BREAKING: NVIDIA's share prices are down 26% from their June peak

The company lost a massive $1 trillion in market capitalization in just a few weeks

NVIDIA stock has declined by 26% over the last several weeks and officially entered a bear market. The company’s market value has dropped by a $1 trillion market cap from its June intra-day peak.

Share prices are still up by 112% year-to-date though. Overall, it is not a new occurrence and in the past couple of years, NVIDIA has seen a few drops between 22%-68%. More details in the below article:

The weakness has been seen in the entire Semiconductor sector which is down by 17% from the peak, the most since October 2023.

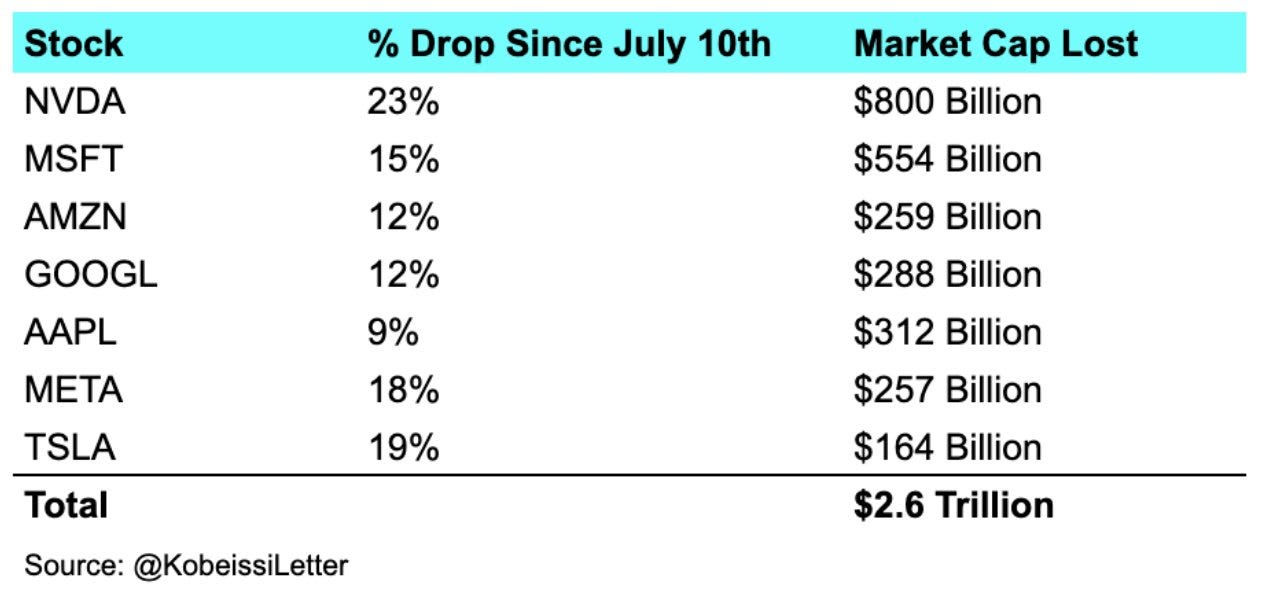

The question is whether NVIDIA’s stock and other Magnificent 7 companies’s shares will bring the S&P 500 into the bear market again, as in 2022. The group has already lost a whopping $2.6 trillion in market value over the last 20 days.

To put this into perspective, NVIDIA’s market share is now $2.55 trillion, down from ~$3.35 trillion.

It looks like something is cracking as Q2 earnings expectations have been sky-high and actual reports have not been satisfying investors so far. As a result, even the S&P 500 has decreased by 4.5% over the last 2 weeks.

As you can read in the most recent market wrap, this week is huge in terms of Big Tech earnings.

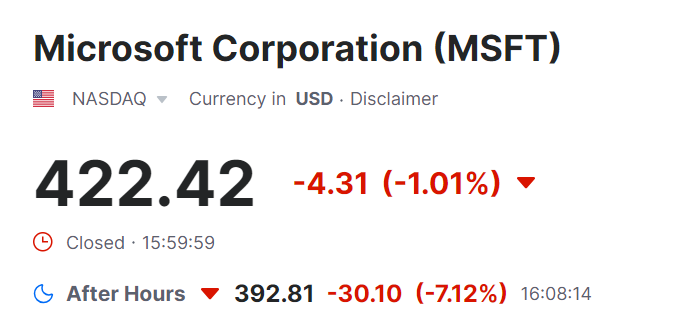

Microsoft already reported after the market close today with Meta coming in on Wednesday while Amazon and Apple on Thursday.

Microsoft’s Q4 Total Sales came at $64.7 billion, above the estimated $64.52B.

Cloud Sales: $36.80B, EST. $36.84B

Intelligent Cloud Sales: $28.52B, EST. $28.72B

Earnings per share: $2.95, EST. $2.93

Despite a slight total revenue and earnings beat, the company missed cloud sales expectations. In effect, the stock has dropped by 7.1% after hours.

Is the concentration bubble finally bursting? We will likely know it in the next several weeks. Given extreme valuations and the deteriorating US economy, my investment portfolio has been positioned very defensively since July 11 and it will be until at least the election before deciding what’s next.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?