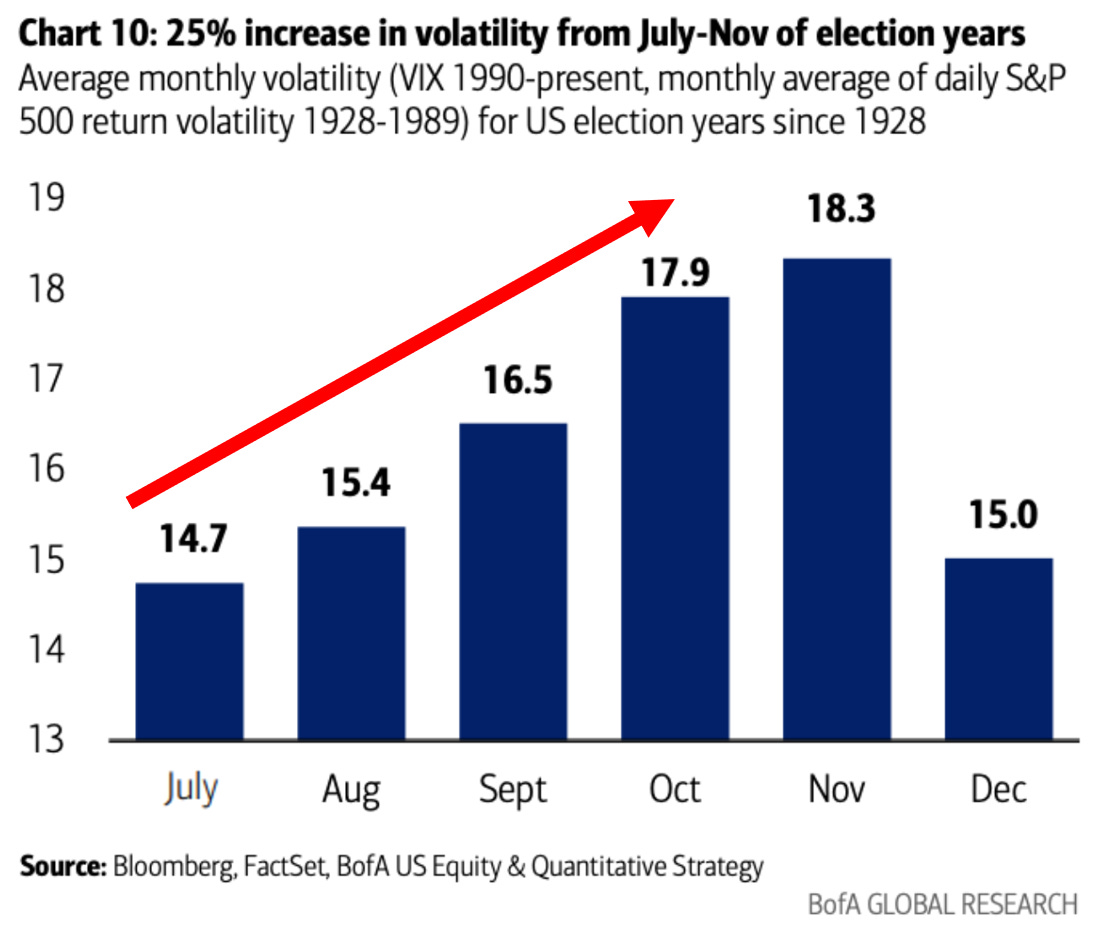

BRACE for more market volatility in upcoming months.

History suggests that the 2nd half of an election year is usually riskier in the markets

First of all, I would like to express my profound gratitude to all of you for subscribing to this content. The number of subscriptions and followers has recently exceeded 1,000! As a token of appreciation please find a 10% discount for an annual subscription. ONLY 4 DAYS LEFT!

Since 1928, the Volatility Index VIX rose by an average of 25% from July to November during election years. This usually triggered the S&P 500 to correct by 3-5% on average roughly a month before an election.

This is explained by investors’ less risky behavior who hedge their market positions with options as there is a lot of uncertainty about the final election outcome and future policies.

After Americans decide and everything gets clear, volatility usually drops by nearly 20% from November to December.

As a result, the S&P 500 rallies by 9-10% on average beginning a day after an election till the end of the year.

Meanwhile, the S&P 500 hit its 33rd all-time high this year. How do stocks usually behave longer-term after reaching a new record? Please find this out in the below article:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), buying me a coffee, and following me on Twitter:

Why subscribe?