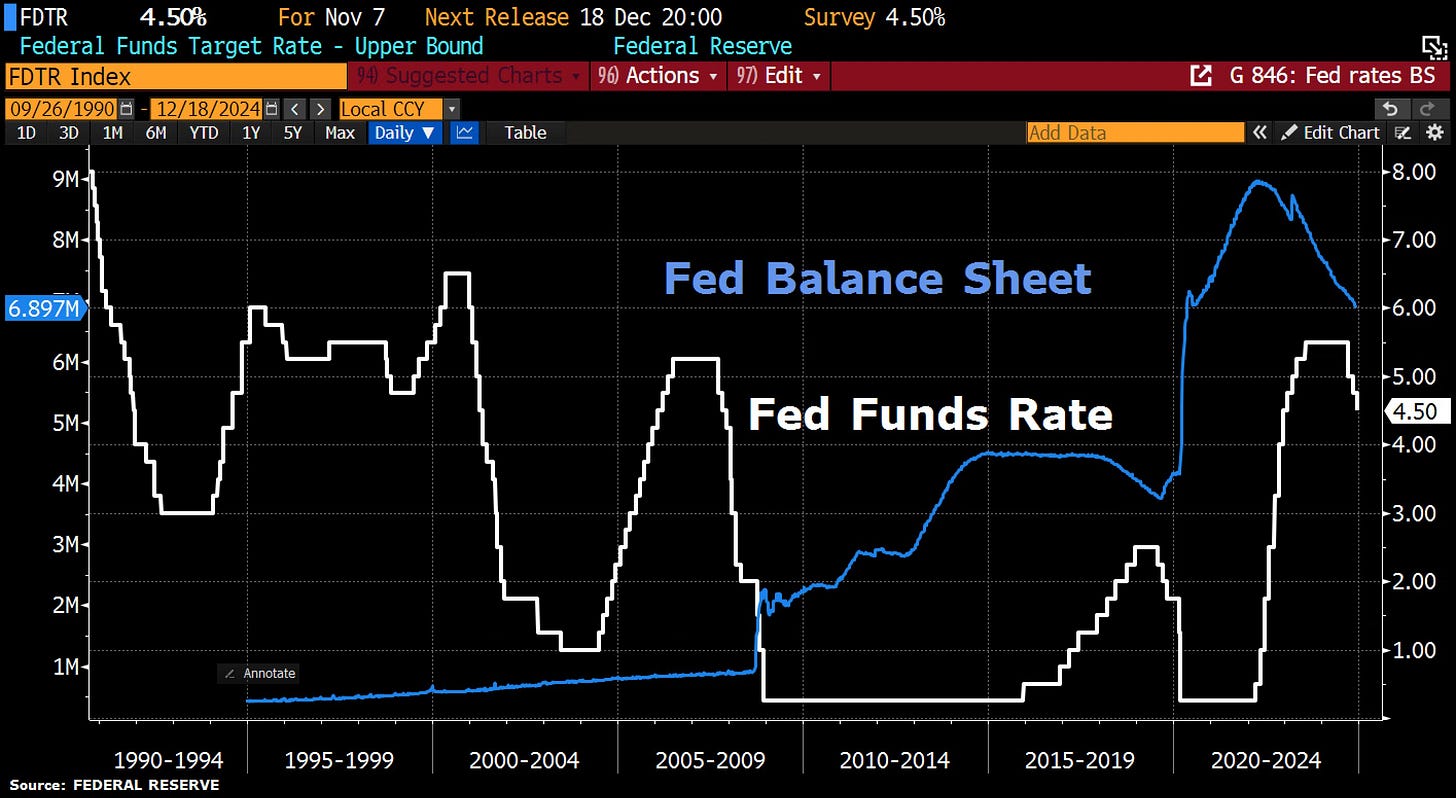

BREAKING: The Fed cut rates by 0.25% to 4.50% on Wednesday

Initial market reaction is negative as the central bank expects higher rates in 2025 than in September forecast

57,000 - this is the number of views of this content over the last 30 days. This is pretty impressive how fast the overall reach has been growing here and on social media. Unfortunately, inflation has also been rising. The best ways to fight this are investing in financial markets and growing business and its profits.

This is why prices for NEW paid subscribers will go up from the 1st of January 2025 to $19.99 a month and $199 a year. This is still below the pricing of most creators and a decent price for the amount and quality of research you receive. You can secure the current (old) pricing below before December ends.

The Fed cut rates by 0.25% on Wednesday bringing its benchmark rate down to 4.50%. This is the third consecutive rate cut after 0.50% in September and 0.25% in November.

