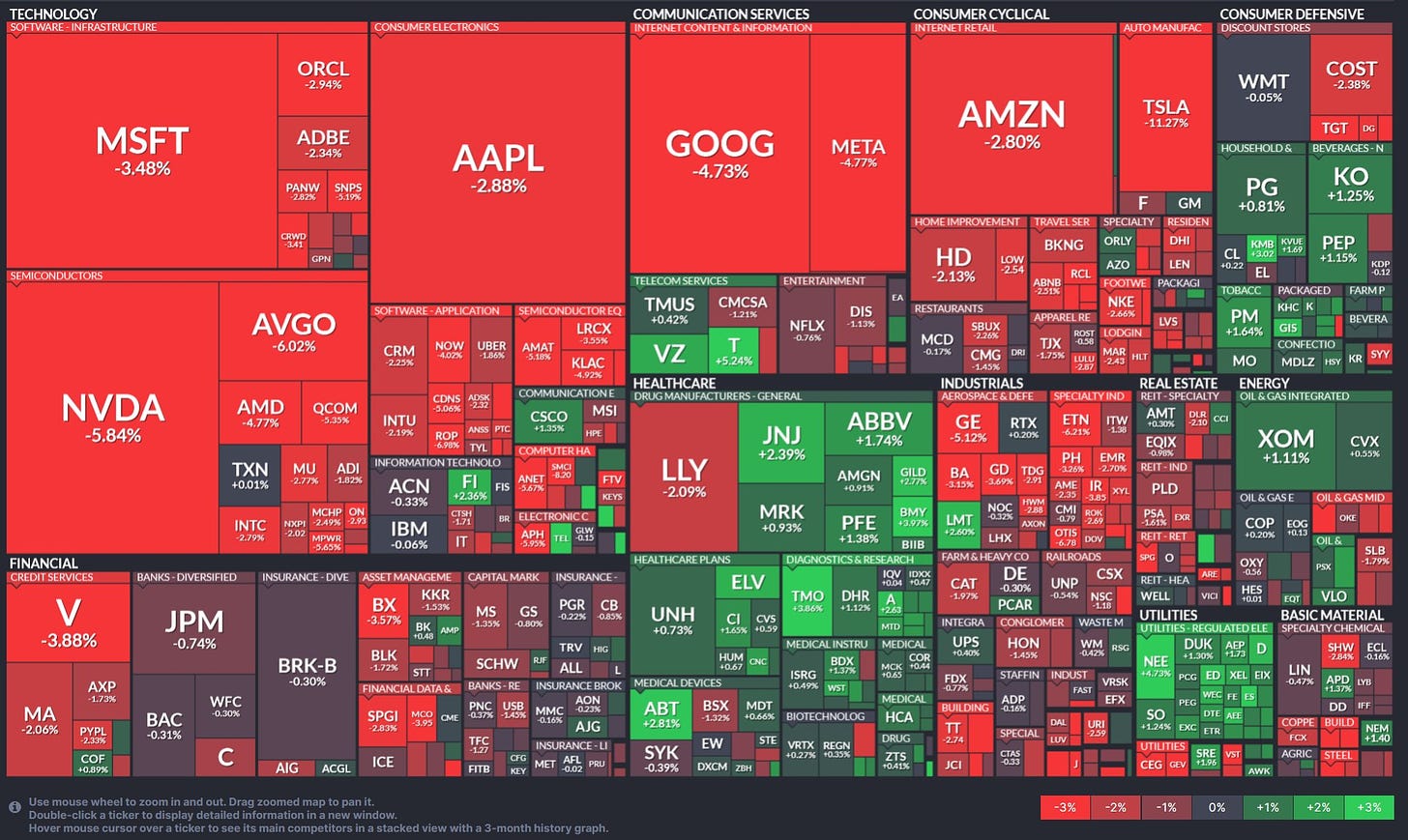

BREAKING: Magnificent 7 lost nearly $2 TRILLION in market capitalization in just 10 days.

