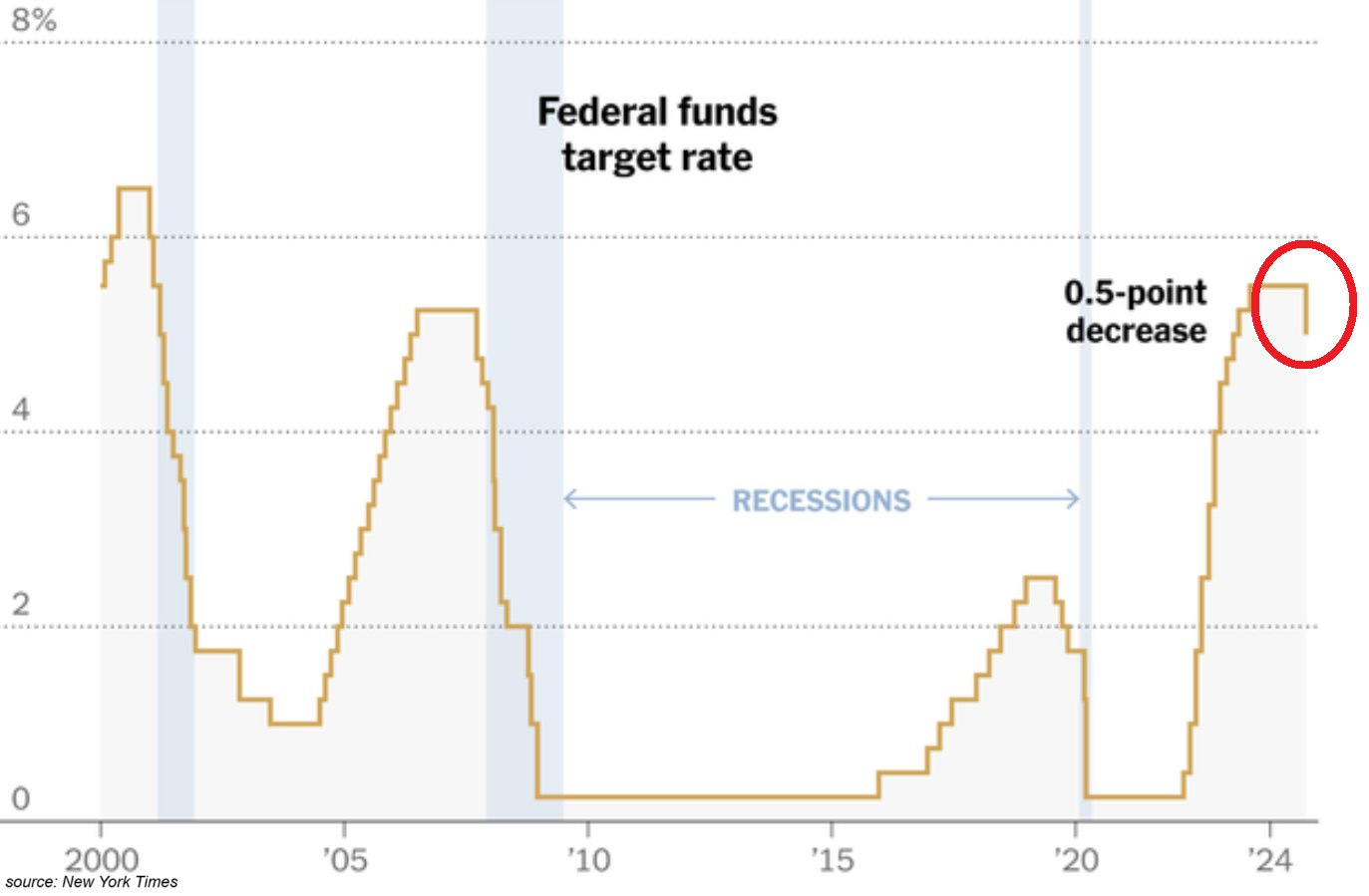

BREAKING: The Fed cut its interest rates by 0.50%, executing the first reduction since March 2020

The Fed IMPLICITLY admitted the economy is weak and they are behind the curve without saying it at all

The Fed cut interest rates by 0.50%, conducting the first reduction since the March 2020 COVID crash.

The central bank expects two more 0.25% cuts in 2024 and an additional 1.00% worth of cuts in 2025.

This was also the biggest Fed surprise since the 2009 Financial Crisis as the market was pricing in ~60% probability of a 0.50% rate cut. Therefore, it was not clear what the Fed is exactly going to do.

Looking at the past, a 50 basis point initial cut was not a good omen for the markets going forward.

Overall, the market reaction was mixed but usually, the same day does not show the true reaction. We would need to wait 1-2 more trading sessions to see how investors exactly interpreted it.

Therefore, the full piece covering the event will come out on Friday. For now, please read how stocks usually react to the Fed cuts within 3-12 months from the first reduction.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?