Are US technology stocks in a new bubble?

The concentration in tech stocks is unprecedented but what about valuations?

There has been an ongoing debate on Wall Street, financial platforms, and even social media about whether the US stock market is in a bubble or not. In the past decade or so, the largest equity market in the world has been mostly driven by large-cap technology stocks. Therefore in this piece, we will focus on this sector and check if it has formed a new bubble, similar to the dot-com bubble of the late 1990s’.

This analysis is extremely important for long-term investors since after an epic run back then, the US technology stocks fell more than 80% in just two years. The chart below presents the Nasdaq index (green line) and the Nasdaq 100 index (black line) from 1995 to 2003.

Moreover, since their March 10, 2000 peak, they needed more than 15 years to break even. And this is not even inflation-adjusted. 15 years for any investor is a really long time.

It is highly unlikely that the same occur again, particularly in the era of money printing (Quantitative Easing), interventionist Fed, and the US government but even a 20-30% drop with a subsequent couple of years of recovery would be a painful experience for investors.

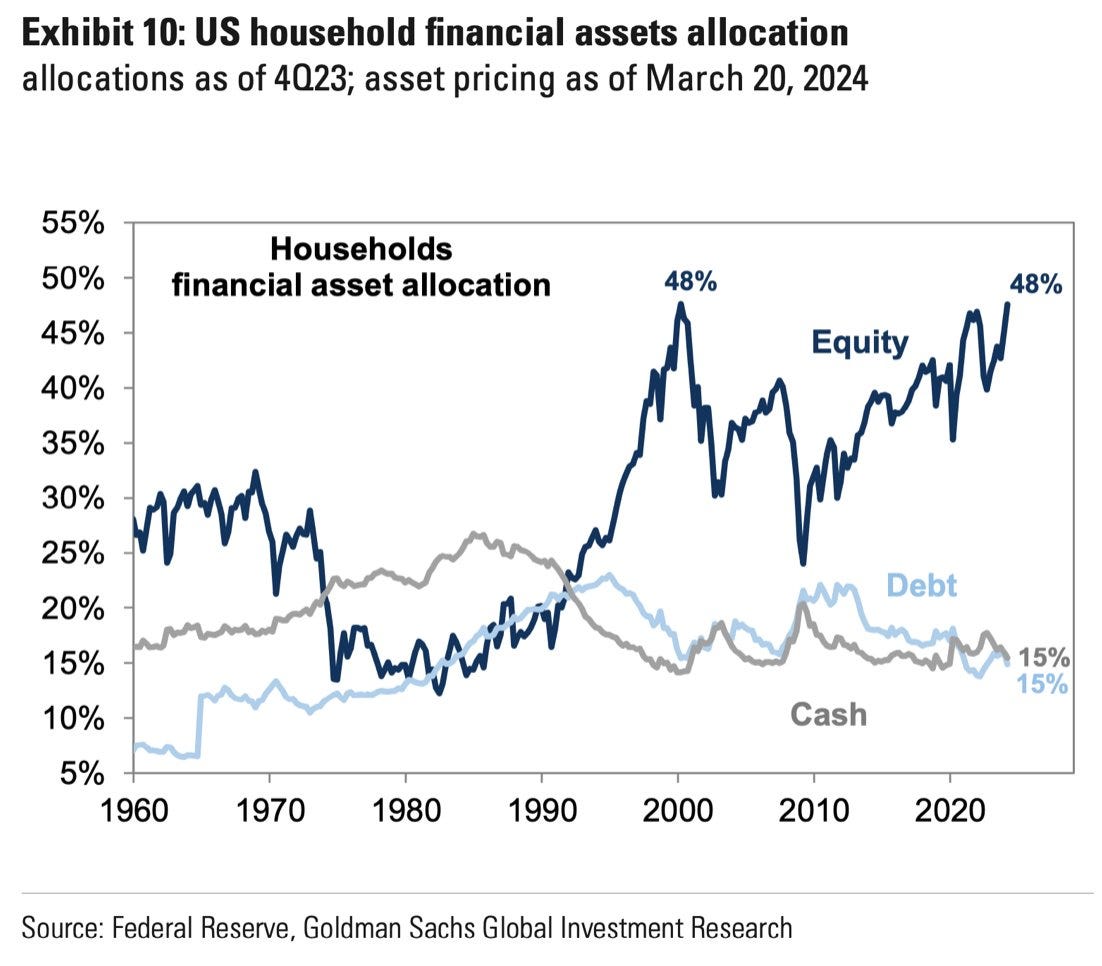

It is even more essential given the fact that after more than 20 years, US households again hold almost 50% of equities in their portfolios just like in early 2000. In other words, there’s a lot of capital at risk these days.

All things considered, let’s find out whether there are any premises to think that US tech stocks are overvalued or in a bubble by looking at different historical measures as well as leading indicators.