Amazon, Apple, Google, Meta, Microsoft, NVIDIA and Tesla combined saw the largest daily loss since October 2022

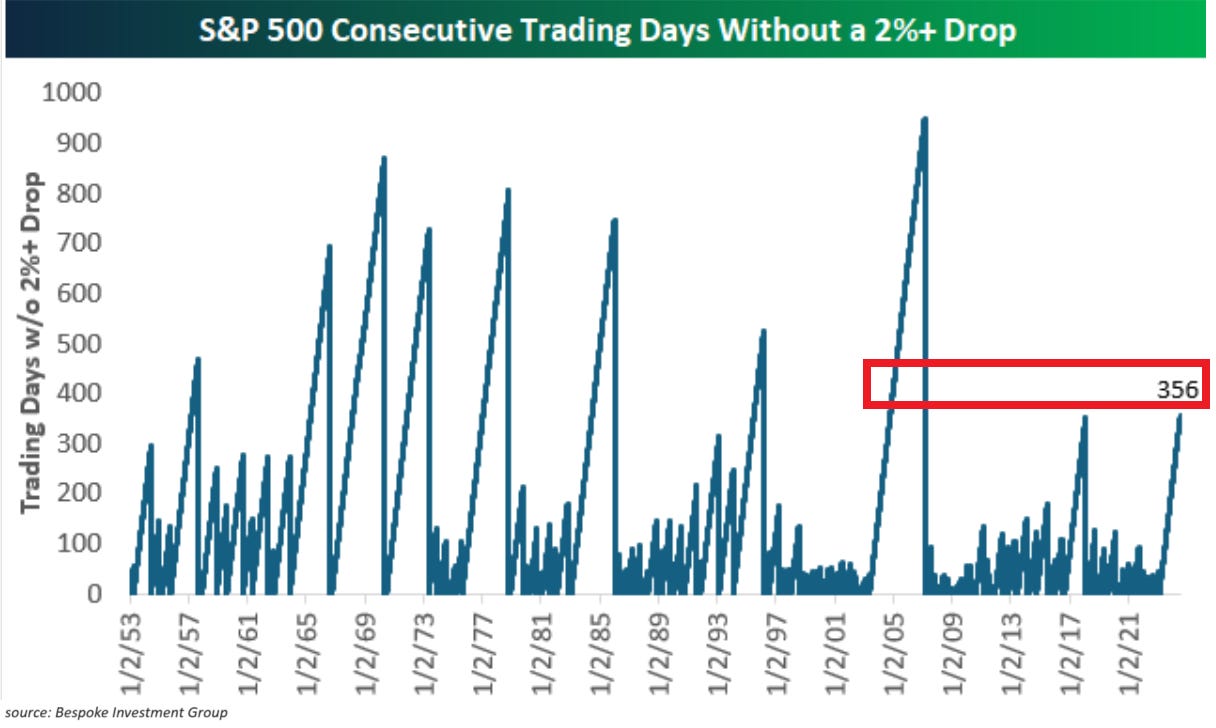

What a trading session it was. S&P 500 dropped by 2.3%, ending the longest streak since the Great Financial Crisis of 356 days without at least a 2% decline. This was also the largest daily decline since December 2022. Today's performance recap:

