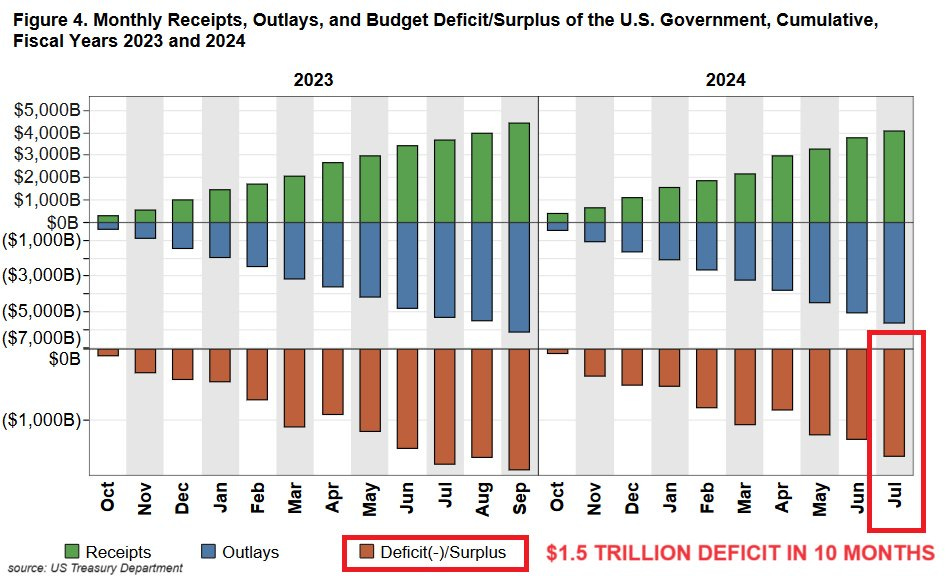

BREAKING: US government deficit hit $1.5 trillion in the first 10 months of the Fiscal Year 2024

In July alone, the US deficit reached a MASSIVE $244 billion.

US government deficit hit $1.5 trillion in the first 10 months of the Fiscal Year 2024. This was down 6% from $1.6 trillion in the same period last year. However, this was larger than all the years before the 2020 COVID Crisis including 2009 - the last year of the Great Financial Crisis when deficit was $1.4 trillion for the entire 12 months.

In other words, the US government is still spending money as if there is a recession or a major crisis.

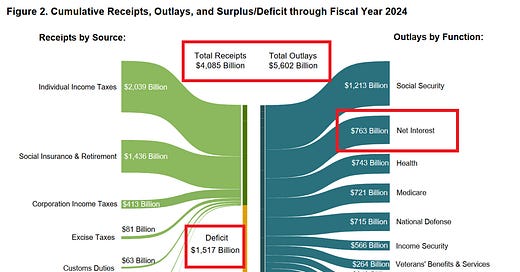

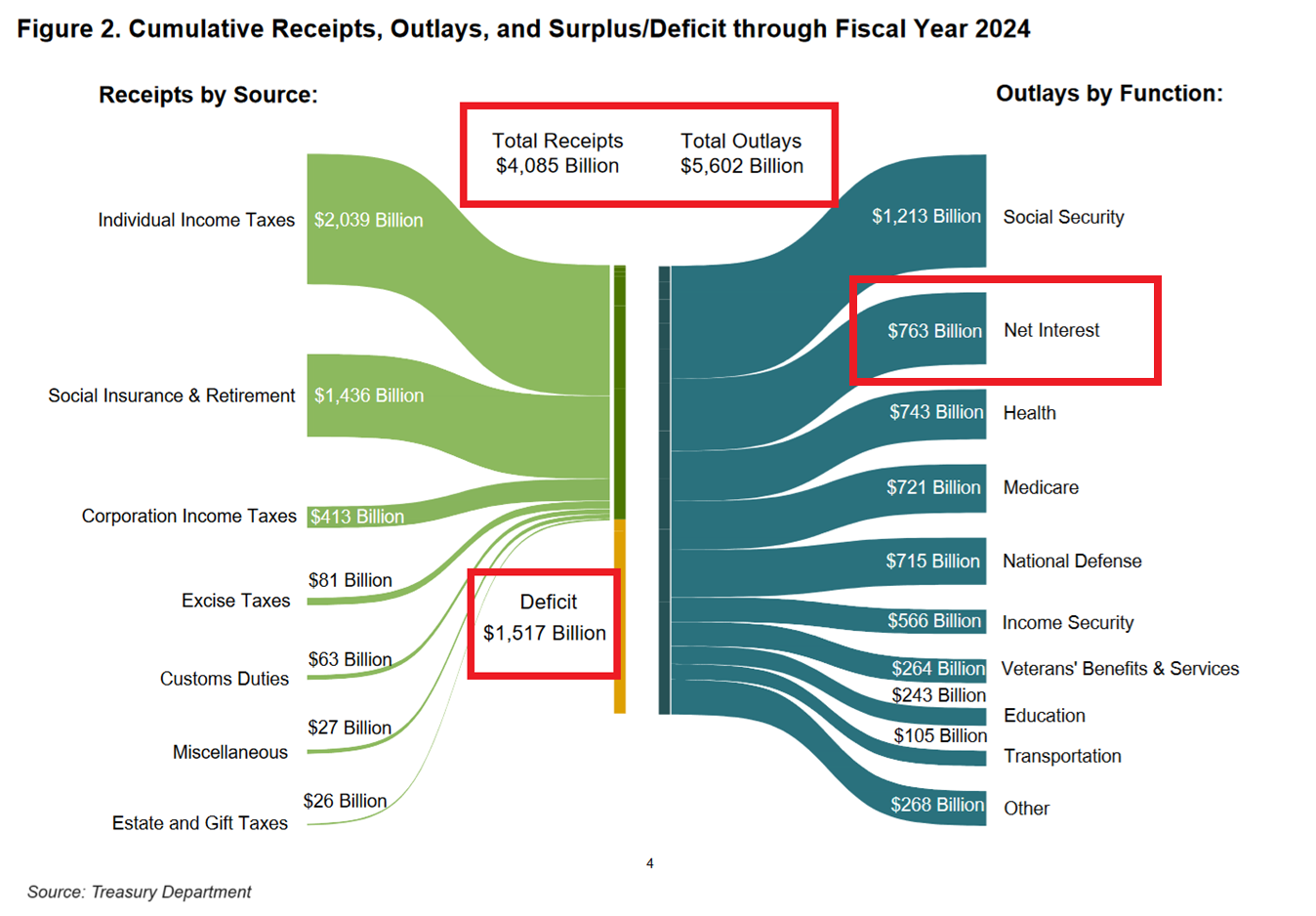

As you can see, total outlays and total receipts were $5.6 trillion and $4.1 trillion.

Social Security was the largest expenditure amounting to $1.2 trillion.

Net interest was the 2nd biggest payment reaching a WHOPPING $763 billion, exceeding health, Medicare, and national defense expenses.

This was offset by the government collecting $2.0 trillion in individual income taxes.

For the full Fiscal Year 2024, the US Treasury estimates the deficit to hit $1.9 trillion, above the $1.7 trillion in 2023 and the most since 2021.

Such a big difference between receipts and outlays will make the federal debt rise even further. The public debt has already hit $35.1 trillion in August, the most ever recorded.

The question is how long can it last and what will be the consequences. If you would like to know answers to these questions and how to invest in such a climate please find below a comprehensive analysis of US public debt:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?