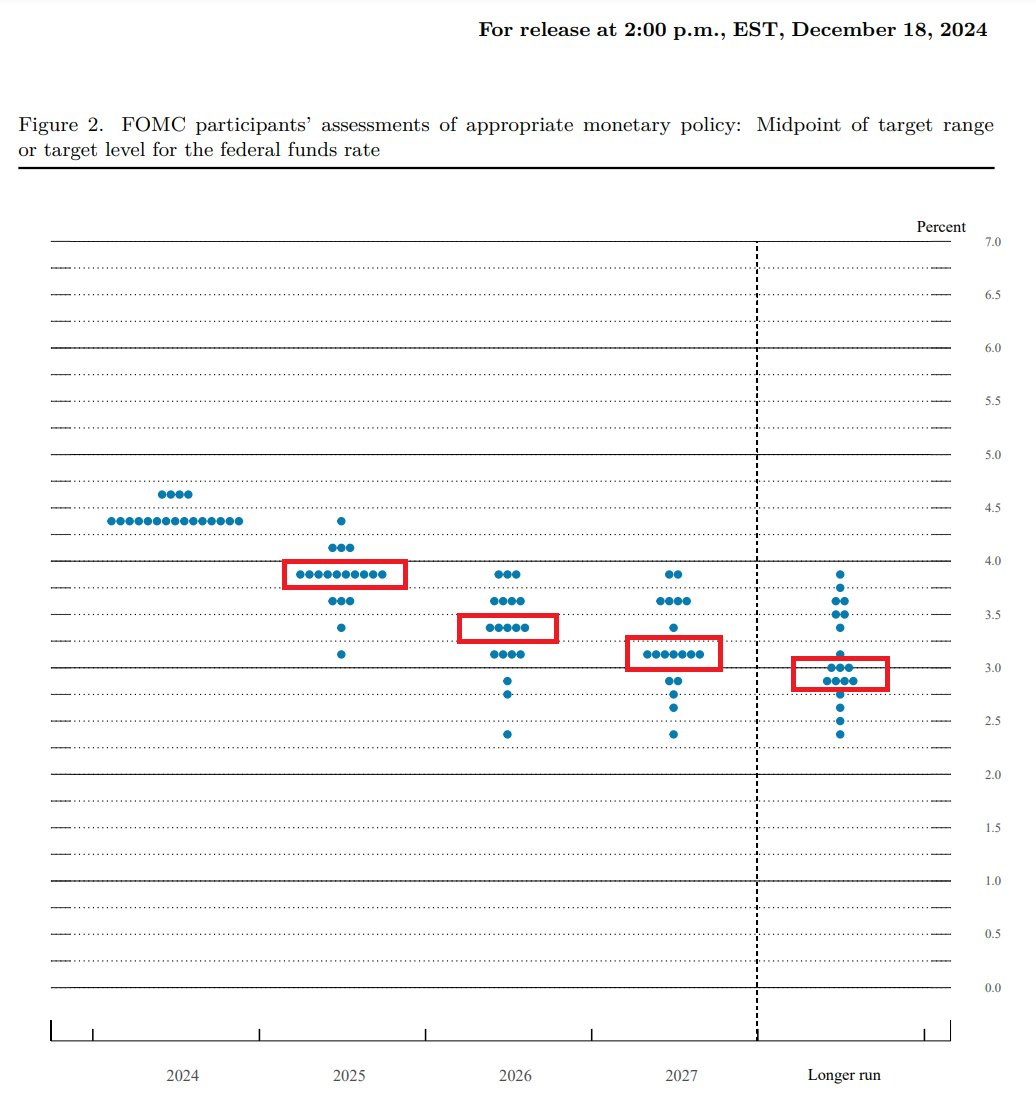

The world’s important central bank also released its economic projections including the dot-plot.

Notably, the Fed now expects rates to come down to 3.875% in 2025 up 0.5% from the September projection of 3.375%. In other words, it now sees 2 fewer rate cuts than previously.

For 2026, the central bank sees rates at 3.375% up 0.5% from September.

In the longer run, the Fed projects rates to come at 3.0%, up 0.125% from the prior 2.875%.

Fed also revised the 2025 inflation forecast to 2.5% up from 2.1%. Which marks a significant change.

To quickly sum up, the Fed sees a slower pace of cuts as concerns over inflation remain. This is why stocks, gold, and bitcoin are falling and the US dollar is strengthening.

Now it all depends on what Fed Chair Jerome Powell says during his press conference.

A full analysis of the event will be released early next week after the dust settles and the market shows its real direction as it usually takes 1-2 days for the markets to digest all the news.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?