S&P 500 -2.3%

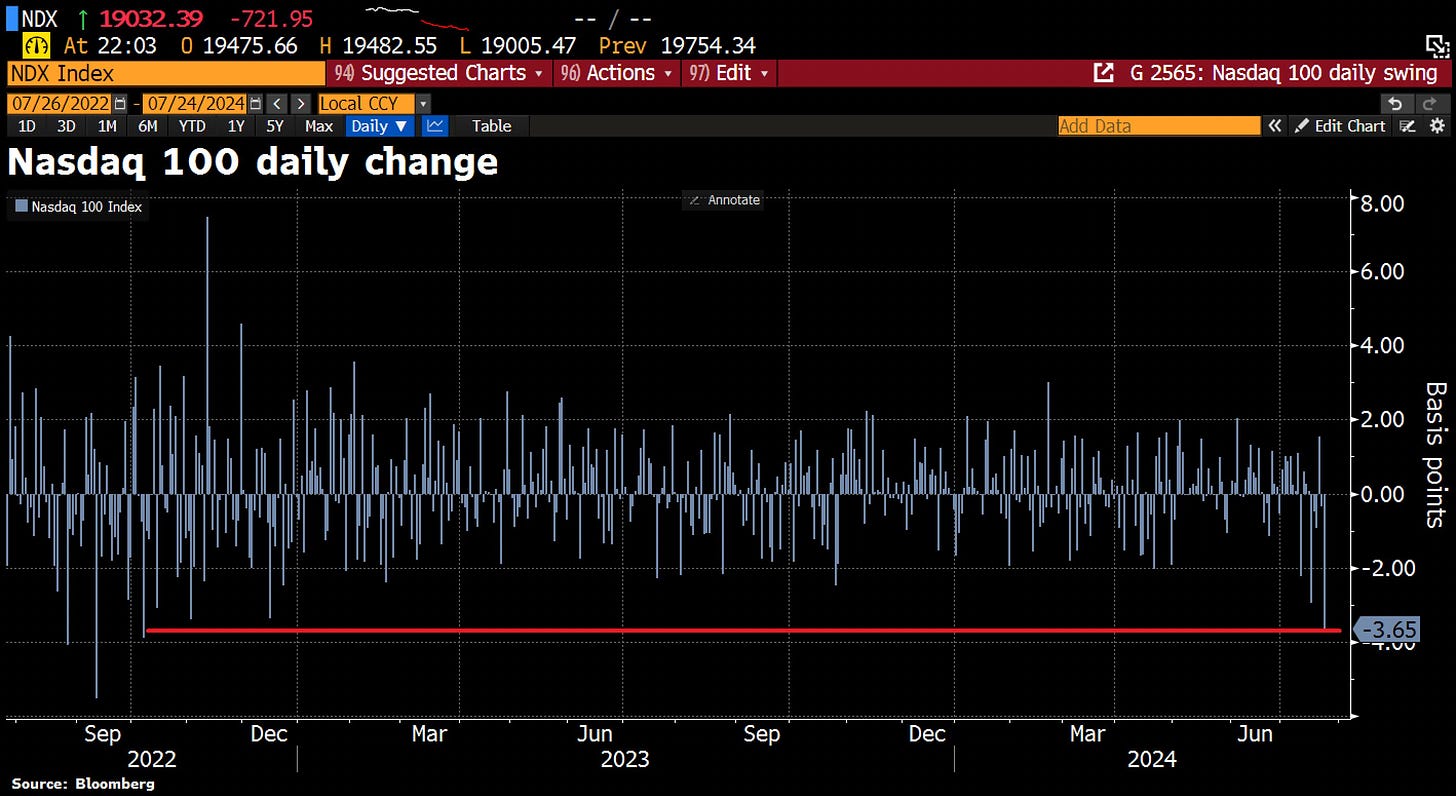

Nasdaq -3.6%

Russell 2000 -2.1%

Dow Jones -1.3%

Bitcoin +0.5%

Bank Index -0.8%

VIX +25%, HIGHEST LEVEL SINCE APRIL 19

Gold -0.3%

Overall, the S&P 500 erased over $1 TRILLION of market capitalization today. The index is also down 4% since its all-time record.

The most pronounced sell-off was seen in the technology sector with NASDAQ 100 posting the worst day since October 2022.

The Magnificent 7 stocks also suffered the largest daily loss since October 2022. Additionally, they have erased nearly $1.75 trillion in market capitalization over the last 10 trading sessions, the most on record. To put this into a perspective, this is almost 50% of the entire market cap of Apple, the world’s largest company.

NVIDIA alone declined by 6.8% in today’s session, broke below the key level (red line), and is down 18% since its all-time high. It would not be a surprise if more investment funds would start selling the stock in the upcoming days after it crossed below this key point.

