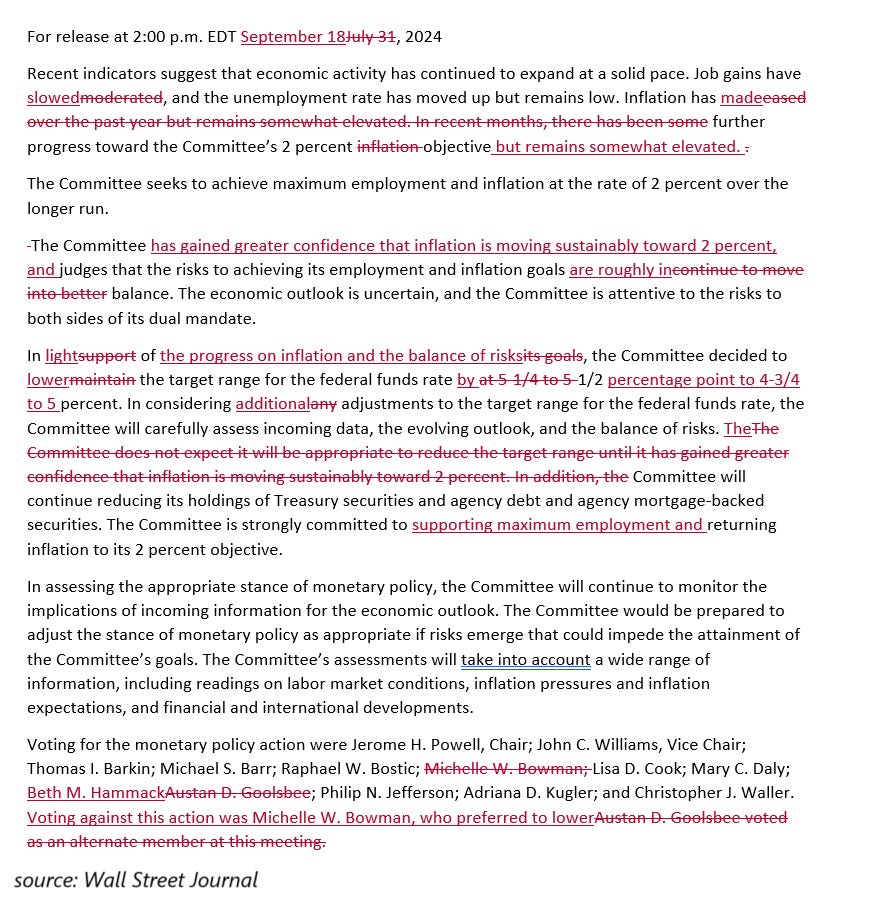

The Federal Reserve cut its interest rates by 0.50% on Wednesday, September 18th, conducting the first reduction since the March 2020 COVID crisis. Interestingly, one Fed governor Michelle Bowman dissented in favor of a 0.25% cut, the first dissent by a governor since 2005.

Overall, the Fed explained its decision by emphasizing that it gained greater confidence that inflation is moving towards the 2% target. However, it admitted that the economic outlook is uncertain and will carefully assess incoming data during the next meetings.

Below you can see the changes made to the Fed statement between July and September.

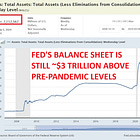

The central bank also reiterated that it will continue its Quantitative Tightening program - the process of reducing its balance sheet. More on that in this article:

It appears that the Fed’s top priority now is the labor market and as we know the outlook for it is not promising.

Overall, the meeting can be assessed as historic as this decision was the most surprising for the markets and economists since 2009.

Let’s recap then the key pieces of the announcement including the Fed Chair Jerome Powell's press conference.

If you would like to see what had happened at the previous meetings, you can see the last 5 recaps below:

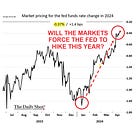

SOMETHING DOES NOT ADD UP IN THE FED ECONOMIC PROJECTIONS