Bitcoin and gold have been leading the everything rally. Weekly market recap, trading week 47/2024

Summary of the trading week using the most popular posts from the X platform

BLACK WEEK OFFER! Please find below a 10% discount for an annual subscription to access premium content and more deep analysis. 5 DAYS LEFT!

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

Relatively muted week with NVIDIA Fiscal Q3 2025 earnings report in focus. Overall, US stocks bounced after the previous week’s decline while Bitcoin and gold outperformed. Notably, the US dollar continues to strengthen.

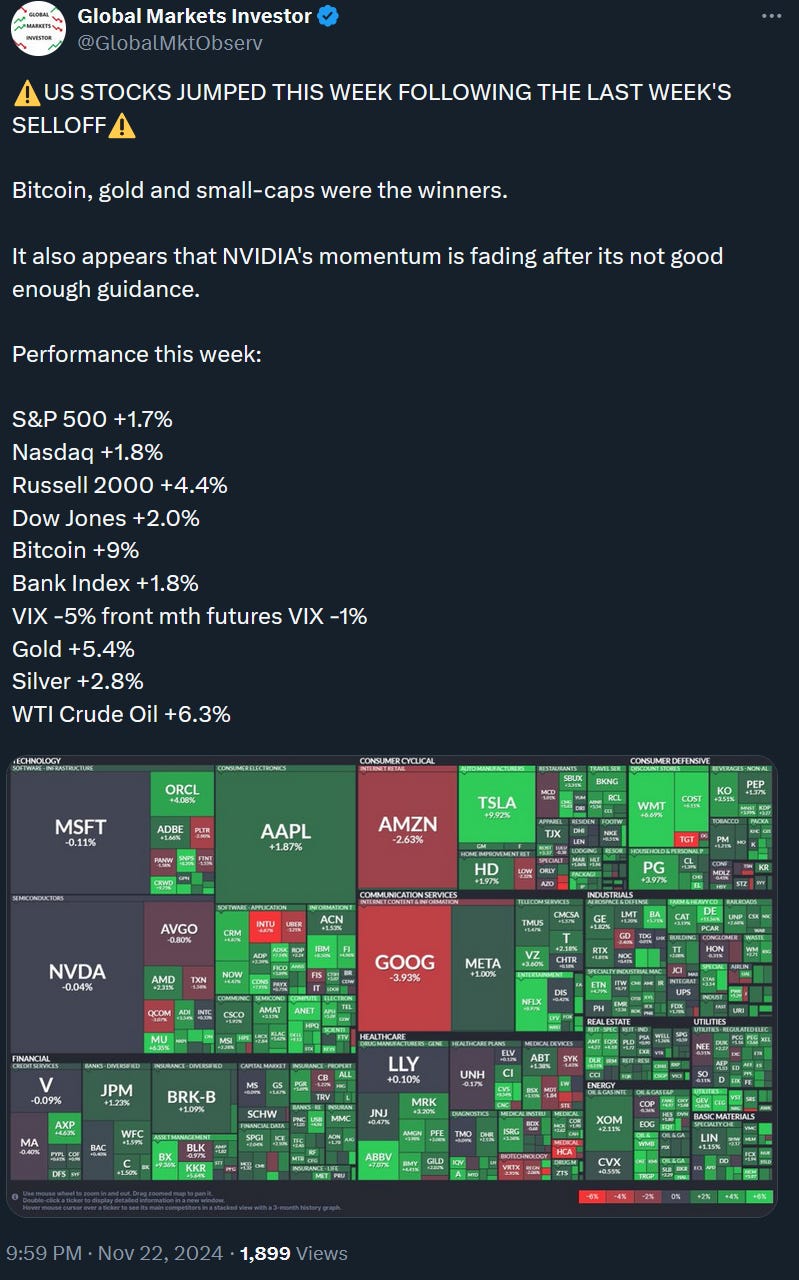

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 increased 1.7%

- Nasdaq index advanced 1.8%

- Dow Jones was up 2.0%

- Russell 2000 (small caps) jumped 4.4%

- VIX fell by 5%

- WTI Crude Oil rose 6.3%

- Silver soared 2.8%

- Gold jumped 5.4%

- Bitcoin surged by 9%

For the trading week ending November 29, key events are:

- Conference Board Consumer Confidence on Tuesday

- US New Home Sales for October on Tuesday

- FOMC Minutes on Tuesday

- US Q2 GDP second estimate on Wednesday

- US PCE Inflation for October on Wednesday

- US Thanksgiving Day on Thursday, markets are closed

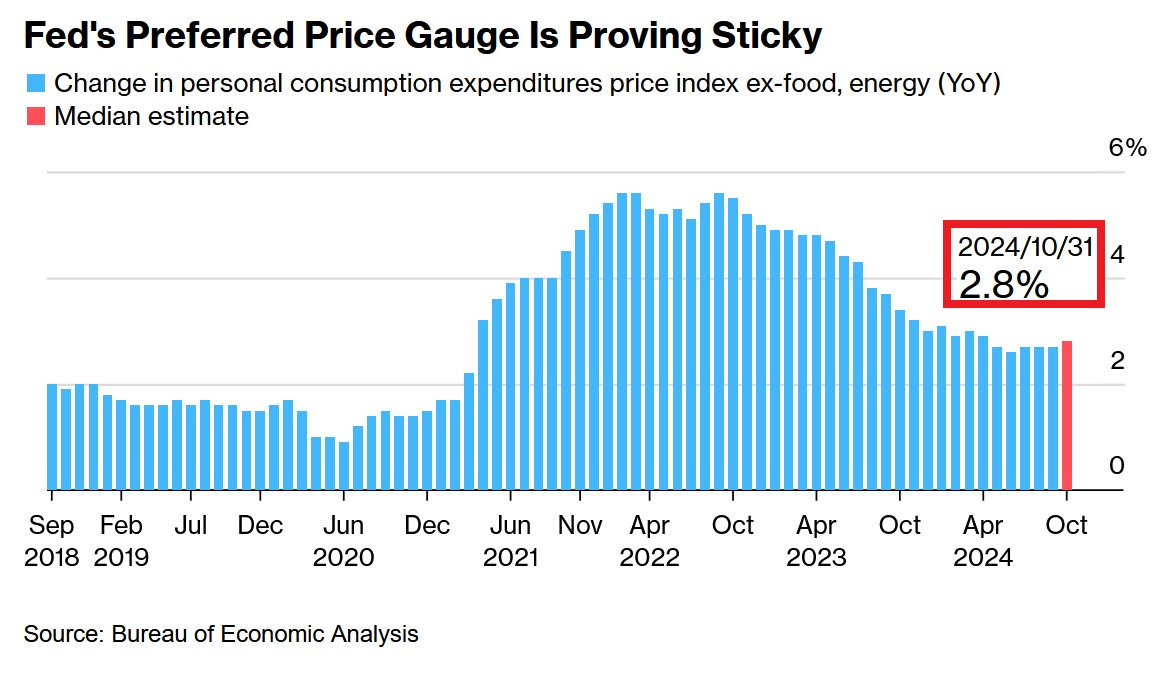

Investors’ eyes will be on October PCE inflation data as there are early signs that it might be re-surging.

The core PCE inflation - the Fed's preferred inflation metric - is expected to rise 0.3% month-over-month and by 2.8% year-over-year in October.

That would be the largest surge since April after 3 consecutive months of 2.7% increases. An upside surprise will likely make stocks sell off while a downside surprise might help the rally to continue.

Other than that, we should be also mindful of some geopolitical headlines.

2) NVIDIA beat all expectations but the guidance slightly disappointed