So what has driven the broad sell-off? A couple of things:

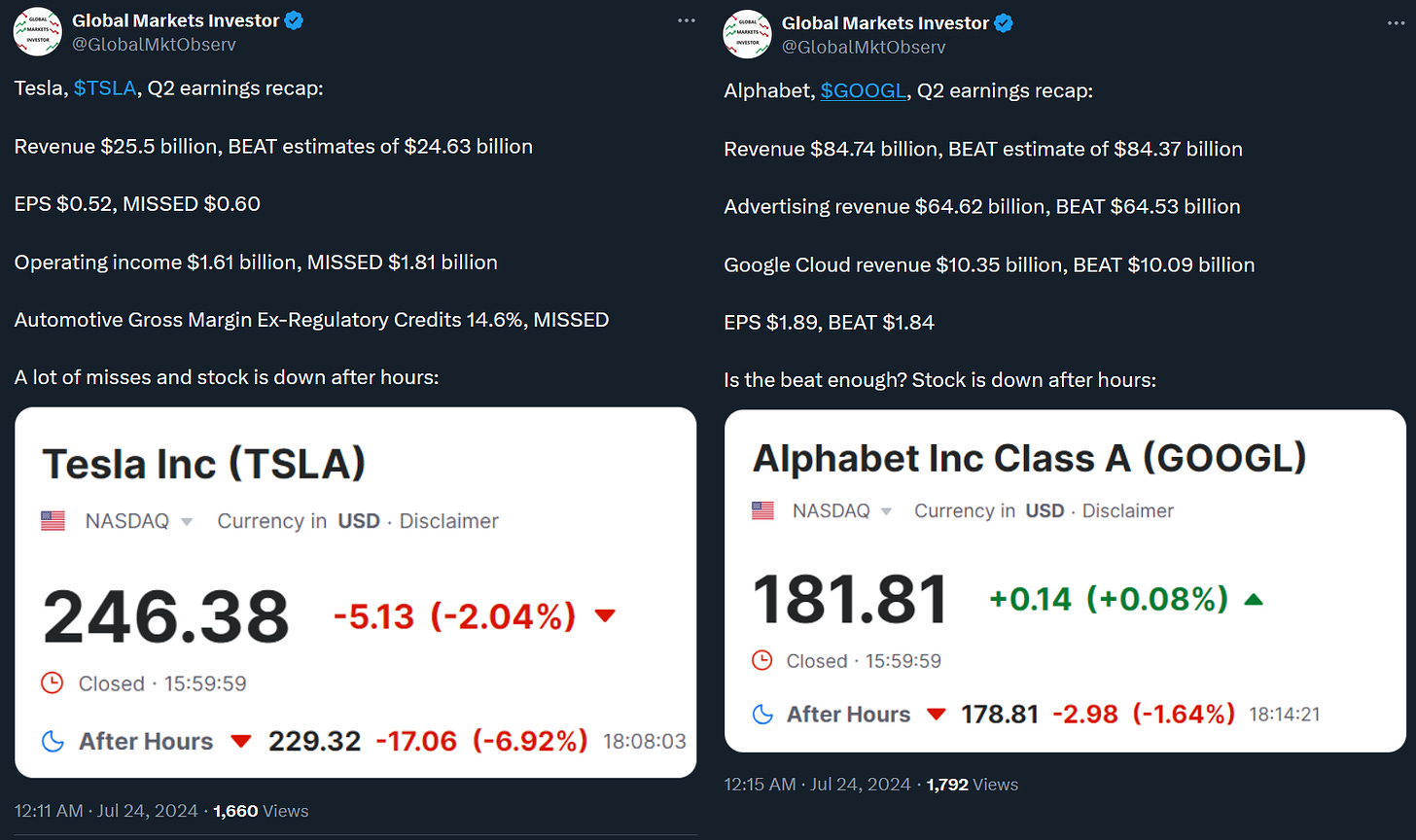

1) Not good enough Q2 earnings results from Tesla and Alphabet (Google’s parent):

Tesla missed all expectations across the board which made the stock fall by 11% today, the worst decline since January 25.

Alphabet shares decreased by 5%, the most since January 31. The company beat total sales and earnings expectations but YouTube advertising revenue fell below the consensus estimate. It looks like large investment funds and investment banking analysts expected a much more significant beat and were not impressed by these results. Interestingly, massive capital expenditures on AI have been put in question by investors with many claiming that AI has not been that innovative yet.

2) US home sales and manufacturing disappointment

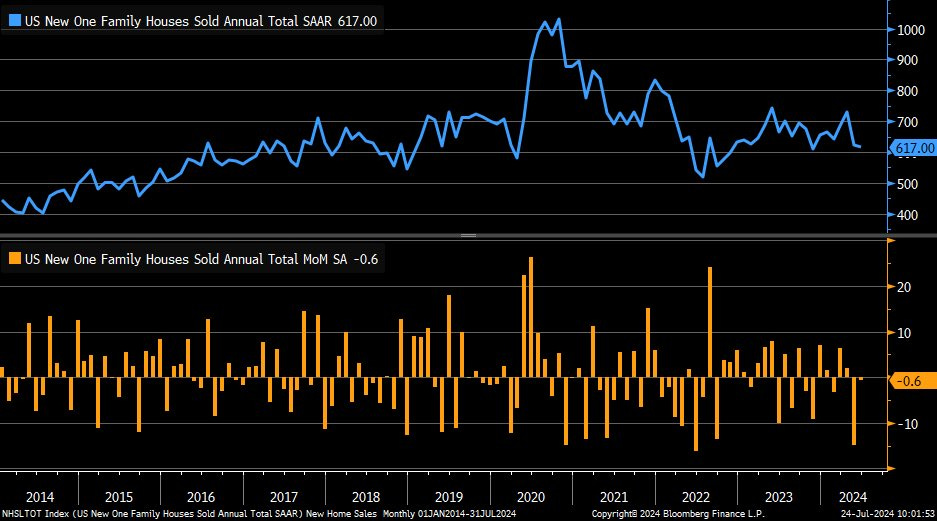

New home sales declined by 0.6% month over month in June, much below the +3.4% average estimates. Overall, new home sales dropped to 617,000 versus the expected 640,000, quite a notable miss.

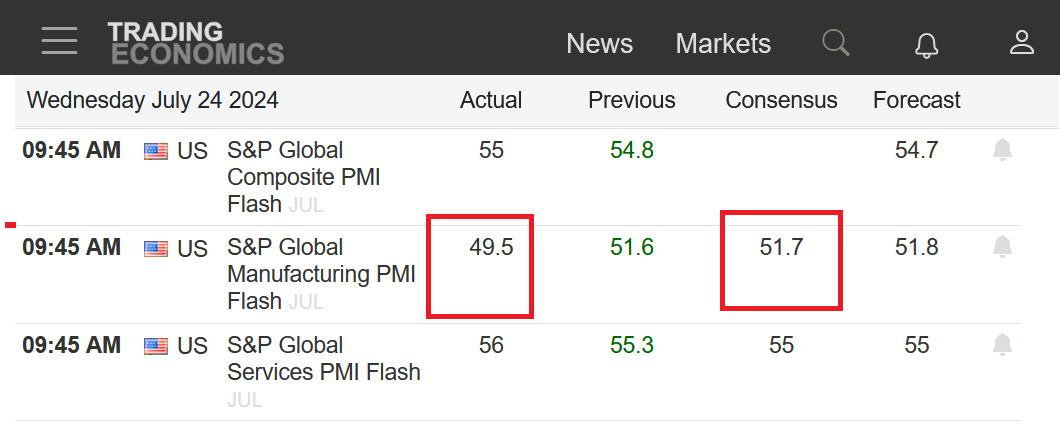

The US manufacturing PMI index fell into a contraction of 49.5 points (above 50 means expansion), below average expectations of 51.7 points. On the positive side, the services sector came above expectations.

Is the AI bubble popping? Is this just a correction? Or the market has started discounting a substantial economic slowdown? It is too early to tell, but you can see more insight about stock market valuations and the current shape of the US economy in the below articles:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?